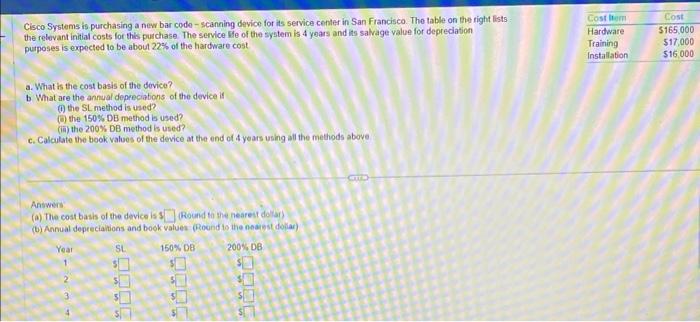

Question: Cisco Systems is purchasing a new bar code-scanning device for its service center in San Francisco. The table on the right lists the relevant initial

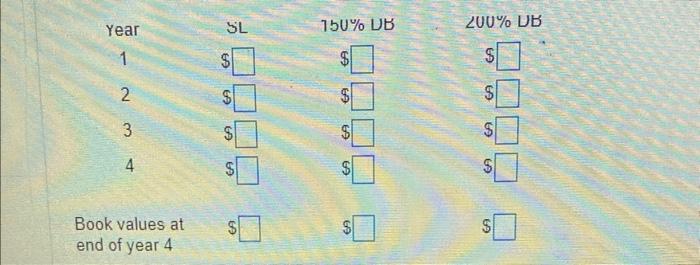

Cisco Systems is purchasing a new bar code-scanning device for its service center in San Francisco. The table on the right lists the relevant initial costs for this purchase. The service Ife of the system is 4 years and its salvage value for depreciation. purposes is expected to be about 22% of the hardware cost? a. What is the cost basis of the device? b. What are the annual depreciabons of the device if (i) the SL method is used? (i) the 150%DB method is used? (iii) the 200%DB method is used? c. Calculate the book values of the device at the end of 4 years using all the methods above Answeis (a) The cost bashs of the device is 1 (Round ta the nearett detat) (b) Annual deprecialtions and book values (Roond to the noarnst dofiar) Year1234SL$$$$15U%UB$$$$LUU%UB$$$$ Book values at end of year 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts