Question: - Chs. 4,5,6,7 i Saved From the video Challenges in and Strategies for Working with Multi-Cultural Virtual Teams, it is vital to remember the two

![the two "C's" which are The Foundational 15 (Algo) [LO10-1, LO10-2] [The](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e2e9972cad0_96666e2e996c5b4d.jpg)

![following information applies to the questions displayed below.] Westerville Company reported the](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e2e997d31f0_96766e2e997673a3.jpg)

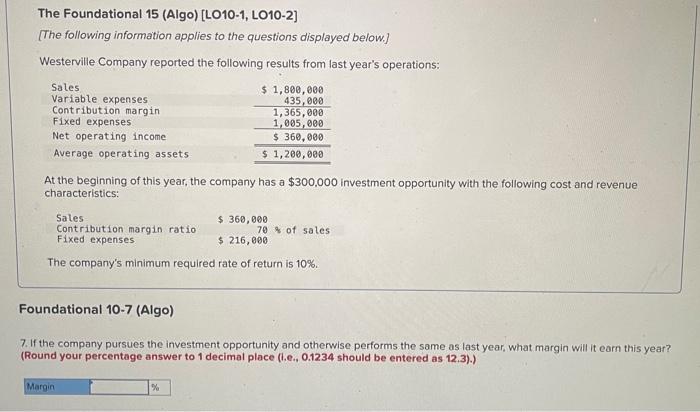

The Foundational 15 (Algo) [LO10-1, LO10-2] [The following information applies to the questions displayed below.] Westerville Company reported the following results from last year's operations: At the beginning of this year, the company has a $300,000 investment opportunity with the following cost and revenue characteristics: The company's minimum required rate of return is 10%. Foundational 10-7 (Algo) 7. If the company pursues the investment opportunity and otherwise performs the same as last year, what margin will it earn this year? (Round your percentage answer to 1 decimal place (1.e., 0.1234 should be entered as 12.3).) From the video Challenges in and Strategles for Working with Multi-Cultural Virtual Teams, it is vital to remember the two " C 's" which are The Foundational 15 (Algo) [LO10-1, LO10-2] [The following information applies to the questions displayed below.] Westerville Company reported the following results from last year's operations: At the beginning of this year, the company has a $300.000 investment opportunity with the following cost and revenue characteristics: The company's minimum required rate of return is 10%. Foundational 10-8 (Algo) The Foundational 15 (Algo) [LO10-1, LO10-2] [The following information applies to the questions displayed below.] Westerville Company reported the following results from last year's operations: At the beginning of this year, the company has a $300,000 investment opportunity with the following cost and revenue characteristics: The company's minimum required rate of return is 10%. Foundational 10-9 (Algo) 9. If the company pursues the investment opportunity ond otherwise performs the same os last year, what ROI will it earn this year? (Do not round intermediate calculations. Round your percentage answer to 1 decimal place (i.e., 0.1234 should be entered as 12.3 ).)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts