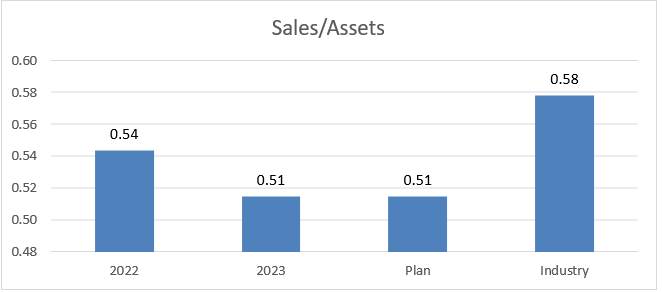

Question: Choose one answer for each part Part 1 : Sales / Assets conclusion: the firm is relatively efficient in producing sales given their size in

Choose one answer for each part

Part :

SalesAssets conclusion:

the firm is relatively efficient in producing sales given their size in assets, and their efficiency is improving.

the firm is relatively efficient in producing sales given their size in assets, but their efficiency is deteriorating.

the firm is not relatively efficient in producing sales given their size in assets, but their efficiency is improving.

the firm is not relatively efficient in producing sales given their size in assets, and their efficiency is deteriorating.

Part :

SalesAssets conclusion, performance trend:

SalesAssets improvement is due to Sales growing at a faster rate than Assets.

SalesAssets improvement is due to Sales falling at a slower rate than Assets.

SalesAssets fell due to Assets growing at a faster rate than Sales.

SalesAssets fell due to Assets beng divested at a slower rate than the decline in Sales.

Part :

Operating Efficiency conclusion:SalesAssets

Overall, the trend in ROA, ROS and SalesAssets all indicate excellent management.

Overall, the most significant problem is the trend in ROS; due to the trend in operating expenses.

Overall, the most significant problem is the trend in ROS; due to the trend in sales.

Overall, the most significant problem is the trend in SalesAssets; due to the trend in sales.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock