Question: Chrustuba Inc. is evaluating a new project that would cost $8.6 million. The company uses a WACC of 9.5%. There is a 50% chance that

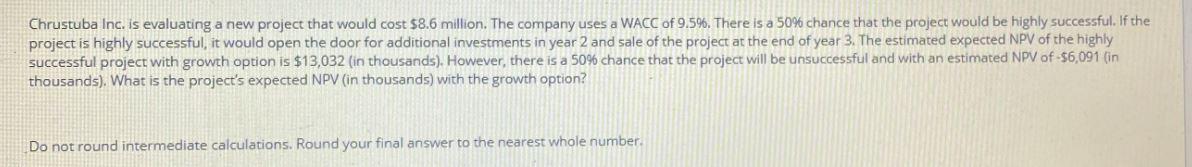

Chrustuba Inc. is evaluating a new project that would cost $8.6 million. The company uses a WACC of 9.5%. There is a 50% chance that the project would be highly successful. If the project is highly successful, it would open the door for additional investments in year 2 and sale of the project at the end of year 3. The estimated expected NPV of the highly successful project with growth option is $13,032 (in thousands). However, there is a 50% chance that the project will be unsuccessful and with an estimated NPV of $6,091 (in thousands). What is the project's expected NPV (in thousands) with the growth option? Do not round intermediate calculations. Round your final answer to the nearest whole number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts