Question: a). Sara is in the process of completing her VAT return for the quarter ended 31 March 2022 in the UAE. The following information

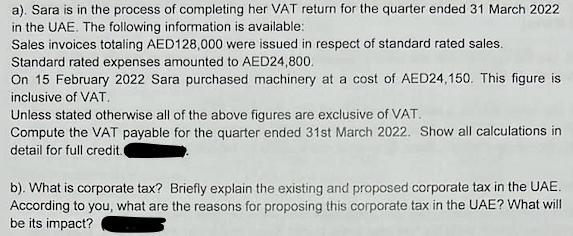

a). Sara is in the process of completing her VAT return for the quarter ended 31 March 2022 in the UAE. The following information is available: Sales invoices totaling AED128,000 were issued in respect of standard rated sales. Standard rated expenses amounted to AED24,800. On 15 February 2022 Sara purchased machinery at a cost of AED24,150. This figure is inclusive of VAT. Unless stated otherwise all of the above figures are exclusive of VAT. Compute the VAT payable for the quarter ended 31st March 2022. Show all calculations in detail for full credit. b). What is corporate tax? Briefly explain the existing and proposed corporate tax in the UAE. According to you, what are the reasons for proposing this corporate tax in the UAE? What will be its impact?

Step by Step Solution

3.34 Rating (175 Votes )

There are 3 Steps involved in it

a VAT payable sales expenses x VAT rate VAT payable 128000 24800 x ... View full answer

Get step-by-step solutions from verified subject matter experts