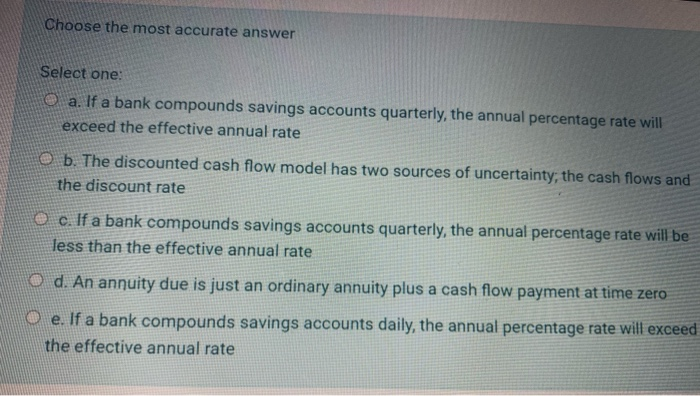

Question: Choose the most accurate answer Select one: a. If a bank compounds savings accounts quarterly, the annual percentage rate will exceed the effective annual rate

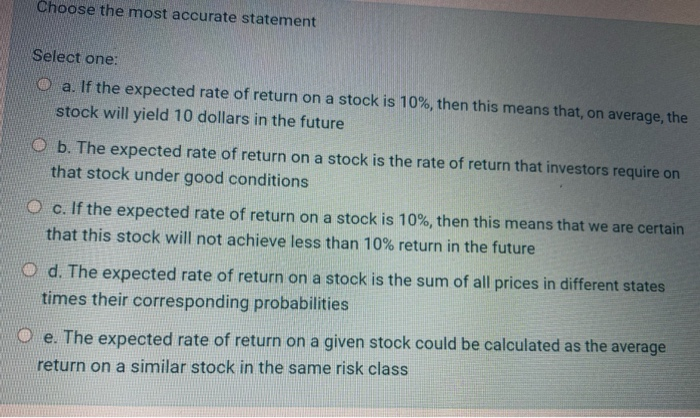

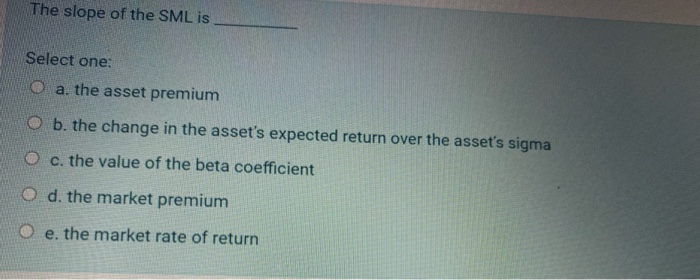

Choose the most accurate answer Select one: a. If a bank compounds savings accounts quarterly, the annual percentage rate will exceed the effective annual rate O b. The discounted cash flow model has two sources of uncertainty, the cash flows and the discount rate c. If a bank compounds savings accounts quarterly, the annual percentage rate will be less than the effective annual rate O d. An annuity due is just an ordinary annuity plus a cash flow payment at time zero O e. If a bank compounds savings accounts daily, the annual percentage rate will exceed the effective annual rate Choose the most accurate statement Select one: O a. If the expected rate of return on a stock is 10%, then this means that, on average, the stock will yield 10 dollars in the future O b. The expected rate of return on a stock is the rate of return that investors require on that stock under good conditions O c. If the expected rate of return on a stock is 10%, then this means that we are certain that this stock will not achieve less than 10% return in the future Od. The expected rate of return on a stock is the sum of all prices in different states times their corresponding probabilities e. The expected rate of return on a given stock could be calculated as the average return on a similar stock in the same risk class The slope of the SML is Select one: O a. the asset premium b. the change in the asset's expected return over the asset's sigma O c. the value of the beta coefficient O d. the market premium e. the market rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts