Question: C-l Each question is worth 3,.33 points. MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question 1) Five years

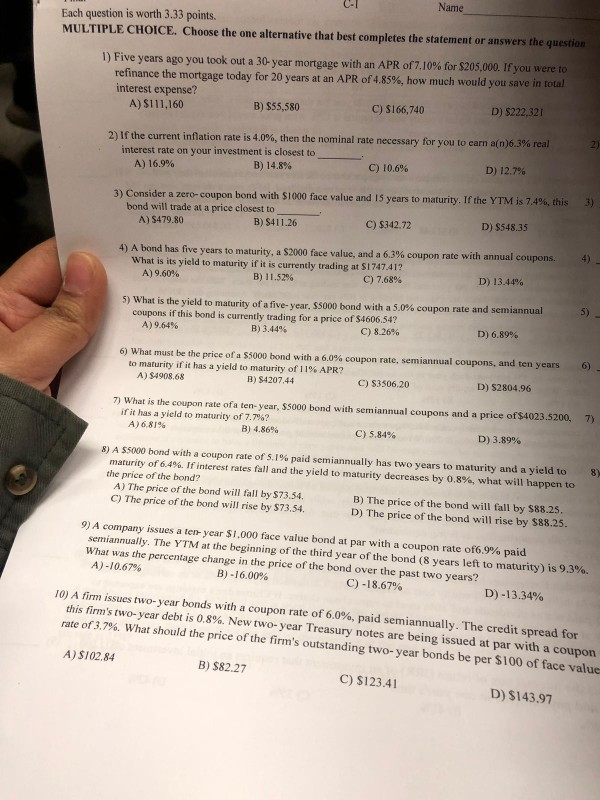

C-l Each question is worth 3,.33 points. MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question 1) Five years ago you took out a 30-year mortgage with an APR of7.10% for S205.000. Try ou were to refinance the mortgage today for 20 years at an APR of4.85%, how much would you save in total interest expense? A) $111,160 D) $222,321 B) $55,580 C) S 166,740 2) If the current inflation rate is 4.0%, then the nominal rate necessary for you to earn a(n)63% real interest rate on your investment is closest to A) 16.9% D) 12.7% C) 10.6% B) 14.8% 3) Consider a zero-coupon bond with $1000 face value and 15 years to maturity. If the YTM is 7.4 bond will trade at a price closest to A) $479.80 D) $548.35 C) $342.72 B) $411.26 4) A bond has five years to maturity, a $2000 face value, and a 6.3% coupon rate with annual coupons what is its yield to maturity if it is currently trading at si 747.417 A) 9.60% 4) D) 13.44% C) 7.68% B) 11.52% 5) what is the yield to maturity of a five-year, SS000 bond with a 5.0% coupon rate and semiannual coupons if this bond is currently trading for a price of S4606.54? A) 9.64% D) 6.89% C) 8.26% B) 3.44% 6) what must be the price of a $5000 bond with a 6.0% coupon rate, semiannual coupons, and ten years to maturity if it has a yield to maturity of 11% APR? A) $4908.68 6) C) S3506.20 D) S2804.96 B) $4207.44 7) What is the coupon rate ofa ten-year, $5000 bond with semiannual coupons and a price of $4023.5200, 7) if it has a yield to maturity of 7.7%? A) 6.81% B) 4.86% C) 5.84% D) 3.89% 8) A S5000 bond with a coupon rate of 51% paid semiannually has two years to maturity and a yield to maturity Of64% If interest rates fall and the yield to maturity decreases by 0.8% what will happen to the price of the bond? A) The price of the bond will fall by $73.54. C) The price of the bond will rise by $73.54. 8) B) The price of the bond will fall by $88.25. D) The price of the bond will rise by $88.25. 9) A company issues a ten-year $1,000 face value bond at par with a coupon rate of69% paid semiannually. The YTM at the beginning of the third year of the bond (8 years left to maturity) is 93% What was the percentage change in the price of the bond over the past two years? A )-10.67% B)-16.00% C)-18.67% D)-13.34% 10) A firm issues two-year bonds with a coupon rate of 60%, paid semiannually. The credit spread for this firm's two-year debt is 0.8%. New two-year Treasury notes are being issued at par with a coupon rate of3.7%. What should the price of the firm's outstanding two-year bonds be per $100 of face value A) S102,84 B) $82.27 C) $123.41

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts