Question: Chrome File Edit View History Bookmarks Profiles Tab Window Help 27% Fri 10:20 PM QE .. . Course eBook X Question 7 - Module 8:

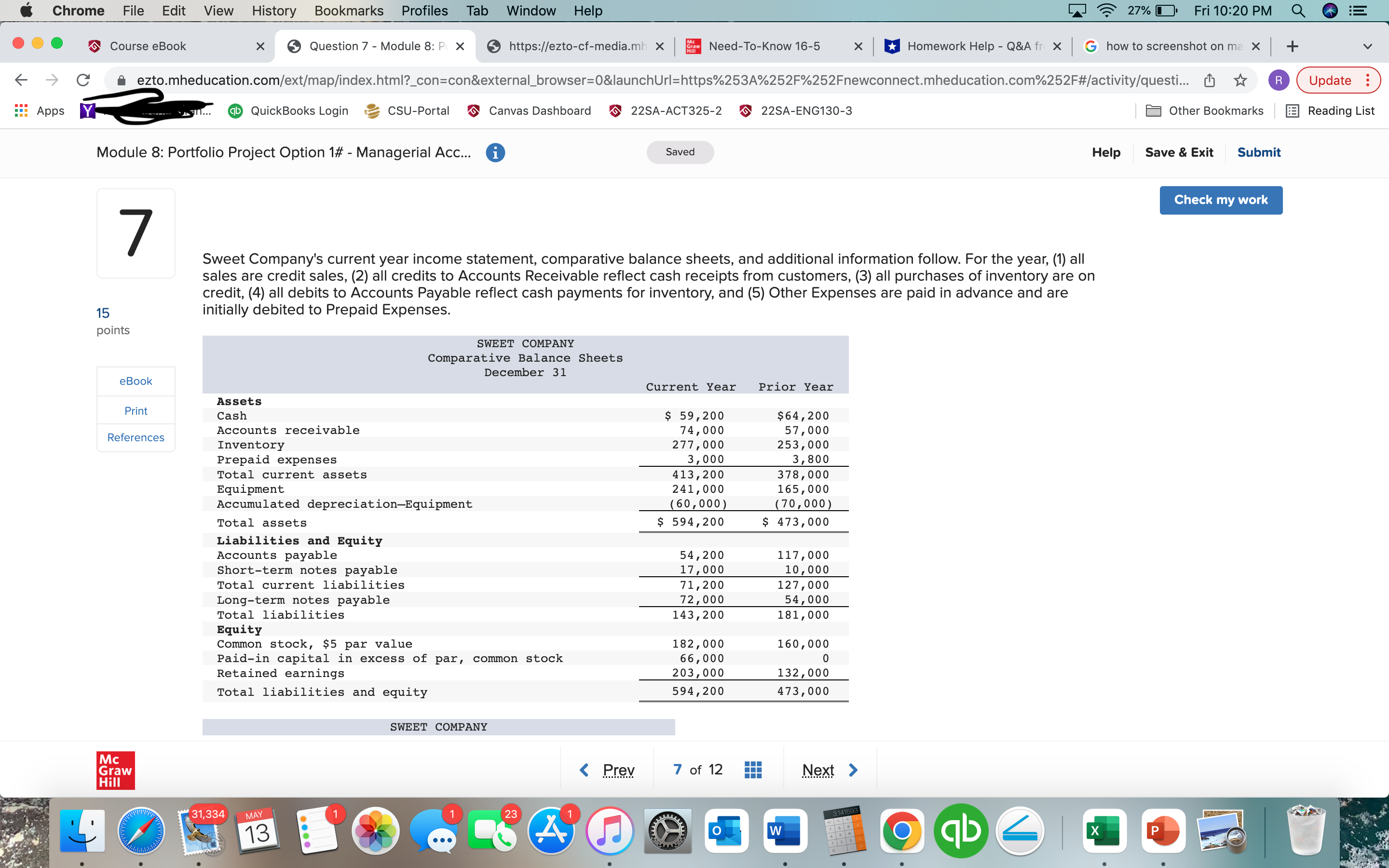

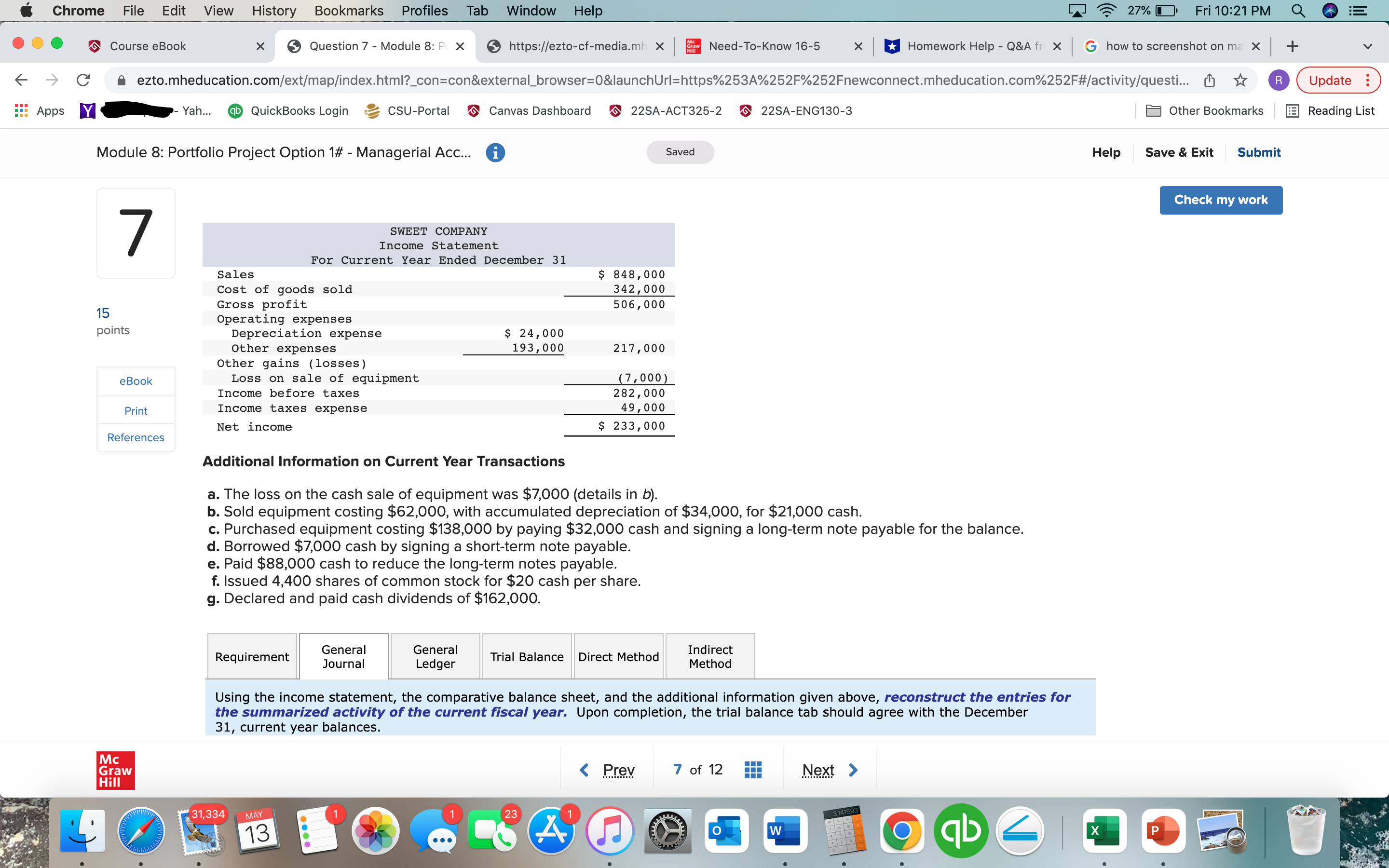

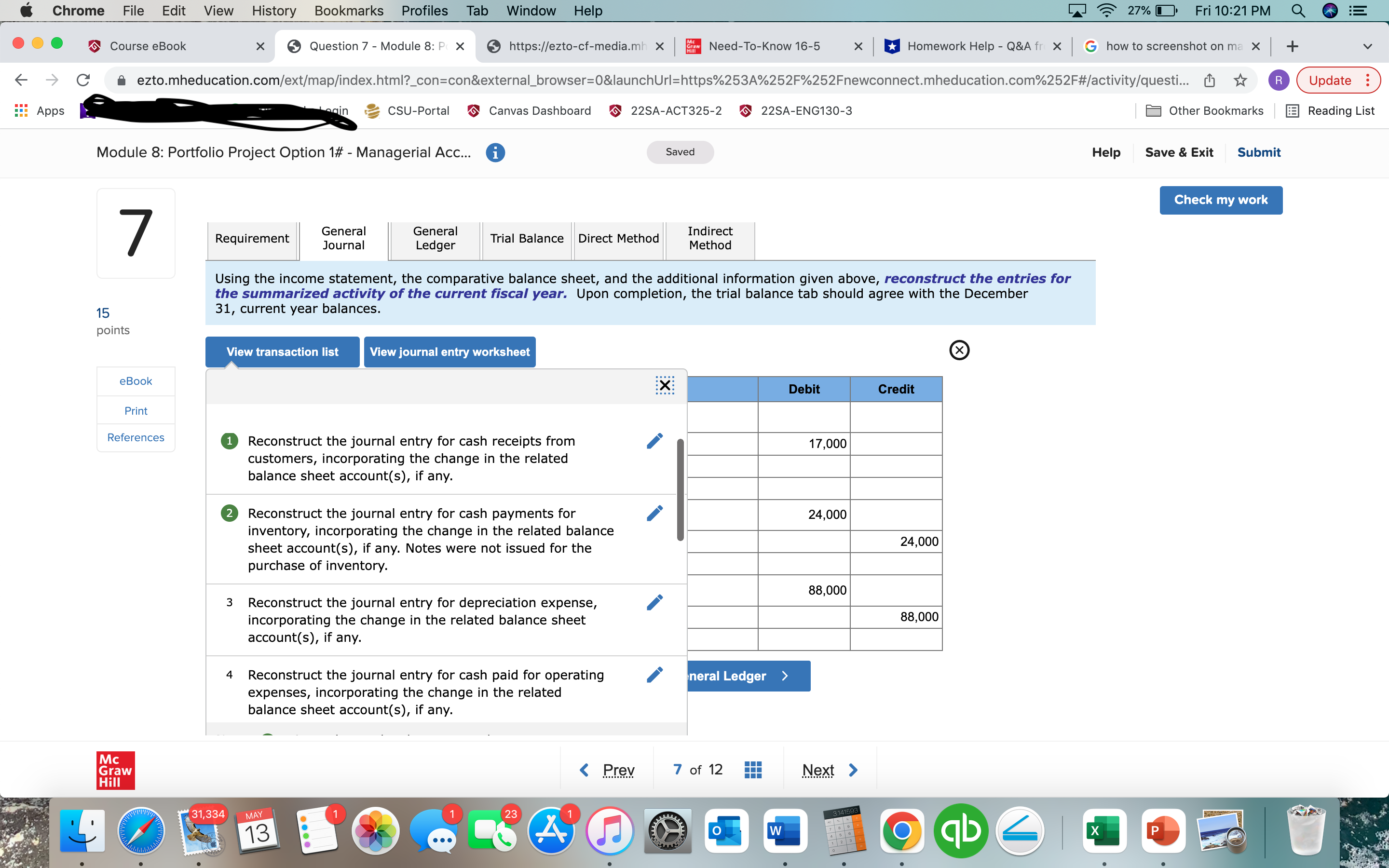

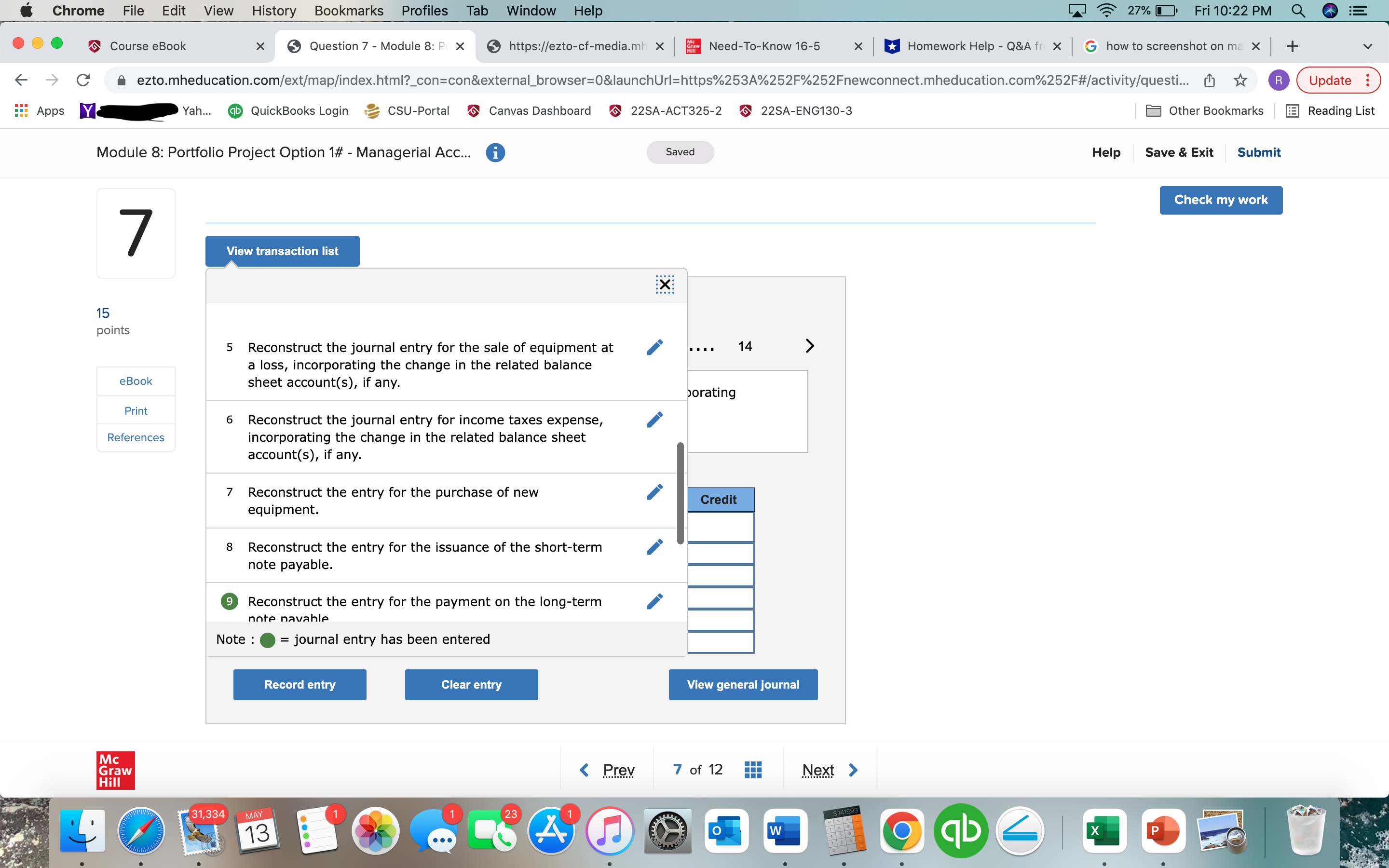

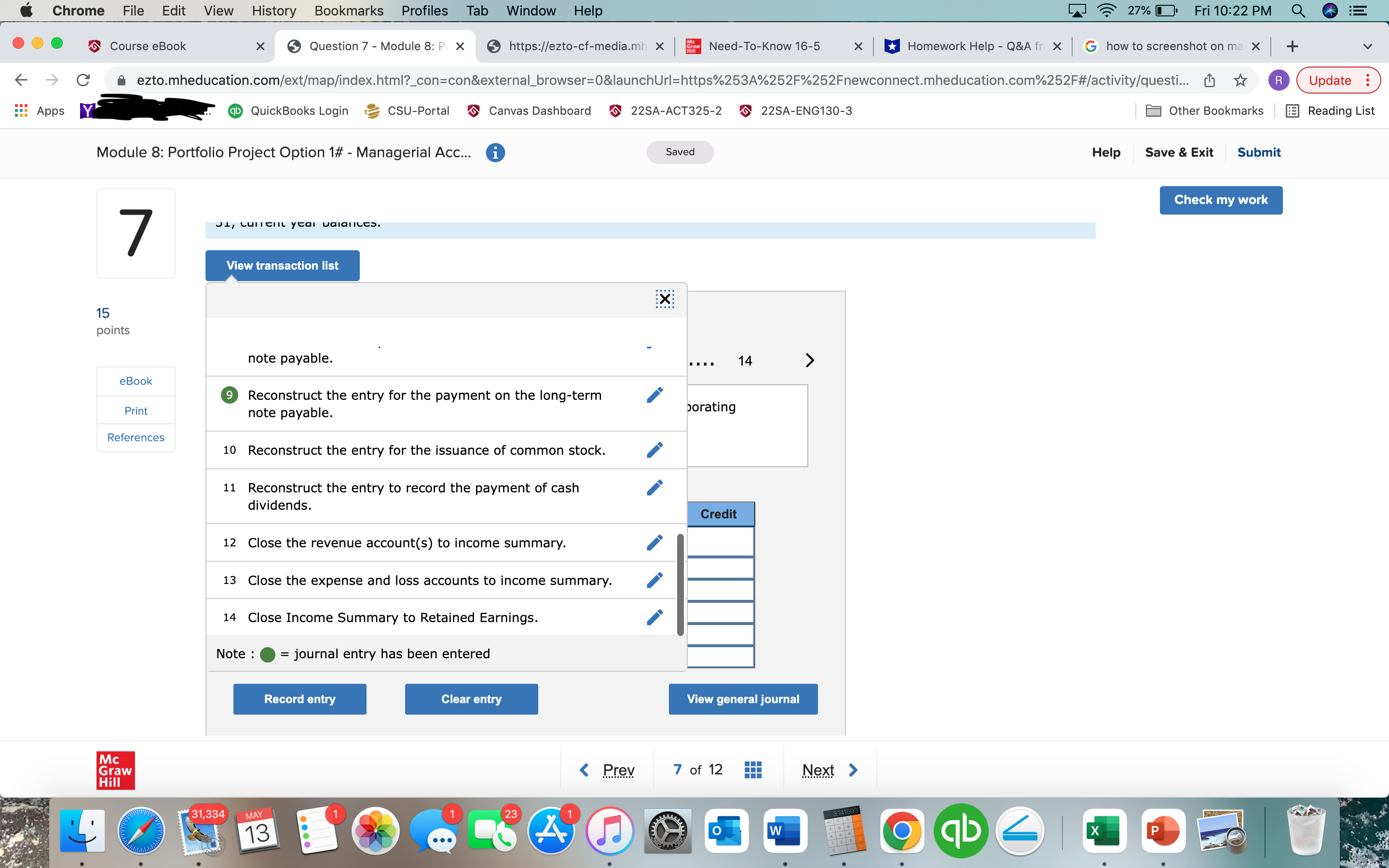

Chrome File Edit View History Bookmarks Profiles Tab Window Help 27% Fri 10:20 PM QE .. . Course eBook X Question 7 - Module 8: P X https://ezto-cf-media.mh x Need-To-Know 16-5 x *Homework Help - Q&A fr X G how to screenshot on ma X + C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/questi... Update Apps D QuickBooks Login CSU-Portal Canvas Dashboard 22SA-ACT325-2 22SA-ENG130-3 Other Bookmarks Reading List Module 8: Portfolio Project Option 1# - Managerial Acc... Saved Help Save & Exit Submit Check my work 7 Sweet Company's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) Other Expenses are paid in advance and are 15 initially debited to Prepaid Expenses. points SWEET COMPANY Comparative Balance Sheets December 31 eBook Current Year Prior Year Assets Print Cash $ 59, 200 $64, 200 74, 000 References Accounts receivable 57 , 000 Inventory 277, 000 253, 000 Prepaid expenses 3, 000 3 , 800 Total current assets 413, 200 378, 000 Equipment 241, 000 165 , 000 Accumulated depreciation-Equipment (60, 000) (70, 000) Total assets $ 594, 200 $ 473, 000 Liabilities and Equity Accounts payable 54, 200 117 , 000 Short-term notes payable 17, 000 10 , 000 Total current liabilities 71, 200 27 , 000 Long-term notes payable 72 , 000 54 , 000 Total liabilities 143, 200 181, 000 Equity Common stock, $5 par value 182 , 000 160 , 000 Paid-in capital in excess of par, common stock 66, 000 Retained earnings 203, 000 132, 000 Total liabilities and equity 594 , 200 473, 000 SWEET COMPANY Mc Graw Hill 31,334 MAY 1 23 13 o W qbChrome File Edit View History Bookmarks Profiles Tab Window Help 27% Fri 10:21 PM QE .. . Course eBook X Question 7 - Module 8: P( X https://ezto-cf-media.mh x Need-To-Know 16-5 x *Homework Help - Q&A fr X G how to screenshot on ma X + - C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/questi... Update Apps Y - Yah... qb QuickBooks Login CSU-Portal