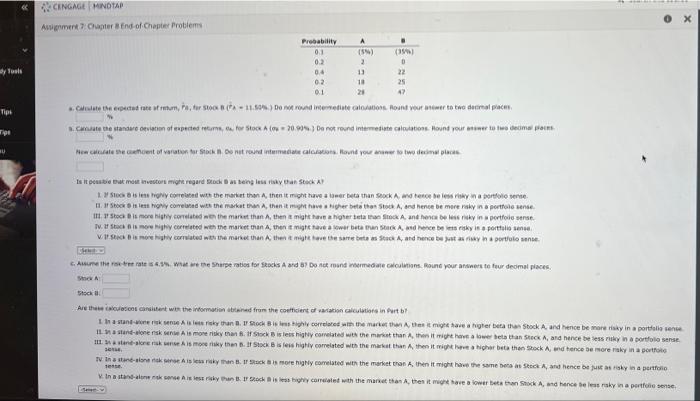

Question: CINGAGEMNOTA Awitter End of Chapter Problems Probability 0.1 0.2 04 02 0.1 (59) 2 13 world D 22 25 47 Tipe 20 Cerpected rate of

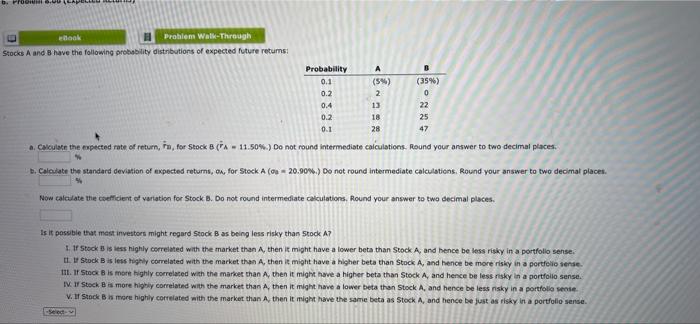

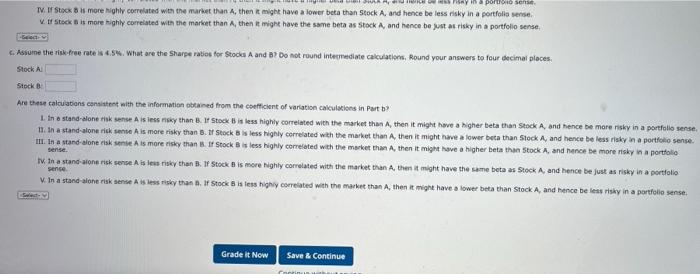

CINGAGEMNOTA Awitter End of Chapter Problems Probability 0.1 0.2 04 02 0.1 (59) 2 13 world D 22 25 47 Tipe 20 Cerpected rate of room, Peter Soo ( 11.06) Do not round mermeiste cotone Hound your aniwer to two dermal pa Ce the standwe deviation of expected return on for Stock A low = 20.00) Danot round intermediate calculation. Hound your time to we decimal pois wale e content of variation to Sokonit round intermediate clown Hound you are to budeme places Tige U Is it pose but most investors might regard to as being less riya Stock 1.500 correlated won the market then, then it might have a beathan Sock Andere best for Skor less howy correlated wit the market than then the sherbeta thon Stock A, and hence be more sky in a portfolosense 1. Stocols more correlated the market than the might have a higher than fick A and hence bele in portfolose 1. Stoch is hy correlated with the more than the might taveaw but that doe iyis portfolio Vistas come with more than then the same bute SA, and hence na portfolosite 6. A. We were shorpe rates for socks and do not mand nomadere calculos. Round your answers to four deomal places She Are there one consistent was the information and from the content of action in Porto 1. In astanek les riskan. Shock Bises correlated in the market thermiqt have a grer beatha Stock A, and hence be more sky in a portfolia sense In a stand-oriensk Ais more risky an . Stock ile highly correlated with more than then it might be beta than Stock A, and hence besessie in a portfolosense 111.1 ore A more than I Stock is highly correlated with the market than then it might har beta then Sock And hence be more risky in a portfoto TV In anoniek is ery. If suck is more highly correlated with the market than then it might have the same besas Schence roky na portfolio In a stanowiskonse is les risky. So is easy correlated with the man than then it might have a lower beta Sack A, and hence les risky portfesse bro.LAPENA eBook Problem Walk-Through Stocks A and have the following probability distributions of expected future returns A Probability 0.1 0.2 0.4 0.2 0.1 (5%) 2 13 18 28 (35%) 0 22 25 47 B Calculate the expected rate of return, in, for Stock B (PA - 11.50%.) Do not round intermediate calculations. Round your answer to two decimal places. b. Calouate the standard deviation of expected returns, ow, for Stock A (or = 20.90%.) Do not round intermediate calculations. Round your answer to two decimal places. Now calculate the coefficient et variation for Stock B. Do not round intermediate calculations, Round your answer to two decimal places. Is it possible that most investors might regard Stock B as being less risky than Stock A7 1. 1 Stock is less highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less risky in a portfolio sense. Stock B is less y correlated with the market than A, then it might have a higher beta than Stock A, and hence be more risky in a portfolio sense 1. If Stock is more Nighly correlated with the market than then it might have a higher beta than Stock A, and hence be less risky in a portfolio sense. IV I Stock is more highly correlated with the market than A then it might have a lower beathan Stock A, and hence be less risky in a portfolio sense V. I Stock is more highly correlated with the market than A, then it might have the same beta as Stock A, and hence be just as risky in a portfolio sense. Seyin a portion sense TV. If Stock 8 is more highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less risky in a portfolio sense v.tr stock is more highly correlated with the market than A, then it might have the same beta as Stock A, and hence be just as risky in a portfolio sense, 6. Assume the rise free rate s 4.5, what are the Sharpe ratios for Stocks A and B? Do not round intermediate calculators, Round your answers to four decimal places. Stock AI Stock Are these calculations consistent with the information obtained from the coefficient of variation calculations in Part ? 1. In a stand-alone risk sense A is less risky than 8. Stock is less highly correlated with the market than then it might have a higher beta than Stock A, and hence be more risky in a portfolio sense 11. In a stand-alone risk sense is more risky than 8. tr Stock is less highly correlated with the market than then it might have a lower beta than Stock A, and hence be less risky in a portfolio sense. m. In a stand-alone risk sentit A is more risky than I Stock is less highly correlated with the market than A, then it might have a higher beta than stock and hence be more risky in a portfolio I tha stand-alone risk sense is less risky than B. 1 Stock is more highly correlated with the market than A, then it might have the same beta as Stock A, and hence be just as risky in a portfolio W.In a standalone risk sense is less than it Stock 3 is less highly correlated with the market than A, then it might have tower beta than Stock A, and hence be less risky in a portfolio sense. sense. sence Grade it Now Save & Continue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts