Question: Choose the false statement. Zero - beta stocks will have a zero standard deviation. If weak form of market efficiency holds, semi - strong market

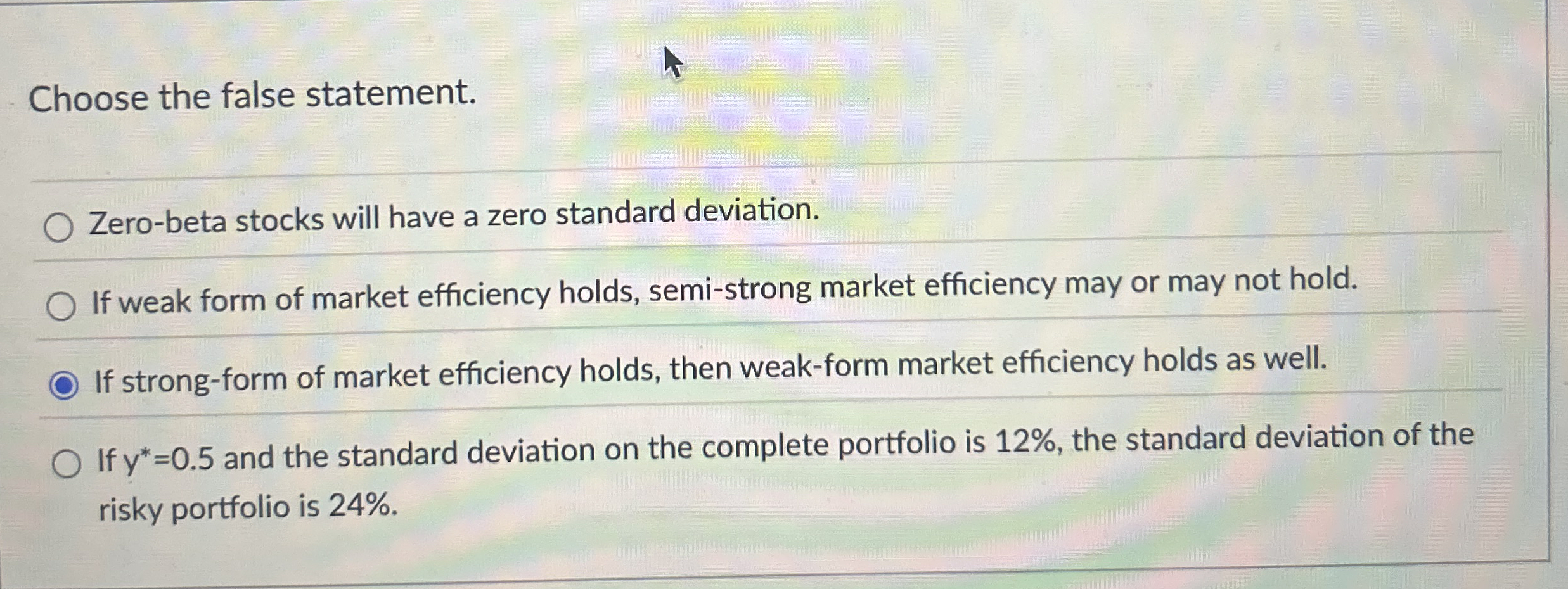

Choose the false statement.

Zerobeta stocks will have a zero standard deviation.

If weak form of market efficiency holds, semistrong market efficiency may or may not hold.

If strongform of market efficiency holds, then weakform market efficiency holds as well.

If and the standard deviation on the complete portfolio is the standard deviation of the risky portfolio is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock