Question: Chrysarbor Textiles is evaluating a new product, a silk/wool blend fabric. Suppose you were recently hired as an assistant to the director of capital budgeting

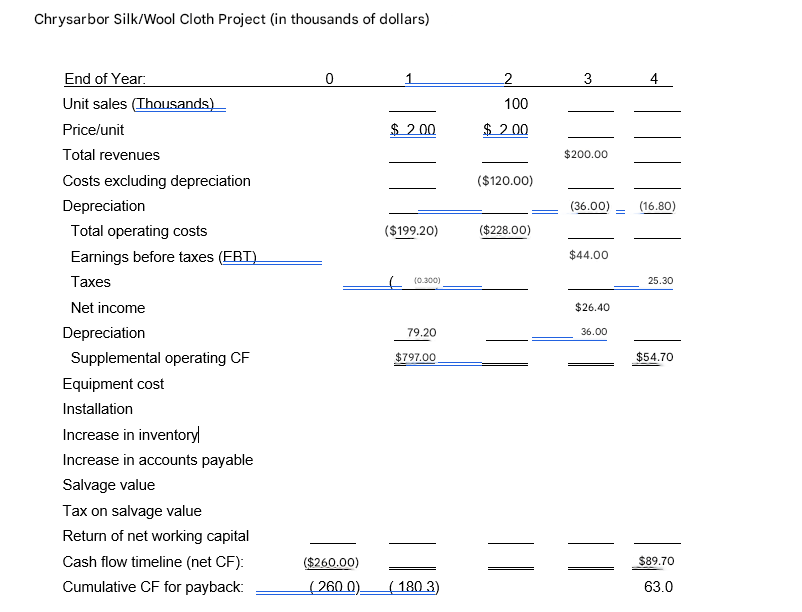

Chrysarbor Textiles is evaluating a new product, a silk/wool blend fabric. Suppose you were recently hired as an assistant to the director of capital budgeting and are to evaluate the new project. The fabric would be produced in an unused building adjacent to Chrysarbor's Hrysarbor, North Carolina, plant. Chrysarbor owns the building, which is fully depreciated. The required equipment would cost $200,000, plus an additional $40,000 for shipping and installation. In addition, inventories would increase by $25,000, while accounts payable would increase by $5,000. All of these costs would be incurred in year 0. Through a special resolution, the machinery could be depreciated under the MACRS system as 3-year property. (See Table 10A.2 at the end of Chapter 10 for the MACRS recovery bonus percentages.) The project is expected to operate for four years, at which time it will be terminated. Cash inflows are assumed to begin one year after the project is completed, or at t = 1, and continue through t = 4. At the end of the project's life (year 4), the equipment is expected to have a salvage value of $25,000. Unit sales are expected to total 100,000 five-yard rolls of textiles per year, and the expected selling price is $2 per roll. Cash operating costs for the project (total operating costs less depreciation) are expected to total 60% of dollar sales. Chrysarbor's marginal tax rate is 40% and its required rate of return is 10%. Tentatively, the silk/wool blend fabric project is of equal risk to Chrysarbor's other assets. You have been asked to evaluate the project and make a recommendation as to whether it should be accepted or rejected. Your supervisor, Mr. Greg Ward, gave you the following set of tasks to complete:

1. Draw a cash flow timeline showing when net cash inflows and outflows will occur, and explain how the timeline can be used to help structure the analysis. 2. Chrysarbor has a standard form used in the capital budgeting process, shown in the following table:

2.1 NPV = Net Present Value? 2.2 IRR = Internal Rate of Return? 2.3 Payback = Payback Period?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts