Question: Cindy opened her RDSP in 2 0 0 9 . Her allocation of grant to contribution amount totals 8 5 % and 1 5 %

Cindy opened her RDSP in Her allocation of grant to contribution amount totals and

respectively. Under the proportionate repayment rule

how much would she be required to repay if she were to make a withdrawal in of $ in

Professors Answer's

Total grant from would total

Total grant money needed to be repaid totals $

$$ for every $ contribution

The assistance holdback amount would be reduced to $

I just need a walkthrough on how the professor got each number

RDSP Withdrawals

Therefore, it becomes imperative to evaluate the timing of such withdrawals for the

following reasons:

If CDSG or CDSB have not been in the plan for at least years before the

withdrawal date, then $ needs to be paid back to the government for each $

the beneficiary withdraws called the "proportionate repayment rule"

Limits are imposed on the amount that can be withdrawn in any given year if the

majority of the funds residing in the plan are made up of CDSGs or CDSBs

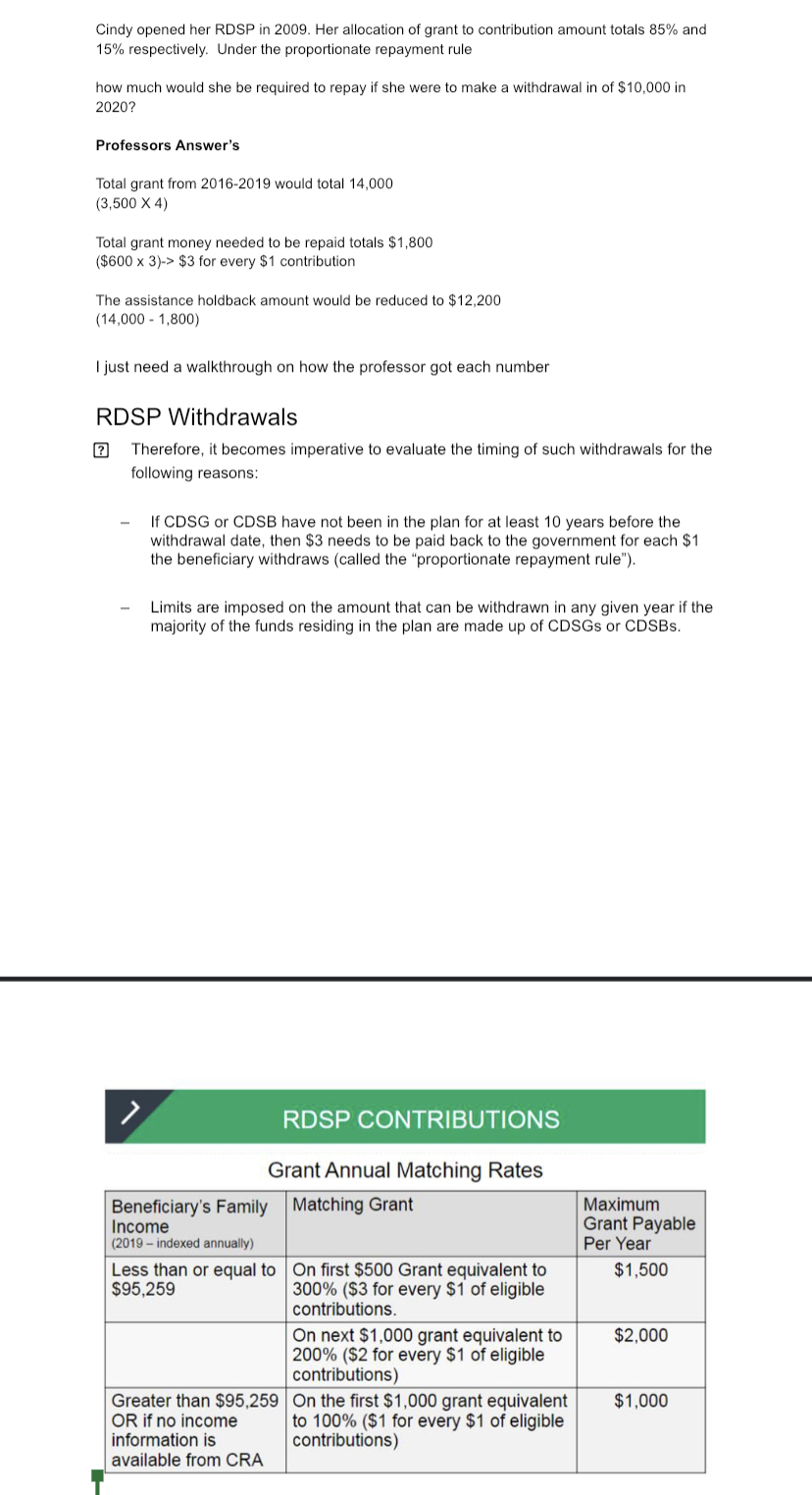

RDSP CONTRIBUTIONS

Grant Annual Matching Rates

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock