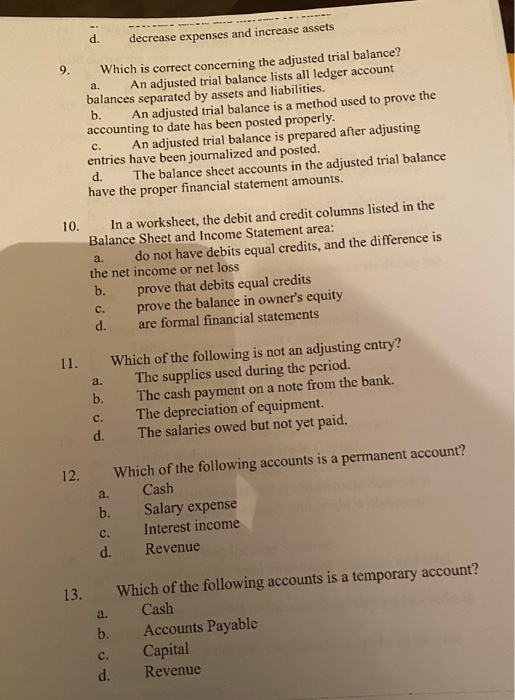

Question: circle the letter with the best response d. decrease expenses and increase assets Which is correct concerning the adjusted trial balance? a. An adjusted trial

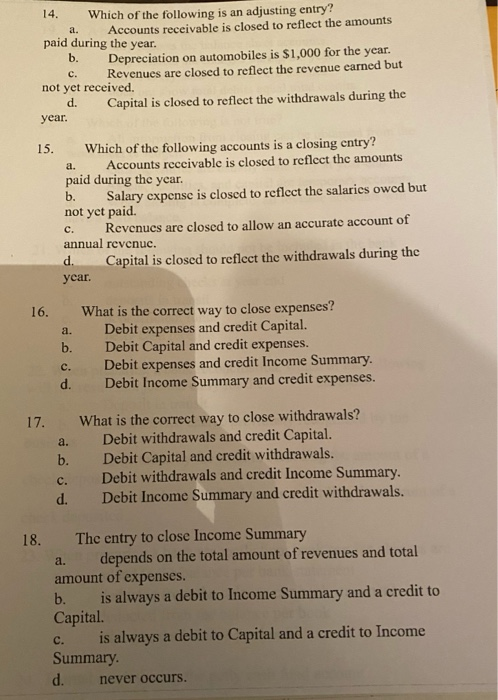

d. decrease expenses and increase assets Which is correct concerning the adjusted trial balance? a. An adjusted trial balance lists all ledger account balances separated by assets and liabilities. b. An adjusted trial balance is a method used to prove the accounting to date has been posted properly. c. An adjusted trial balance is prepared after adjusting entries have been journalized and posted. d. The balance sheet accounts in the adjusted trial balance have the proper financial statement amounts. 10. In a worksheet, the debit and credit columns listed in the Balance Sheet and Income Statement area: a. do not have debits equal credits, and the difference is the net income or net loss prove that debits equal credits prove the balance in owner's equity are formal financial statements b. Which of the following is not an adjusting entry? The supplies used during the period. The cash payment on a note from the bank. The depreciation of equipment. The salaries owed but not yet paid. Which of the following accounts is a permanent account? Cash b. Salary expense Interest income Revenue Which of the following accounts is a temporary account? Cash Accounts Payable Capital Revenue 14. Which of the following is an adjusting entry? a. Accounts receivable is closed to reflect the amounts paid during the year. Depreciation on automobiles is $1,000 for the year. c. Revenues are closed to reflect the revenue earned but not yet received. d. Capital is closed to reflect the withdrawals during the year. 15. Which of the following accounts is a closing entry? a. Accounts receivable is closed to reflect the amounts paid during the year. b. Salary expense is closed to reflect the salaries owed but not yet paid. c. Revenues are closed to allow an accurate account of annual revenue. d. Capital is closed to reflect the withdrawals during the year. a. What is the correct way to close expenses? Debit expenses and credit Capital. Debit Capital and credit expenses. Debit expenses and credit Income Summary. Debit Income Summary and credit expenses. What is the correct way to close withdrawals? a. Debit withdrawals and credit Capital. b. Debit Capital and credit withdrawals. Debit withdrawals and credit Income Summary. Debit Income Summary and credit withdrawals. c. 18. The entry to close Income Summary a. depends on the total amount of revenues and total amount of expenses. b. is always a debit to Income Summary and a credit to Capital. c. is always a debit to Capital and a credit to Income Summary d. never occurs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts