Question: CK 10 Assignment Attempts 2 1 Keep the Highest 2/3 5. The market for common stock Type of corporation Charles Underwood Agency Inc. recently raised

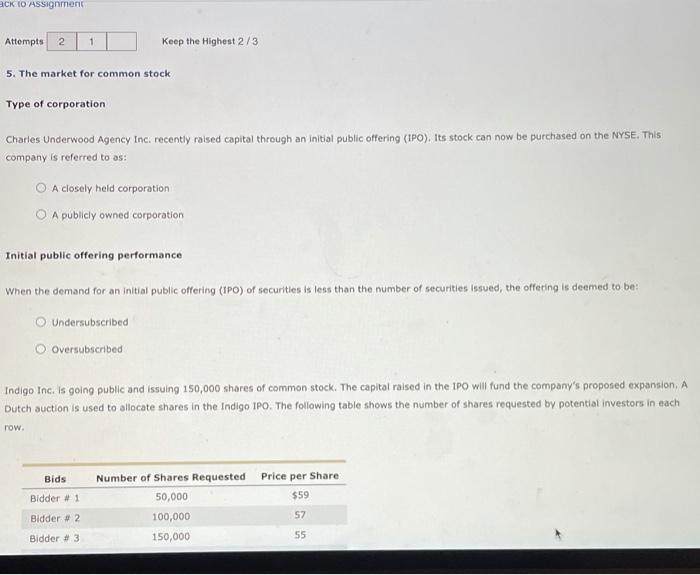

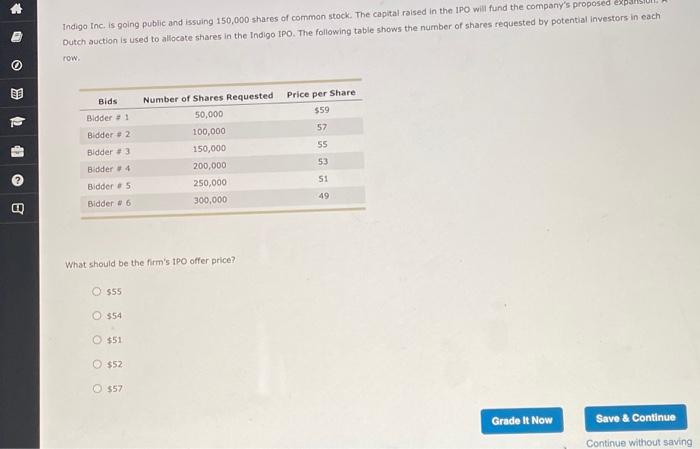

CK 10 Assignment Attempts 2 1 Keep the Highest 2/3 5. The market for common stock Type of corporation Charles Underwood Agency Inc. recently raised capital through an initial public offering (IPO), Its stock can now be purchased on the NYSE. This company is referred to as: A closely held corporation A publicly owned corporation Initial public offering performance When the demand for an initial public offering (IPO) of securities is less than the number of securities Issued, the offering is deemed to be: Undersubscribed Oversubscribed Indigo Inc. is going public and issuing 150,000 shares of common stock. The capital raised in the IPO will fund the company's proposed expansion. A Dutch auction is used to allocate shares in the Indigo IPO. The following table shows the number of shares requested by potential investors in each row Bids Number of Shares Requested Price per Share $59 Bidder #1 50,000 Bidder #2 57 100,000 150,000 55 Bidder #3 Indigo Inc. is going public and issuing 150,000 shares of common stock. The capital raised in the IPO will fund the company's proposed ex Dutch auction is used to allocate shares in the Indigo IPO. The following table shows the number of shares requested by potential investors in each row Price per Share $59 57 Bids Bidder Bidder #2 Bidder 3 Bidder 4 55 Number of Shares Requested 50,000 100,000 150,000 200,000 250,000 300,000 53 si Bidder #5 49 Bidder #6 B What should be the firm's IPO offer price? $55 @ $54 $51 @ $52 557 Grade It Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts