Question: CIEN-440 FA2018 Infrastructure Financing Assignment 3 Due Date: 12 November 2018 Q1. project. He can repay the loan in either of the two ways described

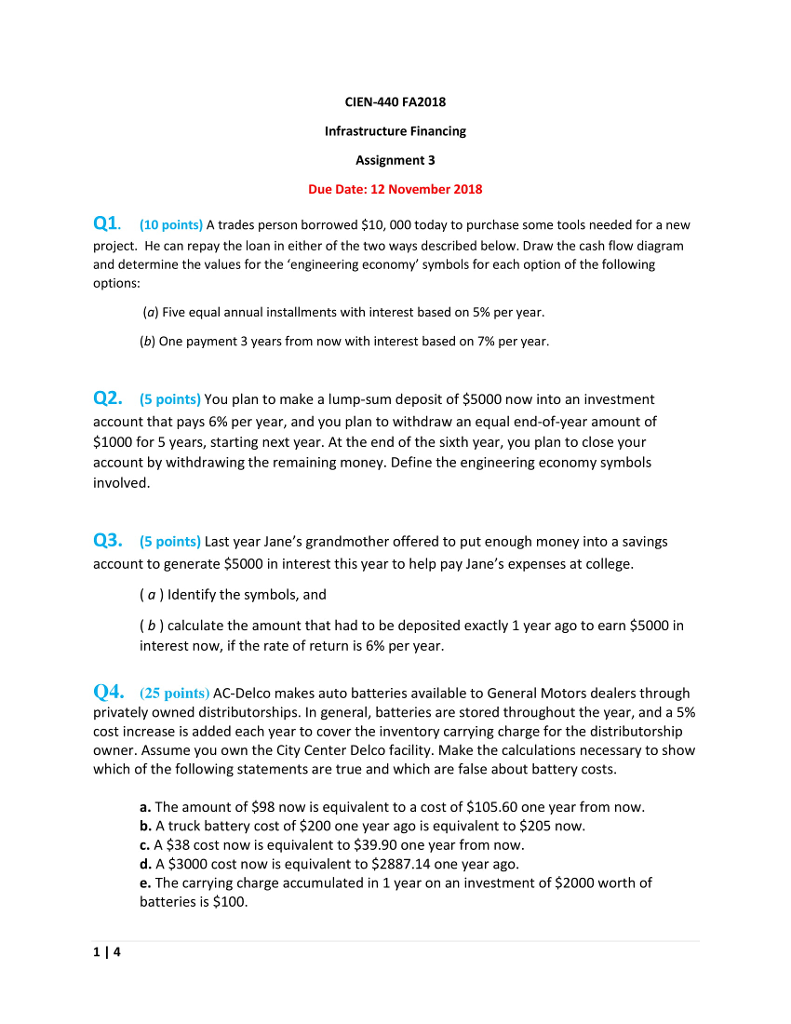

CIEN-440 FA2018 Infrastructure Financing Assignment 3 Due Date: 12 November 2018 Q1. project. He can repay the loan in either of the two ways described below. Draw the cash flow diagram and determine the values for the 'engineering economy' symbols for each option of the following options: (10 points) A trades person borrowed $10, 000 today to purchase some tools needed for a new (a) Five equal annual installments with interest based on 5% per year (b) One payment 3 years from now with interest based on 7% per year Q2. (5 points) You plan to make a lump-sum deposit of $5000 now into an investment account that pays 6% per year, and you plan to withdraw an equal end-of-year amount of $1000 for 5 years, starting next year. At the end of the sixth year, you plan to close your account by withdrawing the remaining money. Define the engineering economy symbols involved Q3. (5 points) Last year Jane's grandmother offered to put enough money into a savings account to generate $5000 in interest this year to help pay Jane's expenses at college (a ) Identify the symbols, and (b) calculate the amount that had to be deposited exactly 1 year ago to earn $5000 in interest now, if the rate of return is 6% per year Q4. (25 points) AC-Delco makes auto batteries available to General Motors dealers through privately owned distributorships. In general, batteries are stored throughout the year, and a 5% cost increase is added each year to cover the inventory carrying charge for the distributorship owner. Assume you own the City Center Delco facility. Make the calculations necessary to show which of the following statements are true and which are false about battery costs a. The amount of $98 now is equivalent to a cost of $105.60 one year from now b. A truck battery cost of $200 one year ago is equivalent to $205 now c. A $38 cost now is equivalent to $39.90 one year from now d. A $3000 cost now is equivalent to $2887.14 one year ago e. The carrying charge accumulated in 1 year on an investment of $2000 worth of batteries is $100 CIEN-440 FA2018 Infrastructure Financing Assignment 3 Due Date: 12 November 2018 Q1. project. He can repay the loan in either of the two ways described below. Draw the cash flow diagram and determine the values for the 'engineering economy' symbols for each option of the following options: (10 points) A trades person borrowed $10, 000 today to purchase some tools needed for a new (a) Five equal annual installments with interest based on 5% per year (b) One payment 3 years from now with interest based on 7% per year Q2. (5 points) You plan to make a lump-sum deposit of $5000 now into an investment account that pays 6% per year, and you plan to withdraw an equal end-of-year amount of $1000 for 5 years, starting next year. At the end of the sixth year, you plan to close your account by withdrawing the remaining money. Define the engineering economy symbols involved Q3. (5 points) Last year Jane's grandmother offered to put enough money into a savings account to generate $5000 in interest this year to help pay Jane's expenses at college (a ) Identify the symbols, and (b) calculate the amount that had to be deposited exactly 1 year ago to earn $5000 in interest now, if the rate of return is 6% per year Q4. (25 points) AC-Delco makes auto batteries available to General Motors dealers through privately owned distributorships. In general, batteries are stored throughout the year, and a 5% cost increase is added each year to cover the inventory carrying charge for the distributorship owner. Assume you own the City Center Delco facility. Make the calculations necessary to show which of the following statements are true and which are false about battery costs a. The amount of $98 now is equivalent to a cost of $105.60 one year from now b. A truck battery cost of $200 one year ago is equivalent to $205 now c. A $38 cost now is equivalent to $39.90 one year from now d. A $3000 cost now is equivalent to $2887.14 one year ago e. The carrying charge accumulated in 1 year on an investment of $2000 worth of batteries is $100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts