Question: Chrome File Edit View History Bookmarks Profiles Tab Window Help G Q Sun Nov 13 11:13 PM D2L Grades - 10820 ACC211 Financ Question 4

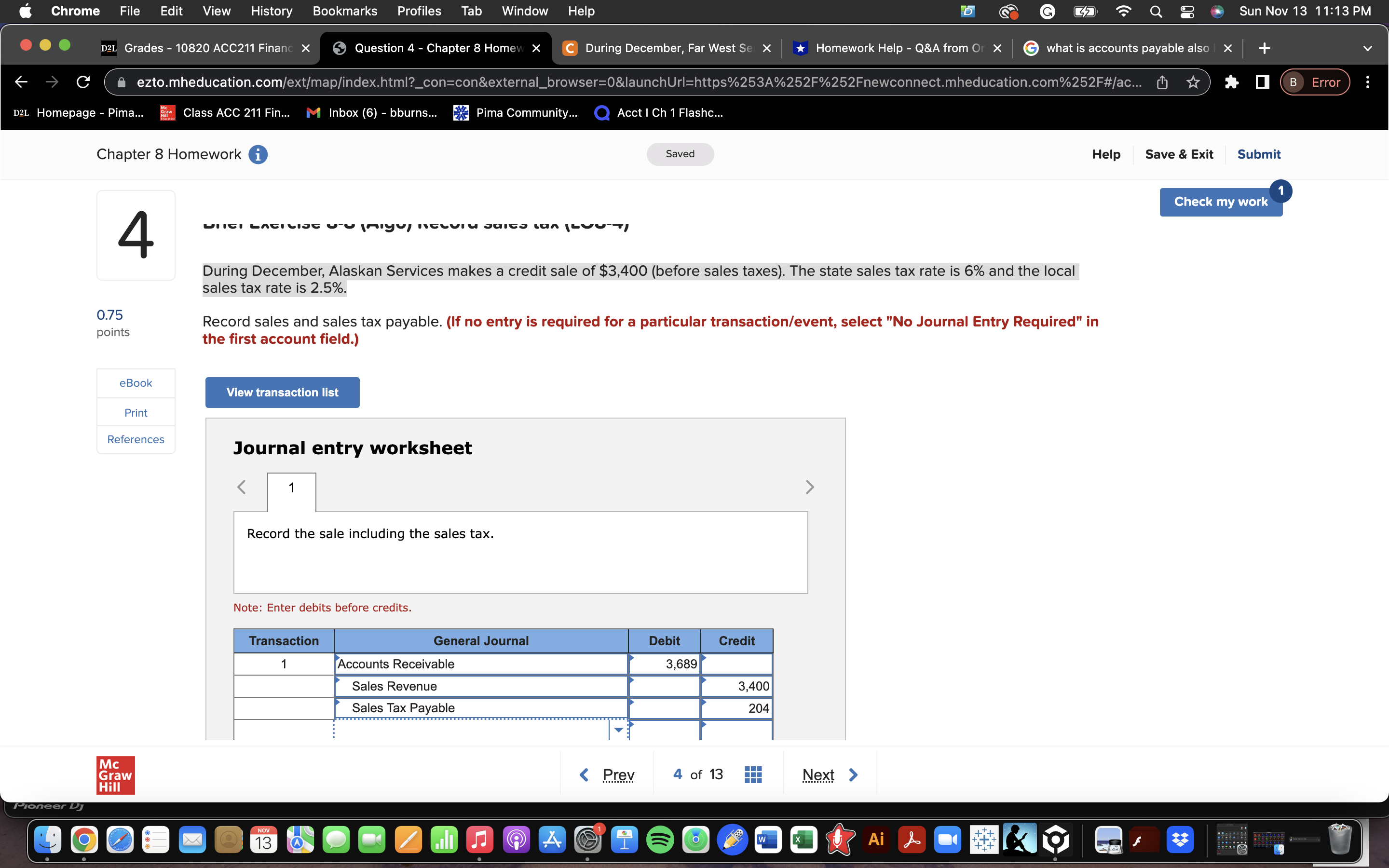

Chrome File Edit View History Bookmarks Profiles Tab Window Help G Q Sun Nov 13 11:13 PM D2L Grades - 10820 ACC211 Financ Question 4 - Chapter 8 Homew > C During December, Far West Se x Homework Help - Q&A from Or x G what is accounts payable also | x C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/ac... * 0 B Error D2L Homepage - Pima... Class ACC 211 Fin... M Inbox (6) - bburns... Pima Community... O Acct | Ch 1 Flashc... Chapter 8 Homework i Saved Help Save & Exit Submit Check my work UNICI LACILISE UTU InIy/ BELVIN JUICE LUA JEVUT) P During December, Alaskan Services makes a credit sale of $3,400 (before sales taxes). The state sales tax rate is 6% and the local sales tax rate is 2.5%. 0.75 Record sales and sales tax payable. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in points the first account field.) eBook View transaction list Print References Journal entry worksheet Record the sale including the sales tax. Note: Enter debits before credits. Transaction General Journal Debit Credit Accounts Receivable 3,689 Sales Revenue 3,400 Sales Tax Payable 204 Mc Graw Hill Pione L: 13 4 Ai & 19

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts