Question: Choose the correct answer Question 42 (2 points) Listen A corporation reports 18000 in client meals expensed. For tax the deductible portion is 50 percent.

Choose the correct answer

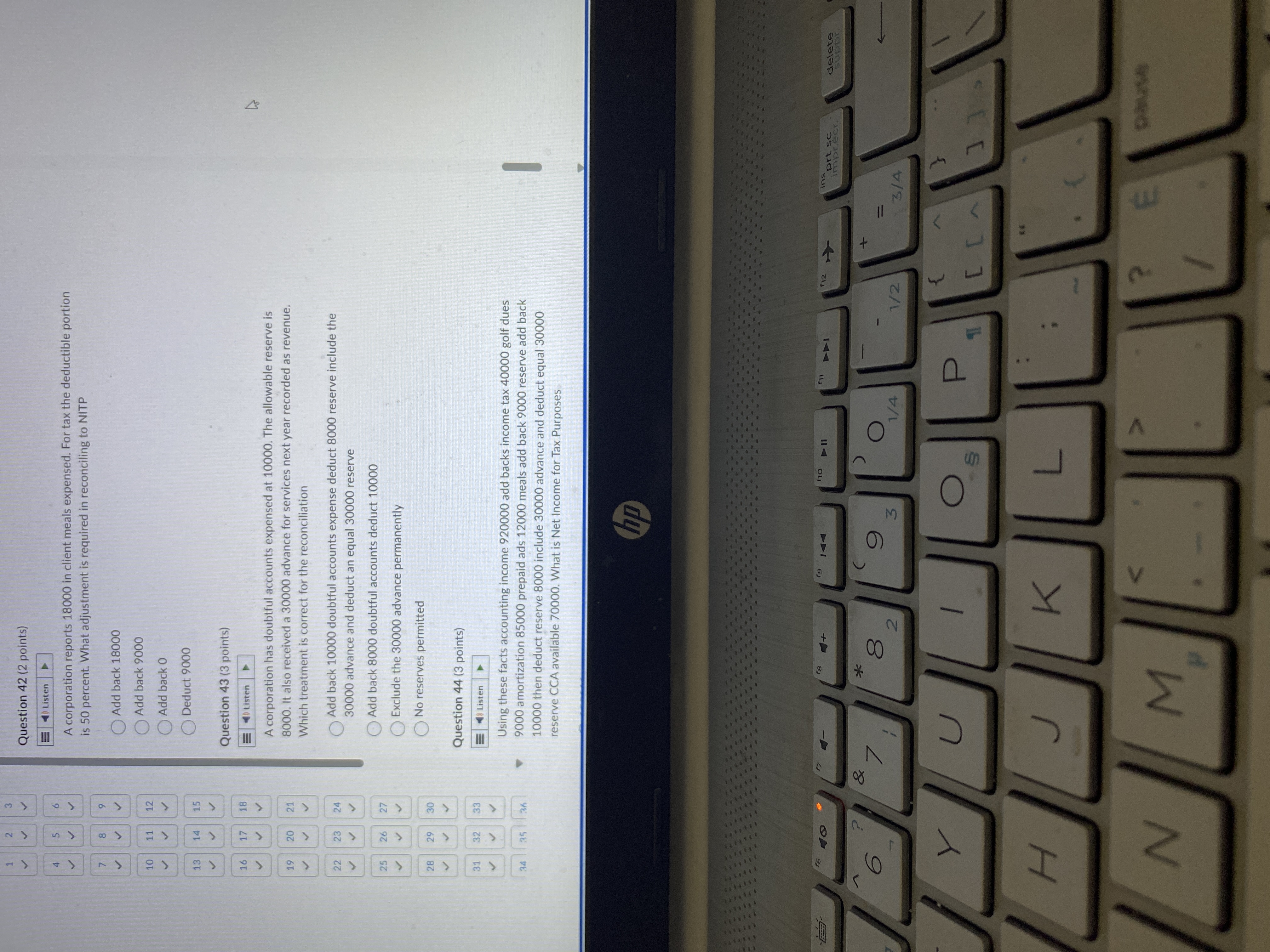

Question 42 (2 points) Listen A corporation reports 18000 in client meals expensed. For tax the deductible portion is 50 percent. What adjustment is required in reconciling to NITP Add back 18000 Add back 9000 10 11 12 Add back O Deduct 9000 13 15 Question 43 (3 points) 16 17 18 ) Listen A corporation has doubtful accounts expensed at 10000. The allowable reserve is 19 20 21 8000. It also received a 30000 advance for services next year recorded as revenue. Which treatment is correct for the reconciliation 24 Add back 10000 doubtful accounts expense deduct 8000 reserve include the 22 30000 advance and deduct an equal 30000 reserve Add back 8000 doubtful accounts deduct 10000 25 26 27 Exclude the 30000 advance permanently No reserves permitted 28 29 30 Question 44 (3 points) 31 32 33 ) Listen Using these facts accounting income 920000 add backs income tax 40000 golf dues 34 35 36 9000 amortization 85000 prepaid ads 12000 meals add back 9000 reserve add back 10000 then deduct reserve 8000 include 30000 advance and deduct equal 30000 reserve CCA available 70000. What is Net Income for Tax Purposes 16 10 17 19 144 10 II $71 DDI F12 ins prt sc delete

Question 42 (2 points) Listen A corporation reports 18000 in client meals expensed. For tax the deductible portion is 50 percent. What adjustment is required in reconciling to NITP Add back 18000 Add back 9000 10 11 12 Add back O Deduct 9000 13 15 Question 43 (3 points) 16 17 18 ) Listen A corporation has doubtful accounts expensed at 10000. The allowable reserve is 19 20 21 8000. It also received a 30000 advance for services next year recorded as revenue. Which treatment is correct for the reconciliation 24 Add back 10000 doubtful accounts expense deduct 8000 reserve include the 22 30000 advance and deduct an equal 30000 reserve Add back 8000 doubtful accounts deduct 10000 25 26 27 Exclude the 30000 advance permanently No reserves permitted 28 29 30 Question 44 (3 points) 31 32 33 ) Listen Using these facts accounting income 920000 add backs income tax 40000 golf dues 34 35 36 9000 amortization 85000 prepaid ads 12000 meals add back 9000 reserve add back 10000 then deduct reserve 8000 include 30000 advance and deduct equal 30000 reserve CCA available 70000. What is Net Income for Tax Purposes 16 10 17 19 144 10 II $71 DDI F12 ins prt sc delete Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock