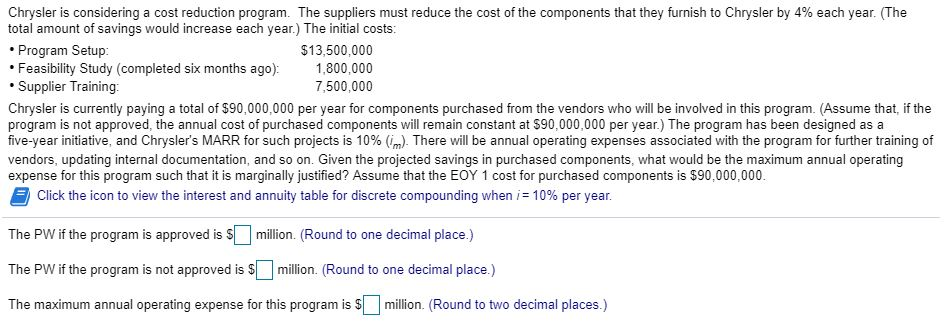

Question: Chrysler is considering a cost reduction program. The suppliers must reduce the cost of the components that they furnish to Chrysler by 4% each year.

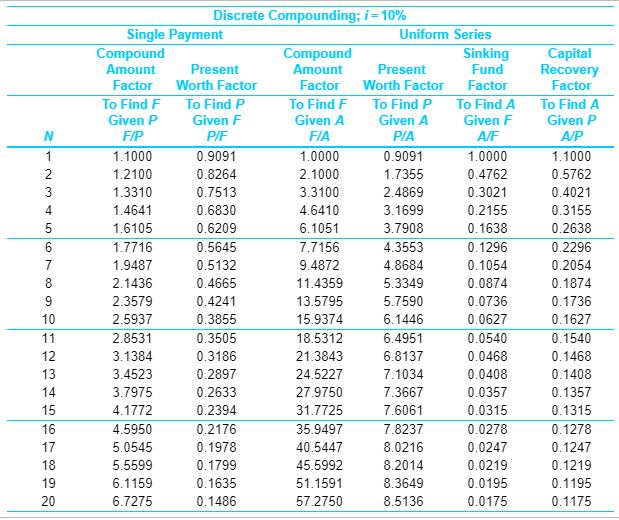

Chrysler is considering a cost reduction program. The suppliers must reduce the cost of the components that they furnish to Chrysler by 4% each year. total amount of savings would increase each year.) The initial costs The Program Setup: Feasibility Study (completed six months ago): $13,500,000 1,800,000 7,500,000 Supplier Training: Chrysler is currently paying a total of $90,000,000 per year for components purchased from the vendors who will be involved in this program. (Assume that, if the program is not approved, the annual cost of purchased components will remain constant at $90,000,000 per year.) The program has been designed as a five-year initiative, and Chrysler's MARR for such projects s 10% There will be annual operating expenses asso ated with the program r ur er training o vendors, updating internal documentation, and so on. Given the projected savings in purchased components, what would be the maximum annual operating expense for this program such that it is marginally justified? Assume that the EOY 1 cost for purchased components is S90,000,000 Click the icon to view the interest and annuity table for discrete compounding when 10% per year. The PW if the program is approved is million. (Round to one decimal place.) The PW if the program is not approved is $million. (Round to one decimal place.) The maximum annual operating expense for this program is und to two decimal places.) 02158-6 4 4 6 7-0 8 8 7 5|87955 06253-95732 6051-7 4433|2 2 2 1 1 15432-2211 0G -1 0 0 0 0000000000000000 02158-6 4 4 6 7-0 8 8 7 5|87955 06253-95732 07016-20876 04321|1 1 0 0 0-0 0 0 0 0 0 0 0 0 0 6051-74-97 4433|2 2 2 1 1 10000-00000-00000-00000 A -1 5 9 9 834906|1 7 4 7 1-7 6496 533 69-5 17-38371|4 8 1 3 6-80235 01233|4 4 5 5 6 6 6 7 7 7-78888 00001-62 00015-57 00140-1 954|23705-77210 597-14 373-38 459-53597-9 5 5 1 52-9 2 995 957 F013617 135-8 1 471|50517 12346-79 14309-5 515-5 6 7 3 4|68956 130 8939-7793 98766-55 333222|2 1 1 1 1 00000-00000-00000-00000 00015|6 7 6 9 7-14352_05995 957 373-3 Flv F-1 2 3 4 6-7 9135|81471|5051 1 2 3 4 5-6 7 8 9 0-1 2 3 4 5 6 7 8 9 0 11 Chrysler is considering a cost reduction program. The suppliers must reduce the cost of the components that they furnish to Chrysler by 4% each year. total amount of savings would increase each year.) The initial costs The Program Setup: Feasibility Study (completed six months ago): $13,500,000 1,800,000 7,500,000 Supplier Training: Chrysler is currently paying a total of $90,000,000 per year for components purchased from the vendors who will be involved in this program. (Assume that, if the program is not approved, the annual cost of purchased components will remain constant at $90,000,000 per year.) The program has been designed as a five-year initiative, and Chrysler's MARR for such projects s 10% There will be annual operating expenses asso ated with the program r ur er training o vendors, updating internal documentation, and so on. Given the projected savings in purchased components, what would be the maximum annual operating expense for this program such that it is marginally justified? Assume that the EOY 1 cost for purchased components is S90,000,000 Click the icon to view the interest and annuity table for discrete compounding when 10% per year. The PW if the program is approved is million. (Round to one decimal place.) The PW if the program is not approved is $million. (Round to one decimal place.) The maximum annual operating expense for this program is und to two decimal places.) 02158-6 4 4 6 7-0 8 8 7 5|87955 06253-95732 6051-7 4433|2 2 2 1 1 15432-2211 0G -1 0 0 0 0000000000000000 02158-6 4 4 6 7-0 8 8 7 5|87955 06253-95732 07016-20876 04321|1 1 0 0 0-0 0 0 0 0 0 0 0 0 0 6051-74-97 4433|2 2 2 1 1 10000-00000-00000-00000 A -1 5 9 9 834906|1 7 4 7 1-7 6496 533 69-5 17-38371|4 8 1 3 6-80235 01233|4 4 5 5 6 6 6 7 7 7-78888 00001-62 00015-57 00140-1 954|23705-77210 597-14 373-38 459-53597-9 5 5 1 52-9 2 995 957 F013617 135-8 1 471|50517 12346-79 14309-5 515-5 6 7 3 4|68956 130 8939-7793 98766-55 333222|2 1 1 1 1 00000-00000-00000-00000 00015|6 7 6 9 7-14352_05995 957 373-3 Flv F-1 2 3 4 6-7 9135|81471|5051 1 2 3 4 5-6 7 8 9 0-1 2 3 4 5 6 7 8 9 0 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts