Question: Chrome File Edit View History Bookmarks Profiles Tab Window Help WORKBRAIN - Emple x M Inbox (2,960) - nithe x @ WhatsApp X ozi McGraw-Hill

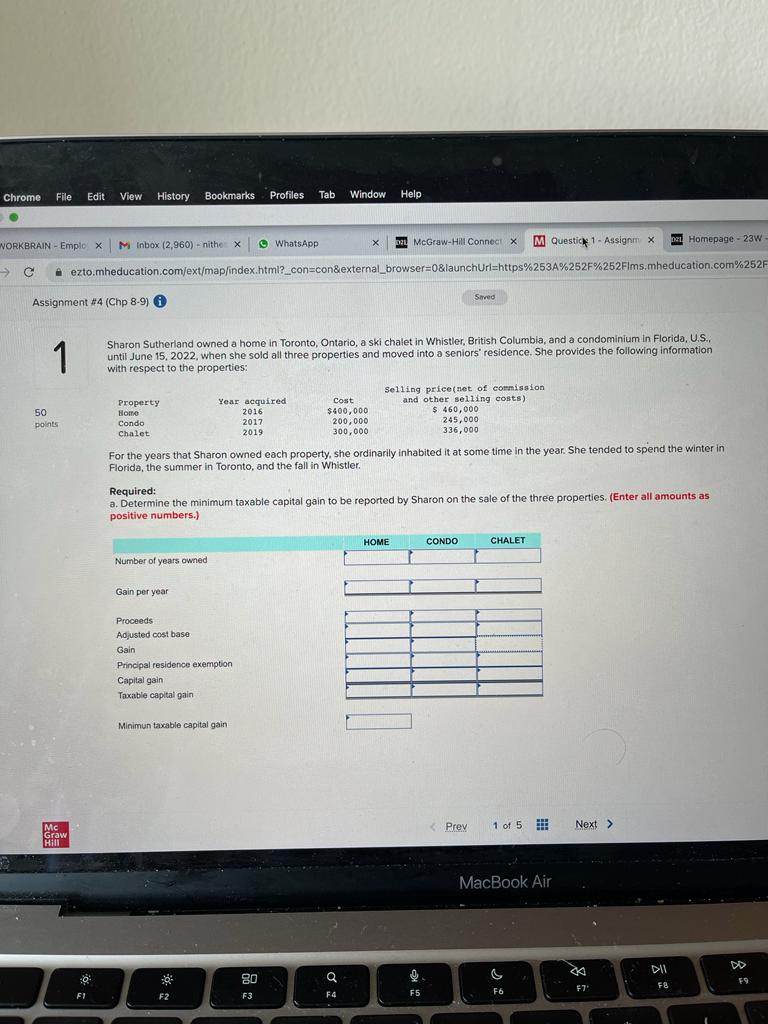

Chrome File Edit View History Bookmarks Profiles Tab Window Help WORKBRAIN - Emple x M Inbox (2,960) - nithe x @ WhatsApp X ozi McGraw-Hill Connect x M Questick 1 - Assignm * mail Homepage - 23w C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUri=https%253A%252F%252FIms.mheducation.com%252F Assignment #4 (Chp 8-9) @ Sharon Sutherland owned a home in Toronto, Ontario, a ski chalet in Whistler, British Columbia, and a condominium in Florida, U.S., until June 15, 2022, when she sold all three properties and moved into a seniors' residence. She provides the following information with respect to the properties: Selling price(net of commission Property Year acquired Cost and other selling costs) 50 2016 $400, 000 $ 460,900 points Condo 2017 200, 000 245, 000 Chalet 2019 300,000 336,900 For the years that Sharon owned each property, she ordinarily inhabited it at some time in the year. She tended to spend the winter in Florida, the summer in Toronto, and the fall in Whistler. Required: a. Determine the minimum taxable capital gain to be reported by Sharon on the sale of the three properties. (Enter all amounts as positive numbers. HOME CONDO CHALET Number of years owned Gain per year Proceeds Adjusted cost base Gain Principal residence exemption Capital gain Taxable capital gain Minimun taxable capital gain Prey 1 of 5 # Next > MacBook Air DD 30 Q S F9 FA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts