Question: Christian Co Schools 2 3 - 2 4 2 0 2 2 - 2 0 2 3 CCHS Liv... KDE Licensure MyAccount | Americ... FastForwardAcademy

Christian Co Schools

CCHS Liv...

KDE Licensure

MyAccount Americ...

FastForwardAcademy

Expungement Certif...

You Will Love Histor...

History Grant Prof...

Changes Are Comin.

Annual Federal Tax Refresher Course

EXAM

CPE

CHANGE COURSE

DASHBOARD

LIBRARY

REPORTING

COMMUNITY

SHOP

SIGNOUT

CLOSE MENU

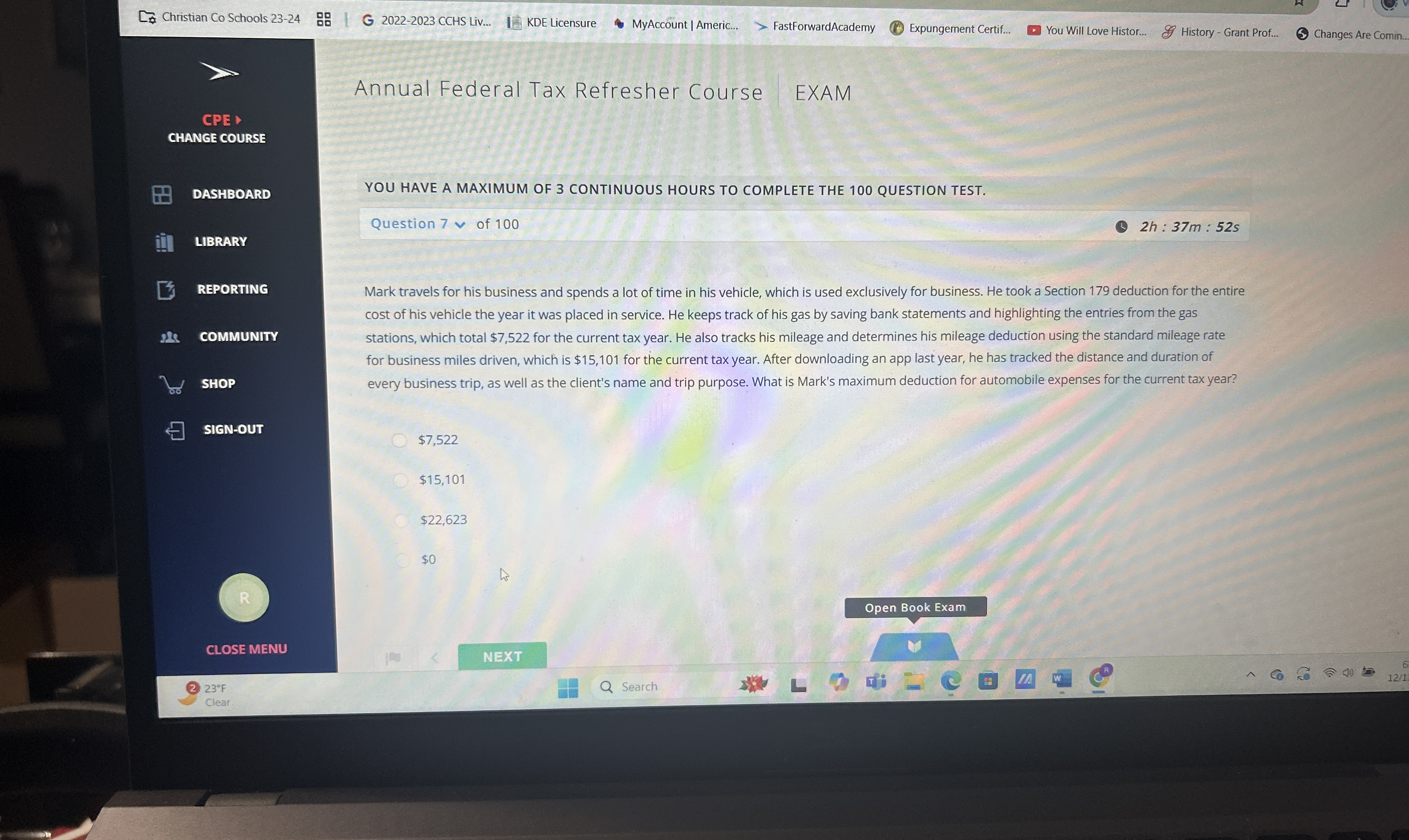

YOU HAVE A MAXIMUM OF CONTINUOUS HOURS TO COMPLETE THE QUESTION TEST.

Question of

Mark travels for his business and spends a lot of time in his vehicle, which is used exclusively for business. He took a Section deduction for the entire cost of his vehicle the year it was placed in service. He keeps track of his gas by saving bank statements and highlighting the entries from the gas stations, which total $ for the current tax year. He also tracks his mileage and determines his mileage deduction using the standard mileage rate for business miles driven, which is $ for the current tax year. After downloading an app last year, he has tracked the distance and duration of every business trip, as well as the client's name and trip purpose. What is Mark's maximum deduction for automobile expenses for the current tax year?

$

$

$

Clear

Search

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock