Question: Chrome File Edit View History Bookmarks Profiles Tab Window Help MT217 Finance O PG Campus =Quiz: Unit 6 Lab Quiz X PG Campus G

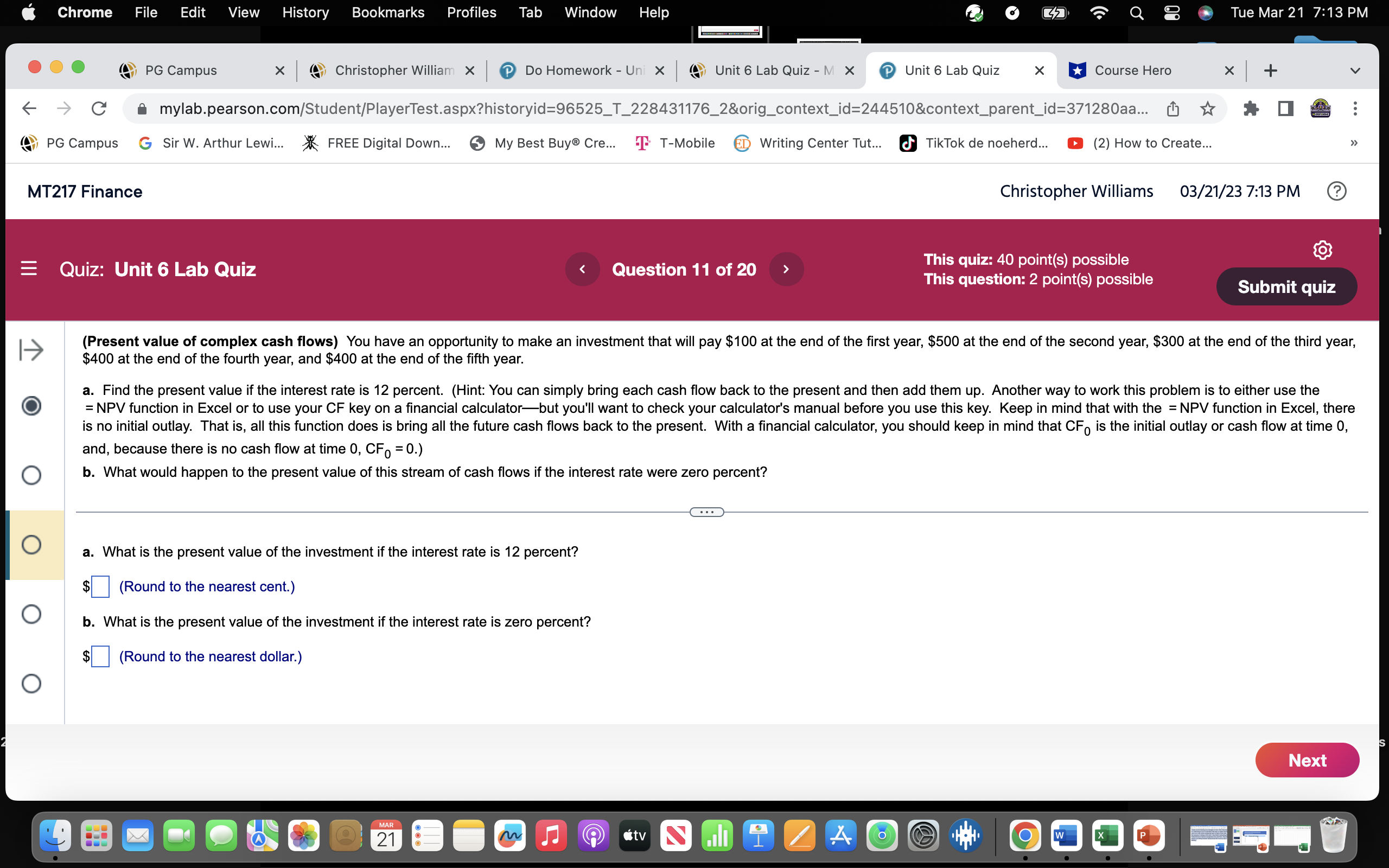

Chrome File Edit View History Bookmarks Profiles Tab Window Help MT217 Finance O PG Campus =Quiz: Unit 6 Lab Quiz X PG Campus G Sir W. Arthur Lewi... *FREE Digital Down... Christopher William X $ Do Homework - Uni X mylab.pearson.com/Student/PlayerTest.aspx?historyid=96525_T_228431176_2&orig_context_id=244510&context_parent_id=371280aa... My Best Buy Cre... T T-Mobile ED Writing Center Tut... Unit 6 Lab Quiz - M X PUnit 6 Lab Quiz a. What is the present value of the investment if the interest rate is 12 percent? $ (Round to the nearest cent.) b. What is the present value of the investment if the interest rate is zero percent? (Round to the nearest dollar.) MAR 21 Question 11 of 20 > X tv Nall A TikTok de noeherd... O Course Hero Christopher Williams (2) How to Create... This quiz: 40 point(s) possible This question: 2 point(s) possible (Present value of complex cash flows) You have an opportunity to make an investment that will pay $100 at the end of the first year, $500 at the end of the second year, $300 at the end of the third year, $400 at the end of the fourth year, and $400 at the end of the fifth year. a. Find the present value if the interest rate is 12 percent. (Hint: You can simply bring each cash flow back to the present and then add them up. Another way to work this problem is to either use the = NPV function in Excel or to use your CF key on a financial calculator-but you'll want to check your calculator's manual before you use this key. Keep in mind that with the NPV function in Excel, there is no initial outlay. That is, all this function does is bring all the future cash flows back to the present. With a financial calculator, you should keep in mind that CFO is the initial outlay or cash flow at time 0, and, because there is no cash flow at time 0, CF =0.) b. What would happen to the present value of this stream of cash flows if the interest rate were zero percent? W Tue Mar 21 7:13 PM SO Ke 03/21/23 7:13 PM Submit quiz >>> Next

Step by Step Solution

3.39 Rating (174 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts