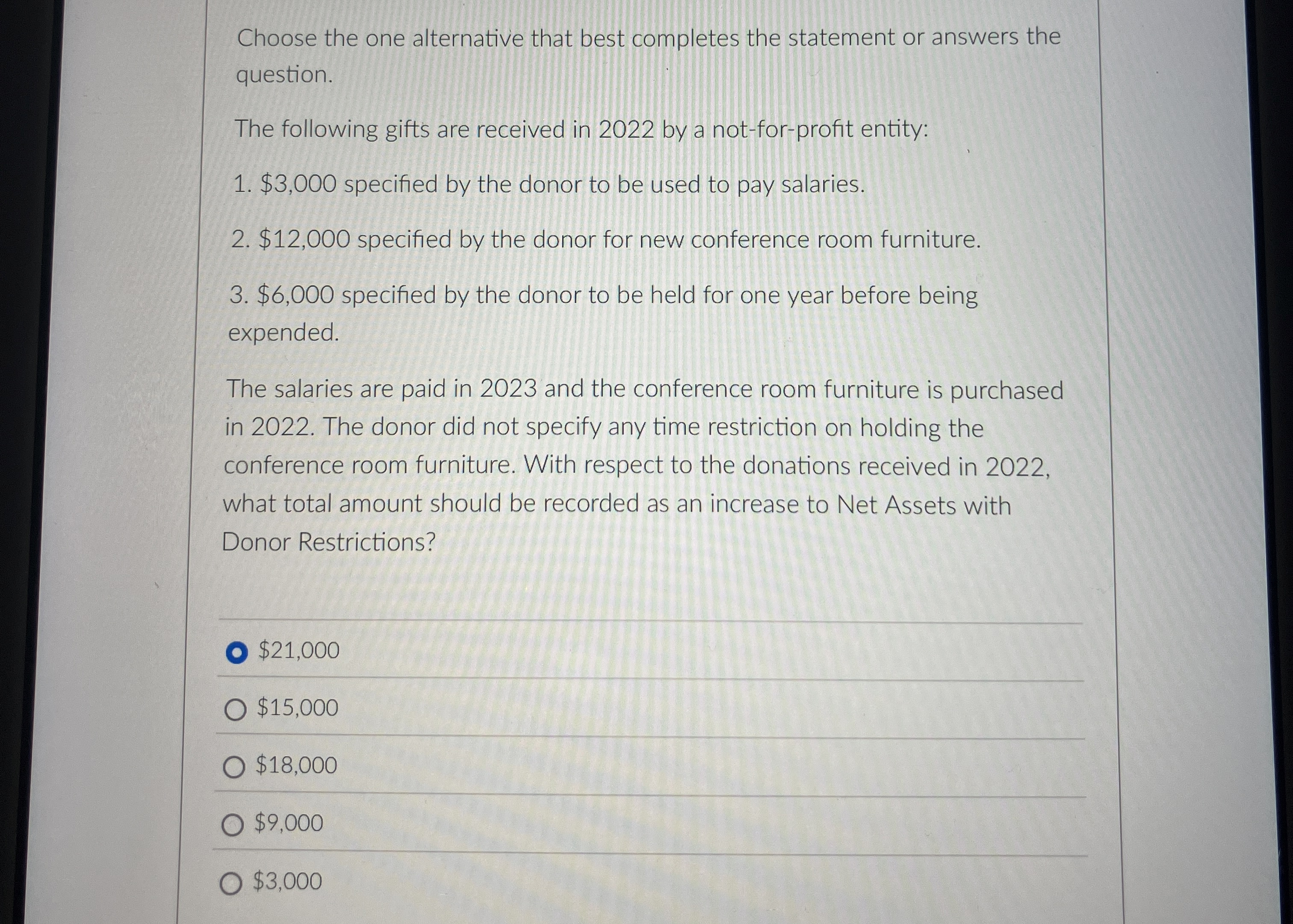

Question: Choose the one alternative that best completes the statement or answers the question. The following gifts are received in 2 0 2 2 by a

Choose the one alternative that best completes the statement or answers the question.

The following gifts are received in by a notforprofit entity:

$ specified by the donor to be used to pay salaries.

$ specified by the donor for new conference room furniture.

$ specified by the donor to be held for one year before being expended.

The salaries are paid in and the conference room furniture is purchased in The donor did not specify any time restriction on holding the conference room furniture. With respect to the donations received in what total amount should be recorded as an increase to Net Assets with Donor Restrictions?

$

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock