Question: Chrome File Edit View History Bookmarks Profiles Tab Window Help ()) A Australian $ 2 Q 8 0 Wed 4 Sep 2:41:51 PM MAA103 A2

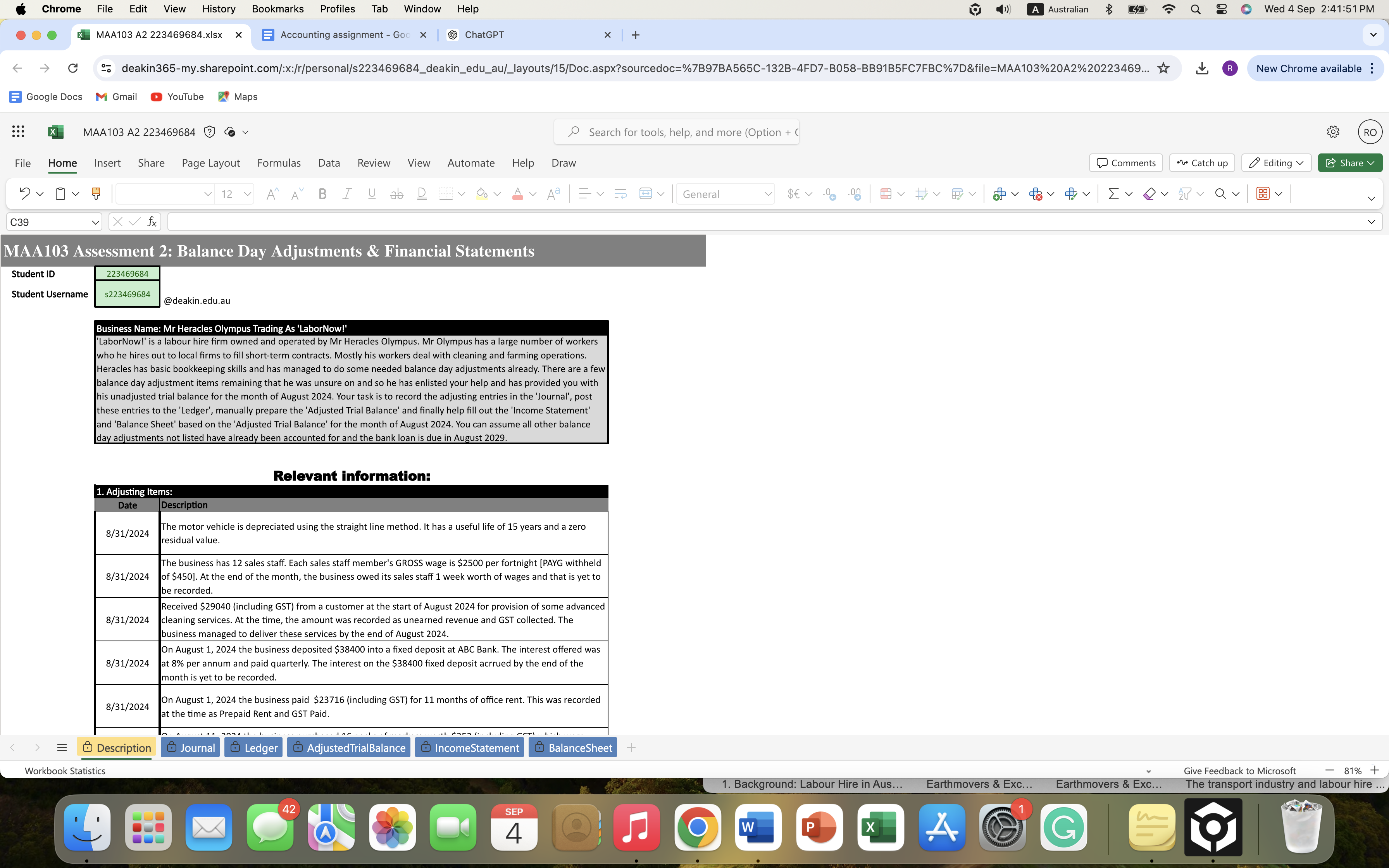

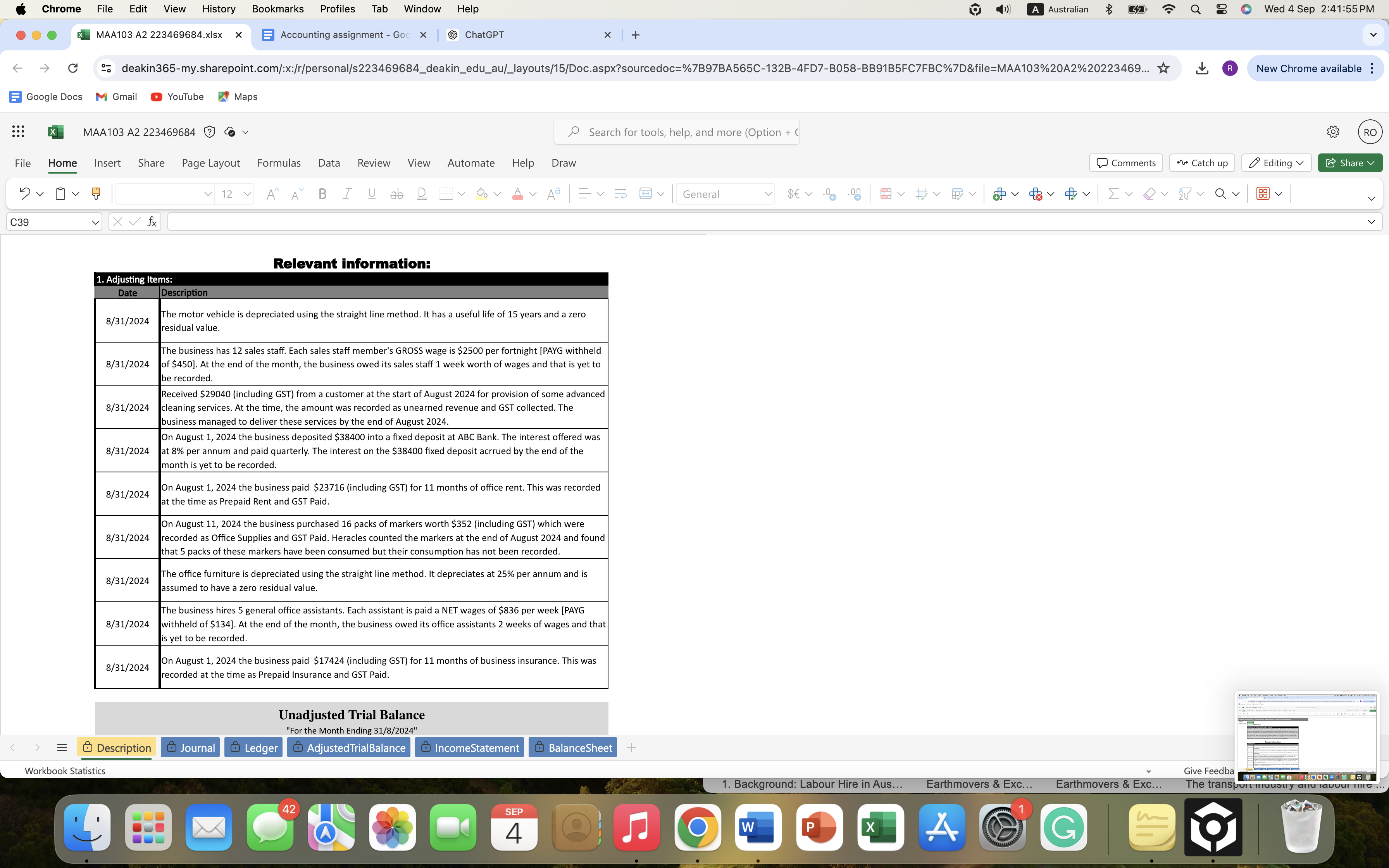

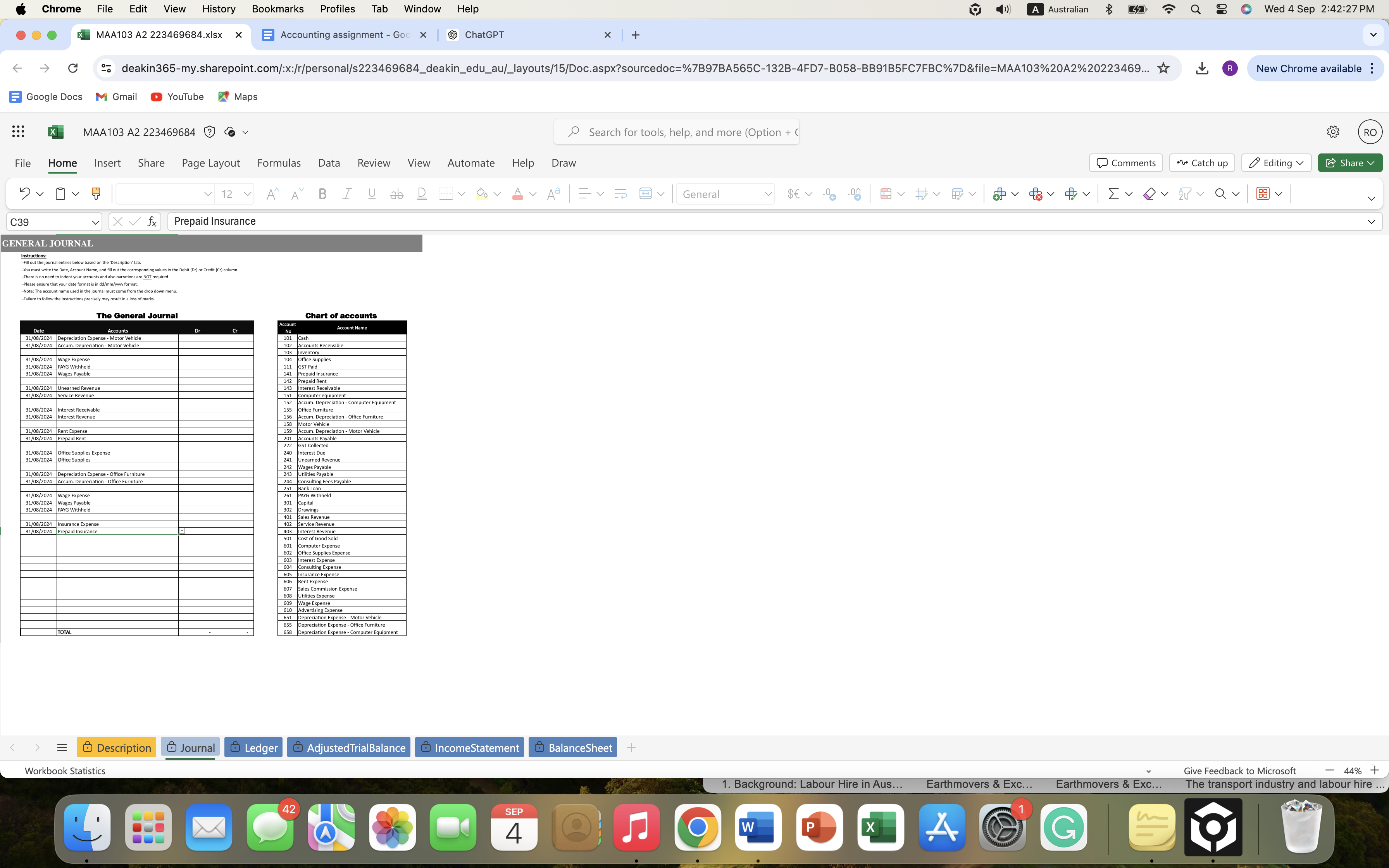

Chrome File Edit View History Bookmarks Profiles Tab Window Help ()) A Australian $ 2 Q 8 0 Wed 4 Sep 2:41:51 PM MAA103 A2 223469684.xIsx x E Accounting assignment - Goo x ChatGPT * + G 2 deakin365-my.sharepoint.com/:x:/r/personal/s223469684_deakin_edu_au/_layouts/15/Doc.aspx?sourcedoc=%7897BA565C-132B-4FD7-B058-BB9185FC7FBC%7D&file=MAA103%20A2%20223469... * New Chrome available : Google Docs M Gmail YouTube Maps MAA103 A2 223469684 3 Search for tools, help, and more (Option + RO File Home Insert Share Page Layout Formulas Data Review View Automate Help Draw Comments " Catch up Editing Share v V 12 ~ A" A B I U ab D V O V AV A = V v General Y SE v . 0 . 8 = V # V E V Q V for # V [ V Q V E T V Q V B V C39 VX V fx MAA103 Assessment 2: Balance Day Adjustments & Financial Statements Student ID 223469684 Student Username $223469684 @deakin.edu.au Business Name: Mr Heracles Olympus Trading As 'LaborNow!' "LaborNow!' is a labour hire firm owned and operated by Mr Heracles Olympus. Mr Olympus has a large number of workers who he hires out to local firms to fill short-term tracts. Mostly his workers deal with cleaning and farming operations. Heracles has basic bookkeeping skills and has managed to do some need balance day adjustments already. There are a few balance day adjustment items remaining that he was unsure on and so he has enlisted your help and has provided you with his unadjusted trial balance for the month of August 2024. Your task is to record the adjusting entries in the 'Journal', post these entries to the 'Ledger', manually prepare the 'Adjusted Trial Balance' and finally help fill out the 'Income Statement' and 'Balance Sheet' based on the 'Adjusted Trial Balance' for the month of August 2024. You can assume all other balance day adjustments not listed have alre loan is due in August 2029. Relevant information: 1. Adjusting Items: Date Description 8/31/2024 The motor vehicle is depreciated using the straight line method. It has a useful life of 15 years and a zero residual value The business has 12 sales staff. Each sales staff member's GROSS wage is $2500 per fortnight [PAYG withheld 8/31/2024 of $450]. At the end of the month, the business owed its sales staff 1 week worth of wages and that is yet to e recorded. Received $29040 (including GST) from a customer at the start of August 2024 for provision of some advanced 8/31/2024 cleaning services. At the time, the amount was recorded as unearned revenue and GST collected. The business managed to deliver these services by the end of August 2024 On August 1, 2024 the business deposited $38400 into a fixed deposit at ABC Bank. The interest offered was 8/31/2024 at 8% per annum and paid quarterly. The interest on the $38400 fixed deposit acrrued by the end of the month is yet to be recorded. 8/31/2024 On August 1, 2024 the business paid $23716 (including GST) for 11 months of office rent. This was recorded at the time as Prepaid Rent and GST Paid. E Description Journal Ledger Adjusted TrialBalance IncomeStatement BalanceSheet + Workbook Statistics Give Feedback to Microsoft - 81% + 1. Background: Labour Hire in Aus... Earthmovers & EXC... Earthmovers & EXc... The transport industry and labour hire .. 42 SEP 4 A GChrome File Edit View History Bookmarks Profiles Tab Window Help ()) A Australian $ 2 Q 8 0 Wed 4 Sep 2:41:55 PM MAA103 A2 223469684.xIsx x E Accounting assignment - Goo x ChatGPT * + G 2 deakin365-my.sharepoint.com/:x:/r/personal/s223469684_deakin_edu_au/_layouts/15/Doc.aspx?sourcedoc=%7897BA565C-132B-4FD7-B058-BB91B5FC7FBC%7D&file=MAA103%20A2%20223469... * New Chrome available : Google Docs M Gmail YouTube Maps MAA103 A2 223469684 3 Search for tools, help, and more (Option + RO File Home Insert Share Page Layout Formulas Data Review View Automate Help Draw Comments Catch up Editing Share v 12 ~ A" A B I U ab D V OV AV A = V v General C39 V X V fx Relevant information: 1. Adjusting Items: Date Description 8/31/2024 The motor vehicle is depreciated using the straight line method. It has a useful life of 15 years and a zero residual value. The business has 12 sales staff. Each sales staff member's GROSS wage is $2500 per fortnight [PAYG withheld 8/31/2024 of $450]. At the end of the month, the business owed its sales staff 1 week worth of wages and that is yet to be recorded Received $29040 (including GST) from a customer at the start of August 2024 for provision of some advanced 8/31/2024 cleaning services. At the time, the amount was recorded as unearned revenue and GST collected. The business managed to deliver these services by the end of August 2024 On August 1, 2024 the business deposited $38400 into a fixed deposit at ABC Bank. The interest offered was 8/31/2024 at 8% per annum and paid quarterly. The interest on the $38400 fixed deposit acrrued by the end of the month is yet to be re 8/31/2024 On August 1, 2024 the business paid $23716 (including GST) for 11 months of office rent. This was recorded at the time as Prepaid Rent and GST Paid. On August 11, 2024 the business purchased 16 packs of markers worth $352 (including GST) which were 8/31/2024 recorded as Office Supplies and GST Paid. Heracles counted the markers at the end of August 2024 and found that 5 packs of these markers have been consumed but their consumption has not been recorded. 8/31/2024 The office furniture is depreciated using the straight line method. It depreciates at 25% per annum and is assumed to have a zero residual value. The business hires 5 general office assistants. Each assistant is paid a NET wages of $836 per week [PAYG 8/31/2024 withheld of $134]. At the end of the month, the business owed its office assistants 2 weeks of wages and that is yet to be recorded. 8/31/2024 On August 1, 2024 the business paid $17424 (including GST) for 11 months of business insurance. This was recorded at the time as Prepaid Insurance and GST Paid. Unadjusted Trial Balance "For the Month Ending 31/8/2024" E Description Journal Ledger Adjusted TrialBalance IncomeStatement BalanceSheet + Workbook Statistics Give Feedba -58050 903468 0 1. Background: Labour Hire in Aus... Earthmovers & EXC... Earthmovers & EXc... The transport muubuy anu lawVUI THE ... 42 SEP 4 A GChrome File Edit View History Bookmarks Profiles Tab Window Help ()) A Australian $ 2 Q 8 0 Wed 4 Sep 2:42:27 PM MAA103 A2 223469684.xIsx x E Accounting assignment - Goo x ChatGPT * + G 2 deakin365-my.sharepoint.com/:x:/r/personal/s223469684_deakin_edu_au/_layouts/15/Doc.aspx?sourcedoc=%7897BA565C-132B-4FD7-B058-BB9185FC7FBC%7D&file=MAA103%20A2%20223469... * New Chrome available : Google Docs M Gmail YouTube Maps X MAA103 A2 223469684 3 Search for tools, help, and more (Option + RO File Home Insert Share Page Layout Formulas Data Review View Automate Help Draw Comments \\ Catch up Editing Share v 12 A" A B I U ab D v OV AV Aa = V v General C39 Xfx Prepaid Insurance GENERAL JOURNAL Instructions: Fil out the journal entries below based on the 'Description' tab. There is no need to account name; she til our the corresponding values in the the Debit (Dr) or Credit (Cr) column. Please ensure that your date format is in dd/mm/vyvy format. alure to folow the instructions precisely may result in a loss of mark The General Journal Chart of accounts Accounts Account Name 31/08/2024 Depreciation Expense - Motor Vehicle 31/08/2024 Accum. Depreciation - Motor Vehicle 02 Accounts Receivable 3109/2024 PAYG Withheld 104 Office Supplies 31/08/2024 Wages Payable 111 GST Paid 142 Prepaid Rent 31/08/2024 Unearned Revenue Interest Receivable 31/08/2024 Service Revenue 143 Inte 15 7 Cor Computer equipment 31/08/2024 Interes $2 Accum. Depreciation - Computer Equipment 31/08/2024 Interest Revenue 195 Off 158 Accum. Depreciation - Office Furniture 31/08/2024 Rent Expense ofor vehicle 31/08/2024 Prepaid Rent 159 Accum. Depreciation . Motor Vehicle 22 GST Collected 31/08/2024 Office Supplies Expense 31/08/2024 Office Supplies 241 Unearned Revenue 31/08/2024 Depreciation Expense - Office Furniture 243 Utilities Payable 31/08/2024 Accum. Depreciation - Office Furniture 244 Consulting Fee 251 Bank Loan 3109/7024 wake Expense 207 PAYG Withheld 31/08/2024 PAYG Withheld 302 Drawings 31/08/2024 Insurance Expense 402 service Revenu 31/08/2024 Prepaid Insurance 403 Interest Revenue 501 Cost of Good Sold 2 office Supplies Expense 3 Interest Expense 607 Sales Commission Expense 108 Utlities Expense o Advertising Expen Depreciation Expense - Motor Vehicle 65s Depreciation Expense - Office Furniture 658 Depreciation Expense - Computer Equipment E Description Journal Ledger Adjusted TrialBalance IncomeStatement BalanceSheet + Workbook Statistics Give Feedback to Microsoft - 44% + 1. Background: Labour Hire in Aus... Earthmovers & EXC... Earthmovers & EXc... The transport industry and labour hire .. 42 SEP 4 A G

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts