Question: Choose two stages the cycle and fully explain at least 3 actions the Operations Manager would unde take in managing operations in each stage. Selected

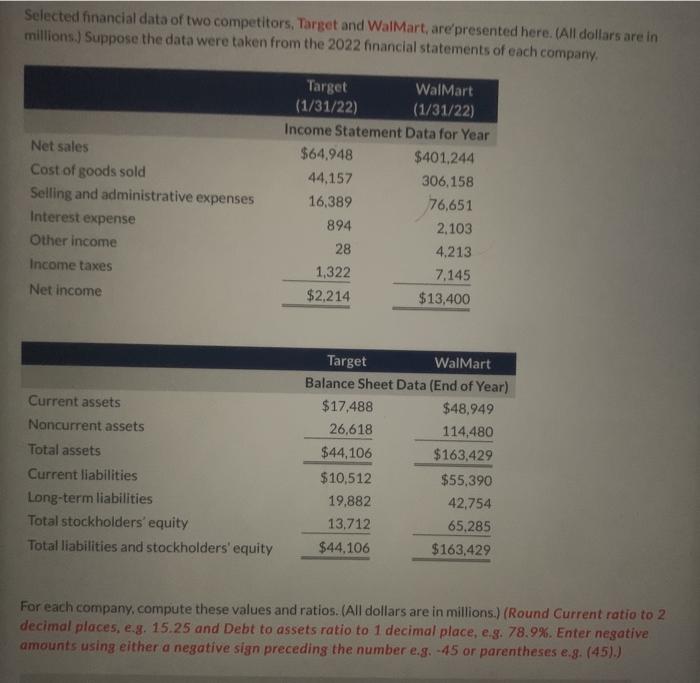

Choose two stages the cycle and fully explain at least 3 actions the Operations Manager would unde take in managing operations in each stage. Selected financial data of two competitors, Target and Walmart, are presented here.(All dollars are in millions.) Suppose the data were taken from the 2022 financial statements of each company. Net sales Cost of goods sold Selling and administrative expenses Interest expense Other income Income taxes Net income Target Walmart (1/31/22) (1/31/22) Income Statement Data for Year $64.948 $401.244 44,157 306,158 16,389 76,651 894 2,103 28 4.213 1,322 7,145 $2.214 $13,400 Current assets Noncurrent assets Total assets Current liabilities Long-term liabilities Total stockholders' equity Total liabilities and stockholders' equity Target Walmart Balance Sheet Data (End of Year) $17.488 $48,949 26,618 114,480 $44,106 $163,429 $10,512 $55,390 19,882 42,754 13,712 65,285 $44,106 $163,429 For each company, compute these values and ratios. (All dollars are in millions.) (Round Current ratio to 2 decimal places, e.g. 15.25 and Debt to assets ratio to 1 decimal place, e.g. 78.9%. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e 8. (45).) Choose two stages the cycle and fully explain at least 3 actions the Operations Manager would unde take in managing operations in each stage. Selected financial data of two competitors, Target and Walmart, are presented here.(All dollars are in millions.) Suppose the data were taken from the 2022 financial statements of each company. Net sales Cost of goods sold Selling and administrative expenses Interest expense Other income Income taxes Net income Target Walmart (1/31/22) (1/31/22) Income Statement Data for Year $64.948 $401.244 44,157 306,158 16,389 76,651 894 2,103 28 4.213 1,322 7,145 $2.214 $13,400 Current assets Noncurrent assets Total assets Current liabilities Long-term liabilities Total stockholders' equity Total liabilities and stockholders' equity Target Walmart Balance Sheet Data (End of Year) $17.488 $48,949 26,618 114,480 $44,106 $163,429 $10,512 $55,390 19,882 42,754 13,712 65,285 $44,106 $163,429 For each company, compute these values and ratios. (All dollars are in millions.) (Round Current ratio to 2 decimal places, e.g. 15.25 and Debt to assets ratio to 1 decimal place, e.g. 78.9%. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e 8. (45).)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts