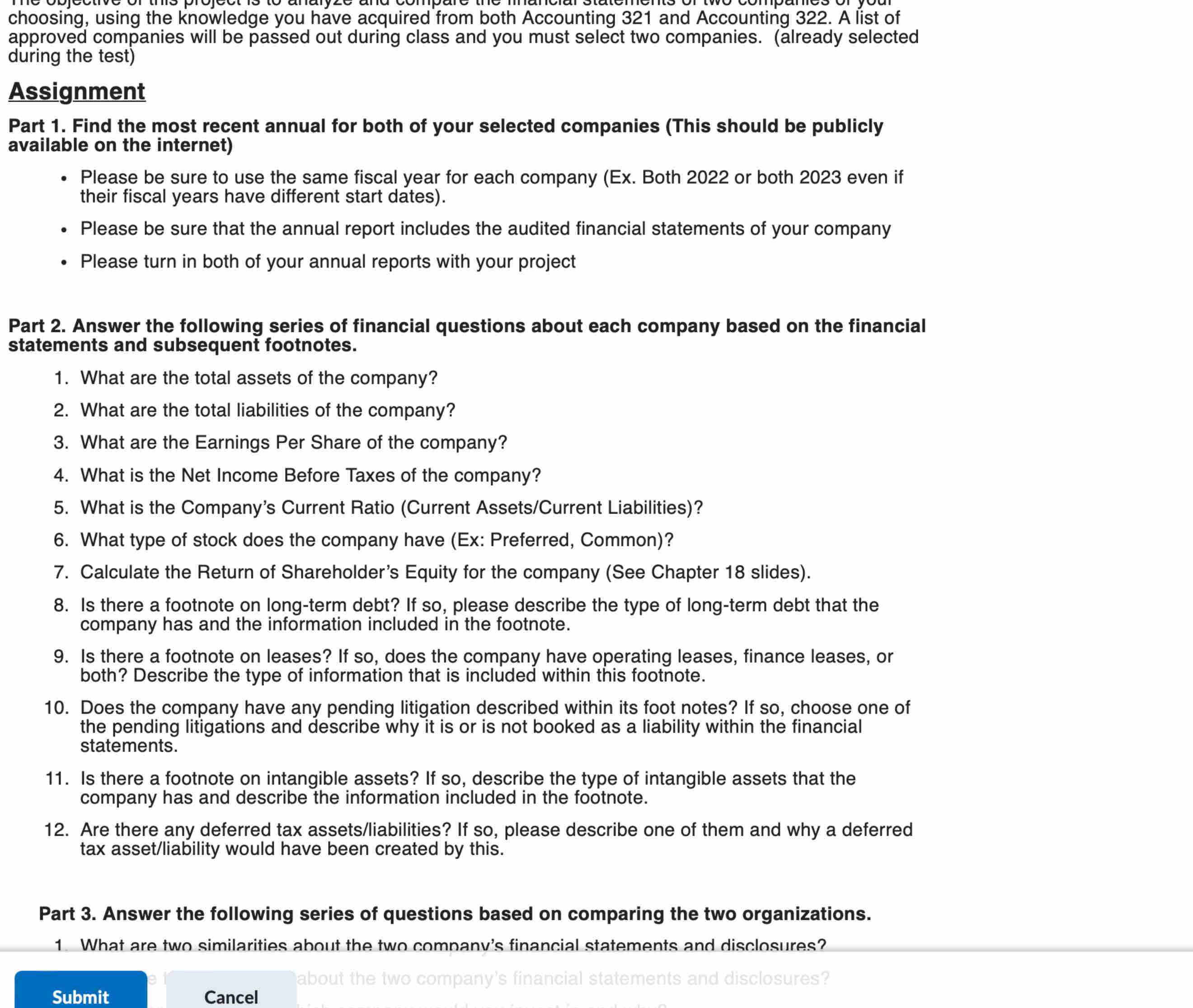

Question: choosing, using the knowledge you have acquired from both Accounting 3 2 1 and Accounting 3 2 2 . A list of approved companies will

choosing, using the knowledge you have acquired from both Accounting and Accounting A list of

approved companies will be passed out during class and you must select two companies. already selected

during the test

Assignment

Part Find the most recent annual for both of your selected companies This should be publicly

available on the internet

Please be sure to use the same fiscal year for each company Ex Both or both even if

their fiscal years have different start dates

Please be sure that the annual report includes the audited financial statements of your company

Please turn in both of your annual reports with your project

Part Answer the following series of financial questions about each company based on the financial

statements and subsequent footnotes.

What are the total assets of the company?

What are the total liabilities of the company?

What are the Earnings Per Share of the company?

What is the Net Income Before Taxes of the company?

What is the Company's Current Ratio Current AssetsCurrent Liabilities

What type of stock does the company have Ex: Preferred, Common

Calculate the Return of Shareholder's Equity for the company See Chapter slides

Is there a footnote on longterm debt? If so please describe the type of longterm debt that the

company has and the information included in the footnote.

Is there a footnote on leases? If so does the company have operating leases, finance leases, or

both? Describe the type of information that is included within this footnote.

Does the company have any pending litigation described within its foot notes? If so choose one of

the pending litigations and describe why it is or is not booked as a liability within the financial

statements.

Is there a footnote on intangible assets? If so describe the type of intangible assets that the

company has and describe the information included in the footnote.

Are there any deferred tax assetsliabilities If so please describe one of them and why a deferred

tax assetliability would have been created by this.

Part Answer the following series of questions based on comparing the two organizations.

What are two similarities about the two comnanv's financial statements and disclosures?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock