Question: Chrome File Edit View History Bookmarks Profiles Tab Window Help 15% Q 8 Sat 28 Jan 4:58:54 PM G Google whis > Bb Youtube Vide

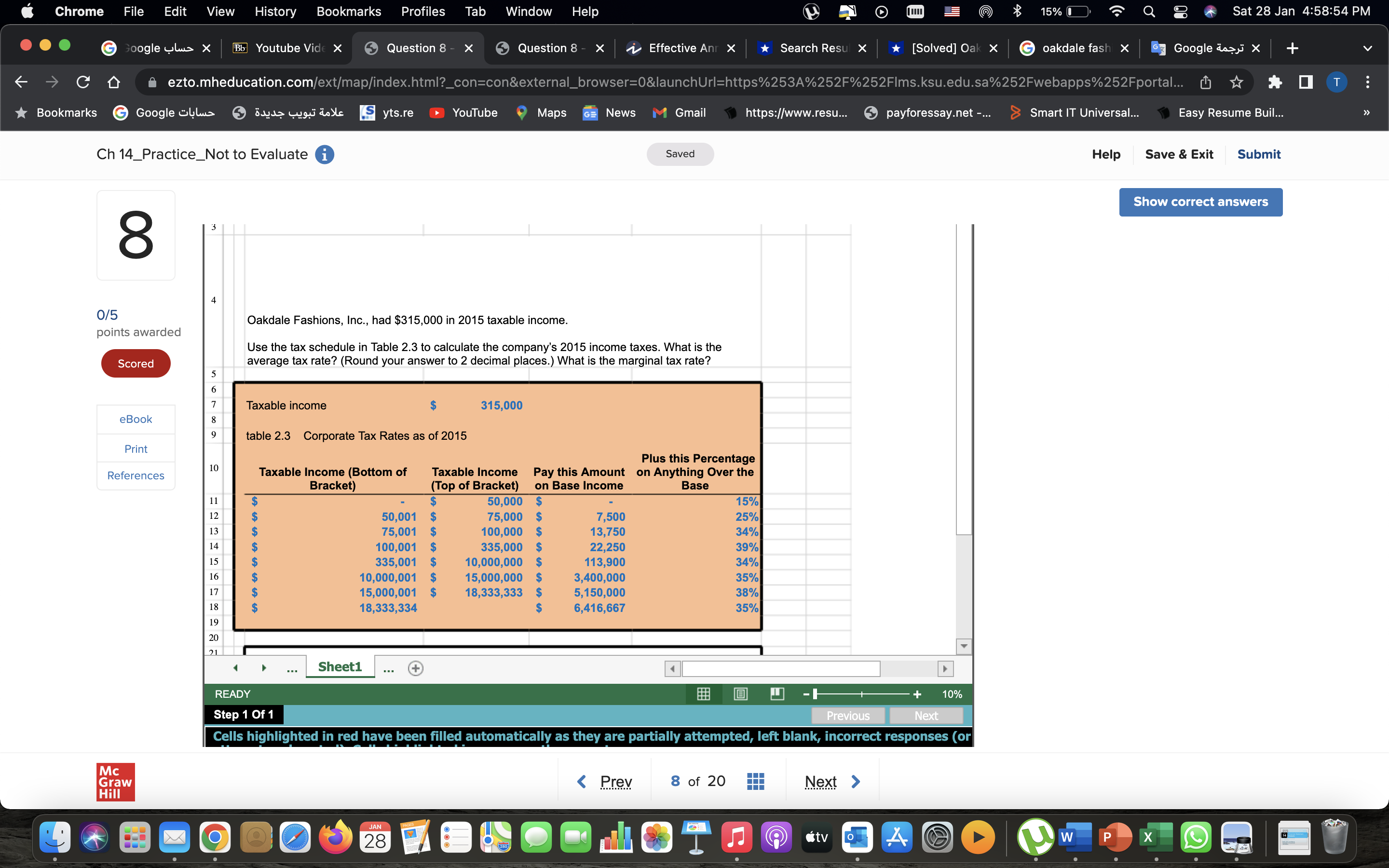

Chrome File Edit View History Bookmarks Profiles Tab Window Help 15% Q 8 Sat 28 Jan 4:58:54 PM G Google whis > Bb Youtube Vide X Question 8 - > Question 8 - X Effective Anr X Search Resul [Solved] Oak x G oakdale fash x Google day X C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252FIms.ksu.edu.sa%252Fwebapps%252Fportal... ( T Bookmarks G Google blue & Byde Lugn doc S yts.re YouTube Maps = News M Gmail https://www.resu... Smart IT Universal... Easy Resume Buil Ch 14_Practice_Not to Evaluate i Saved Help Save & Exit Submit Show correct answers 8 4 0/5 Oakdale Fashions, Inc., had $315,000 in 2015 taxable income. points awarded Use the tax schedule in Table 2.3 to calculate the company's 2015 income taxes. What is the Scored average tax rate? (Round your answer to 2 decimal places.) What is the marginal tax rate? Taxable income 315,000 eBook table 2.3 Corporate Tax Rates as of 2015 Print Plus this Percentage 10 References Taxable Income (Bottom of Taxable Income Pay this Amount on Anything Over the Bracket) (Top of Bracket) on Base Income Base 50,000 15% 50,001 75,000 7,500 25% 75,001 100,000 13,750 34% 100,001 335,000 22,250 39% 335,001 10,000,000 113,900 34% 10,000,001 15,000,000 3,400,000 35% 15,000,001 18,333,333 5,150,000 38% 18,333,334 6,416,667 35% 21 Sheet1 ... + READY + 10% Step 1 Of 1 Previous Next Cells highlighted in red have been filled automatically as they are partially attempted, left blank, incorrect responses (or Mc Graw Hill 9 JAN 28 tv A W P X O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts