Question: Chrome File Edit View History Bookmarks People Tab Window Help DUN OF )) BUS. 100% 27 Tue 17:21 Q ... McGraw-Hill Connect X Question 1

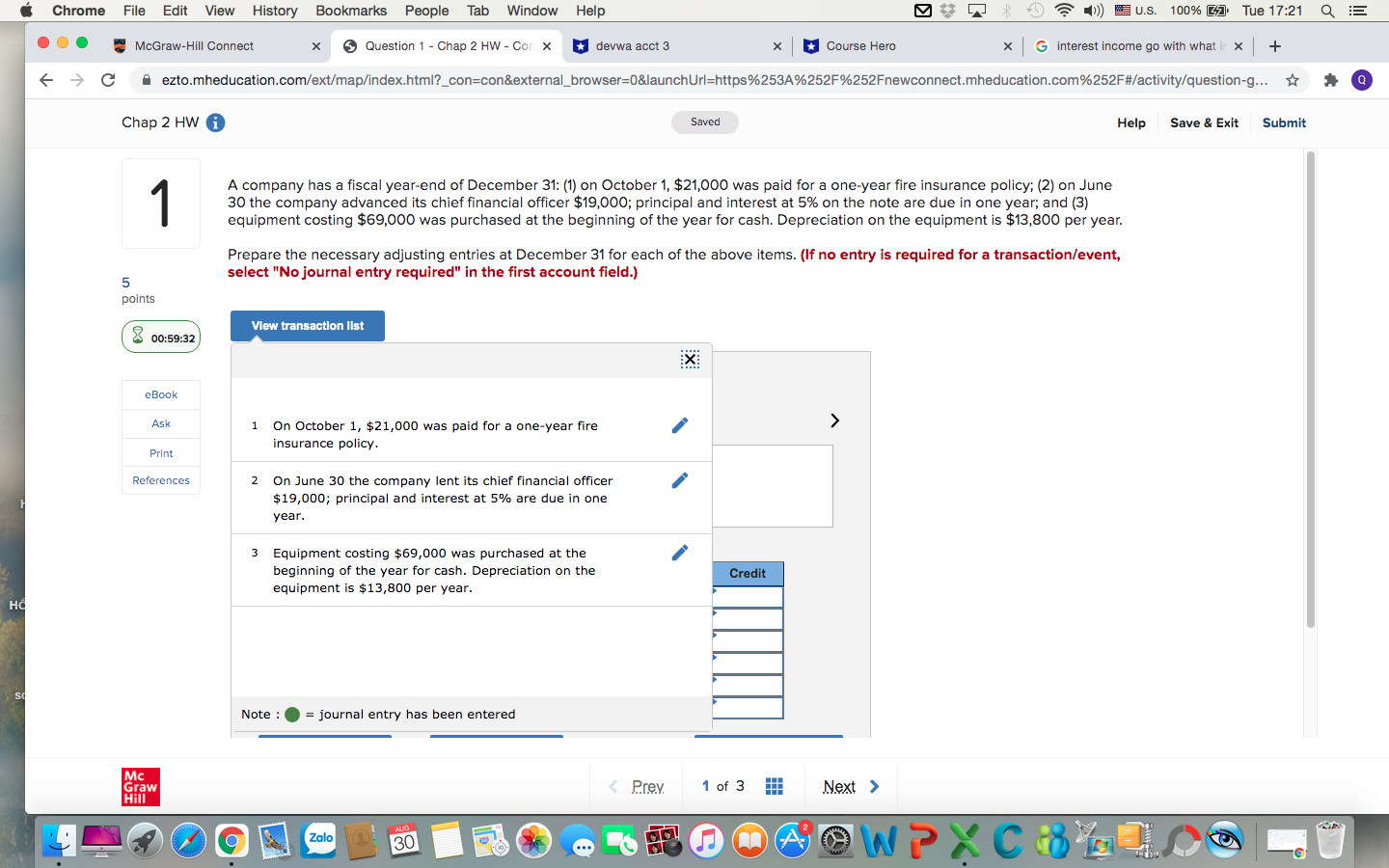

Chrome File Edit View History Bookmarks People Tab Window Help DUN OF )) BUS. 100% 27 Tue 17:21 Q ... McGraw-Hill Connect X Question 1 - Chap 2 HW - Con x devwa acct 3 * *Course Hero * G interest income go with what it x + C A ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-g... # Q Chap 2 HW Saved Help Save & Exit Submit 1 A company has a fiscal year-end of December 31: (1) on October 1, $21,000 was paid for a one-year fire insurance policy; (2) on June 30 the company advanced its chief financial officer $19,000; principal and interest at 5% on the note are due in one year; and (3) equipment costing $69,000 was purchased at the beginning of the year for cash. Depreciation on the equipment is $13,800 per year. Prepare the necessary adjusting entries at December 31 for each of the above items. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 5 points View transaction list 00:59:32 X eBook Ask 1 On October 1, $21,000 was paid for a one-year fire insurance policy. Print References On June 30 the company lent its chief financial officer $19,000; principal and interest at 5% are due in one year. Equipment costing $69,000 was purchased at the beginning of the year for cash. Depreciation on the Credit equipment is $13,800 per year. Note : = journal entry has been entered Mc Graw Hil AUG O Zalo 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts