Question: Chrome File Edit View History Bookmarks Profiles Tab PG Campus MT217 Finance Question 4 = Quiz: Unit 7 Lab Quiz O Question 5 Question

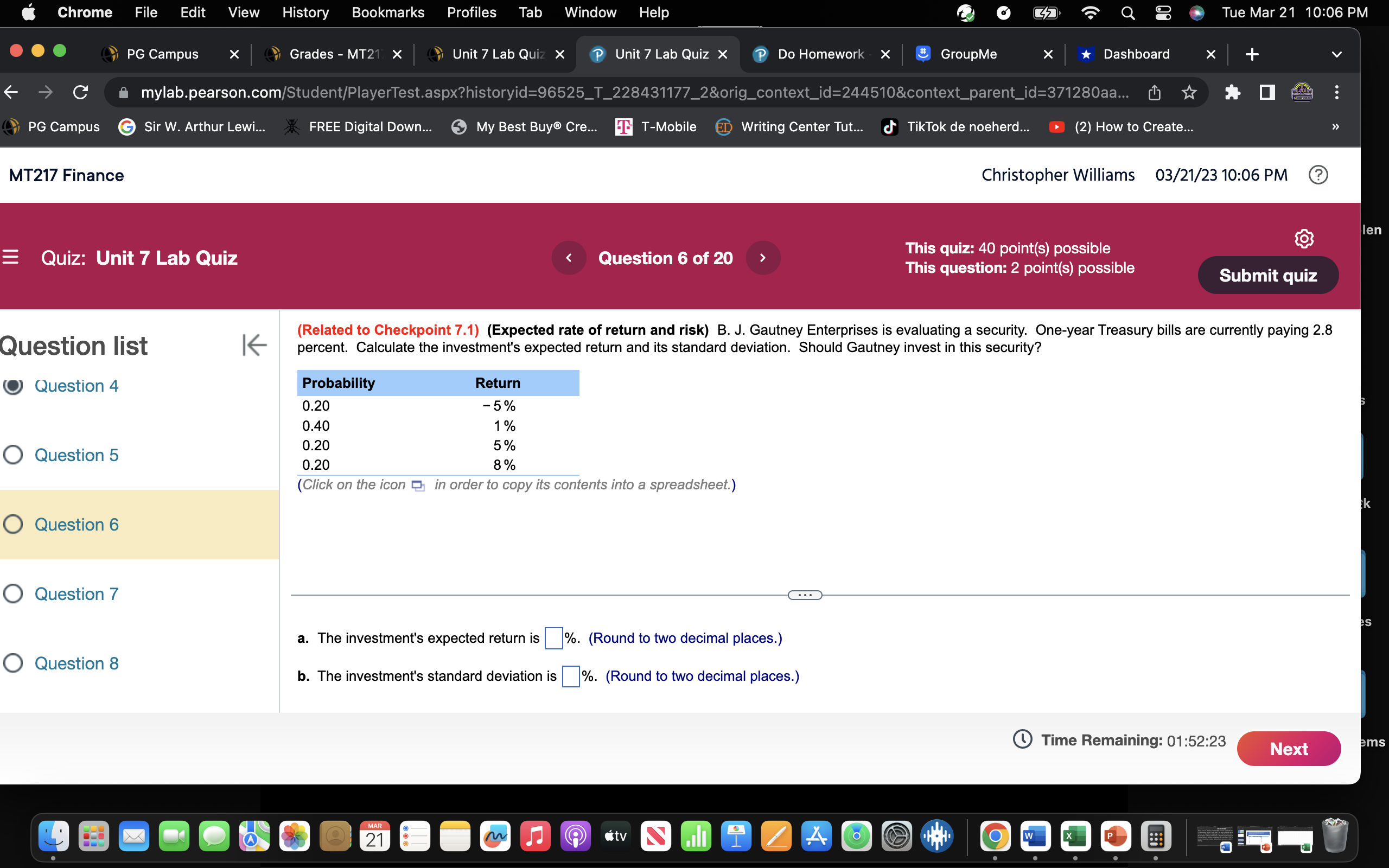

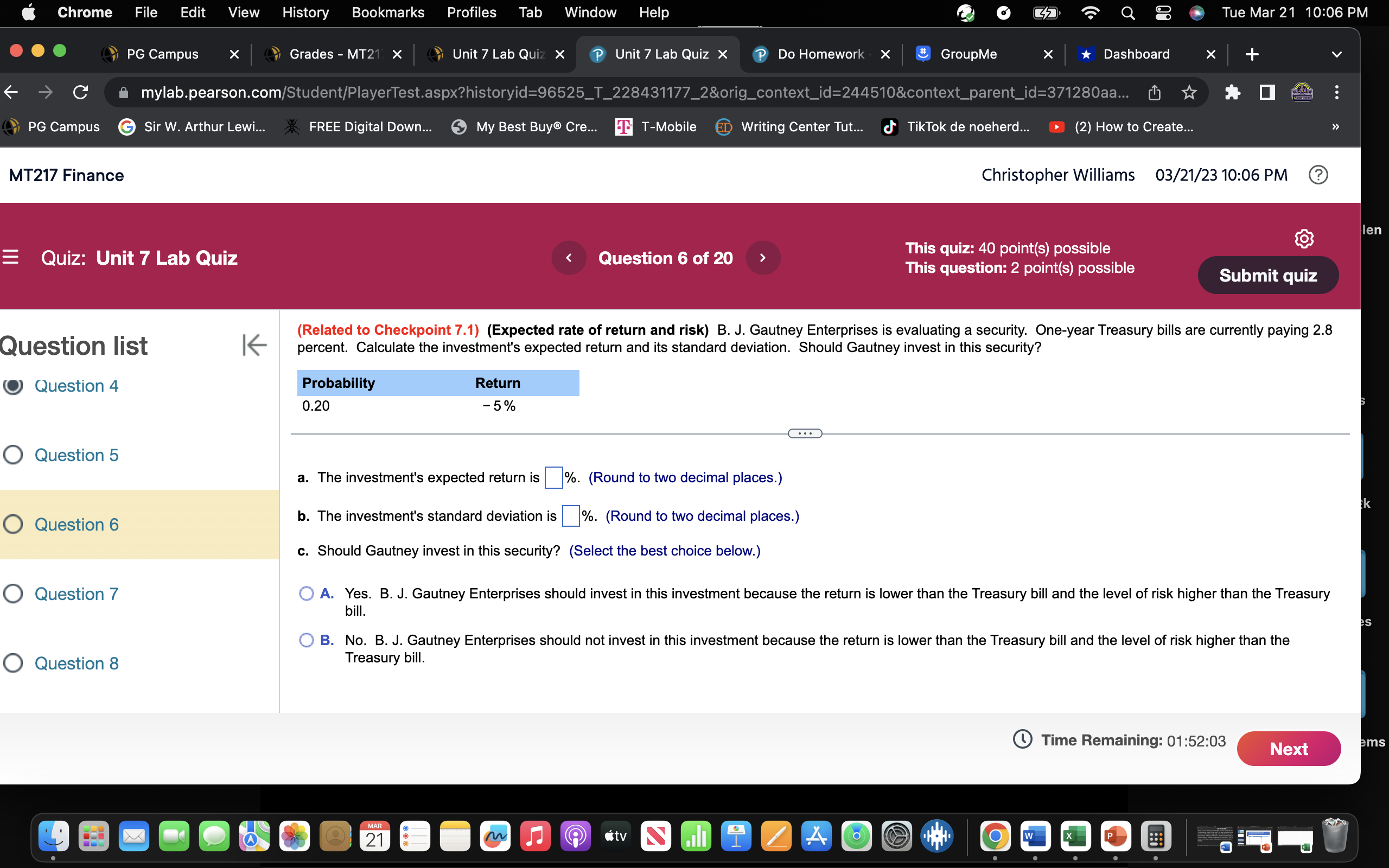

Chrome File Edit View History Bookmarks Profiles Tab PG Campus MT217 Finance Question 4 = Quiz: Unit 7 Lab Quiz O Question 5 Question list O Question 6 PG Campus O Question 7 O Question 8 Sir W. Arthur Lewi... Grades - MT21 X K mylab.pearson.com/Student/PlayerTest.aspx?historyid=96525_T_228431177_2&orig_context_id=244510&context_parent_id=371280aa... My Best Buy Cre... TT-Mobile ED Writing Center Tut... FREE Digital Down... Window Help Unit 7 Lab Quiz X P Unit 7 Lab Quiz X P Do Homework X MAR 21 < Return - 5% 1% 5% 8% Question 6 of 20 > Probability 0.20 0.40 0.20 0.20 (Click on the icon in order to copy its contents into a spreadsheet.) a. The investment's expected return is%. (Round to two decimal places.) b. The investment's standard deviation is %. (Round to two decimal places.) tv A GroupMe O W TikTok de noeherd... (Related to Checkpoint 7.1) (Expected rate of return and risk) B. J. Gautney Enterprises is evaluating a security. One-year Treasury bills are currently paying 2.8 percent. Calculate the investment's expected return and its standard deviation. Should Gautney invest in this security? X Dashboard This quiz: 40 point(s) possible This question: 2 point(s) possible O (2) How to Create... Christopher Williams 03/21/23 10:06 PM W Tue Mar 21 10:06 PM X + Submit quiz Time Remaining: 01:52:23 >> Next len S k es ems Chrome File Edit View History Bookmarks Profiles Tab PG Campus MT217 Finance Question 4 = Quiz: Unit 7 Lab Quiz O Question 5 Question list O Question 6 PG Campus O Question 7 O Question 8 Sir W. Arthur Lewi... Grades - MT21 X K mylab.pearson.com/Student/PlayerTest.aspx?historyid=96525_T_228431177_2&orig_context_id=244510&context_parent_id=371280aa... My Best Buy Cre... TT-Mobile ED Writing Center Tut... FREE Digital Down... Probability 0.20 Window Help Unit 7 Lab Quiz X P Unit 7 Lab Quiz X P Do Homework X Return - 5% < MAR 21 Question 6 of 20 > a. The investment's expected return is %. (Round to two decimal places.) b. The investment's standard deviation is%. (Round to two decimal places.) c. Should Gautney invest in this security? (Select the best choice below.) GroupMe tv A TikTok de noeherd... O (Related to Checkpoint 7.1) (Expected rate of return and risk) B. J. Gautney Enterprises is evaluating a security. One-year Treasury bills are currently paying 2.8 percent. Calculate the investment's expected return and its standard deviation. Should Gautney invest in this security? W X Dashboard This quiz: 40 point(s) possible This question: 2 point(s) possible O A. Yes. B. J. Gautney Enterprises should invest in this investment because the return is lower than the Treasury bill and the level of risk higher than the Treasury bill. (2) How to Create... Christopher Williams 03/21/23 10:06 PM B. No. B. J. Gautney Enterprises should not invest in this investment because the return is lower than the Treasury bill and the level of risk higher than the Treasury bill. O W Tue Mar 21 10:06 PM X + Submit quiz Time Remaining: 01:52:03 >> Next len S ik es ems

Step by Step Solution

There are 3 Steps involved in it

The calculation is given in the table below Probability Return Return P... View full answer

Get step-by-step solutions from verified subject matter experts