Canvas Dashboard 22SA-ACT325-2 22SA-ENG130-3 Other Bookmarks Reading List Module 8: Portfolio Project Option 1# - Managerial Acc... Saved Help Save & Exit Submit Check my work 7 SWEET COMPANY Income Statement For Current Year Ended December 31 Sales $ 848 , 000 Cost of goods sold 342, 000 Gross profit 506, 000 15 Operating expenses points Depreciation expense $ 24, 000 Other expenses 193, 000 217, 000 Other gains (losses) eBook Loss on sale of equipment (7, 000) Income before taxes 282 , 000 Print Income taxes expense 49, 000 Net income $ 233, 000 References Additional Information on Current Year Transactions a. The loss on the cash sale of equipment was $7,000 (details in b). b. Sold equipment costing $62,000, with accumulated depreciation of $34,000, for $21,000 cash. c. Purchased equipment costing $138,000 by paying $32,000 cash and signing a long-term note payable for the balance. d. Borrowed $7,000 cash by signing a short-term note payable. e. Paid $88,000 cash to reduce the long-term notes payable. f. Issued 4,400 shares of common stock for $20 cash per share. g. Declared and paid cash dividends of $162,000. Requirement General General Trial Balance Direct Method Indirect Journal Ledger Method Using the income statement, the comparative balance sheet, and the additional information given above, reconstruct the entries for the summarized activity of the current fiscal year. Upon completion, the trial balance tab should agree with the December 31, current year balances. Mc Graw Hill 31,334 MAY 1 23 13 O W qb XChrome File Edit View History Bookmarks Profiles Tab Window Help 27% Fri 10:21 PM QE .. . Course eBook X Question 7 - Module 8: P( X https://ezto-cf-media.mh x Need-To-Know 16-5 * *Homework Help - Q&A fr X G how to screenshot on ma X + C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/questi... Update Apps CSU-Portal Canvas Dashboard 22SA-ACT325-2 22SA-ENG130-3 Other Bookmarks Reading List Module 8: Portfolio Project Option 1# - Managerial Acc... Saved Help Save & Exit Submit Check my work 7 Requirement General General Journal Trial Balance Direct Method Indirect Ledger Method Using the income statement, the comparative balance sheet, and the additional information given above, reconstruct the entries for the summarized activity of the current fiscal year. Upon completion, the trial balance tab should agree with the December 15 31, current year balances. points View transaction list View journal entry worksheet x eBook X Debit Credit Print References Reconstruct the journal entry for cash receipts from 17,000 customers, incorporating the change in the related balance sheet account(s), if any. 2 Reconstruct the journal entry for cash payments for 24,000 inventory, incorporating the change in the related balance sheet account(s), if any. Notes were not issued for the 24,000 purchase of inventory. 88,000 3 Reconstruct the journal entry for depreciation expense, incorporating the change in the related balance sheet 88,000 account(s), if any. 4 Reconstruct the journal entry for cash paid for operating neral Ledger > expenses, incorporating the change in the related balance sheet account(s), if any. Mc Graw Hill 31,334 MAY 1 23 13 o W qbChrome File Edit View History Bookmarks Profiles Tab Window Help 27% Fri 10:22 PM QE . . . Course eBook X Question 7 - Module 8: P( X https://ezto-cf-media.mh x Need-To-Know 16-5 x *Homework Help - Q&A fr X G how to screenshot on ma X + - C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/questi... Update Apps Y Yah... ab QuickBooks Login CSU-Portal Canvas Dashboard 22SA-ACT325-2 22SA-ENG130-3 Other Bookmarks Reading List Module 8: Portfolio Project Option 1# - Managerial Acc... Saved Help Save & Exit Submit Check my work 7 View transaction list 15 points 5 Reconstruct the journal entry for the sale of equipment at 14 > a loss, incorporating the change in the related balance eBook sheet account(s), if any. borating Print 6 Reconstruct the journal entry for income taxes expense, References Incorporating the change in the related balance sheet account(s), if any 7 Reconstruct the entry for the purchase of new Credit equipment. 8 Reconstruct the entry for the issuance of the short-term note payable. 9 Reconstruct the entry for the payment on the long-term note navable Note : = journal entry has been entered Record entry Clear entry View general journal Mc Graw Hill 31,334 MAY 1 23 13 O WChrome File Edit View History Bookmarks Profiles Tab Window Help 27% Fri 10:22 PM QE .. . Course eBook X Question 7 - Module 8: P( X https://ezto-cf-media.mh x Need-To-Know 16-5 x *Homework Help - Q&A fr X G how to screenshot on ma X + C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/questi... Update Apps Y qb QuickBooks Login CSU-Portal Canvas Dashboard 22SA-ACT325-2 22SA-ENG130-3 Other Bookmarks Reading List Module 8: Portfolio Project Option 1# - Managerial Acc... Saved Help Save & Exit Submit Check my work 7 1, CullGIRL yeal ualalltes. View transaction list X: 15 points note payable. 14 eBook 9 Reconstruct the entry for the payment on the long-term Print note payable. porating References 10 Reconstruct the entry for the issuance of common stock. 11 Reconstruct the entry to record the payment of cash dividends. Credit 12 Close the revenue account(s) to income summary. 13 Close the expense and loss accounts to income summary. 14 Close Income Summary to Retained Earnings. Note : = journal entry has been entered Record entry Clear entry View general journal Mc Graw Hill 31,334 MAY 1 23 13 O W

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts