Question: C-language Program 2: You need a program to maintain information about your employees' payroll. Assume that you have the following employees: Name Hours Worked Hourly

C-language

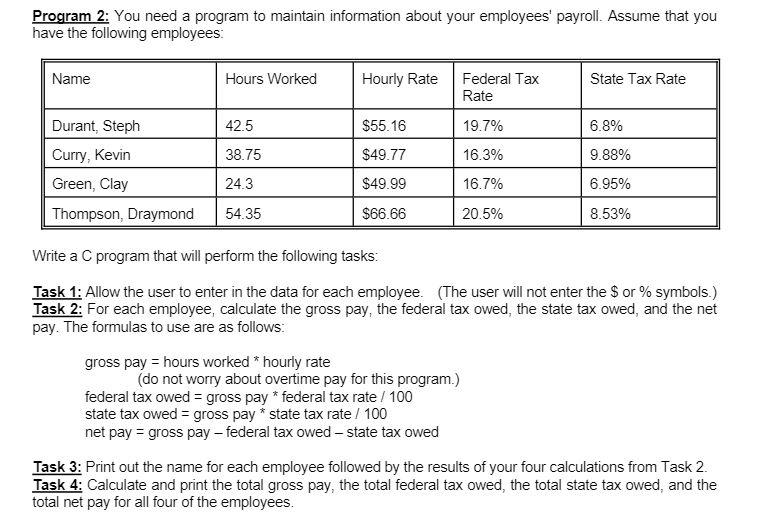

Program 2: You need a program to maintain information about your employees' payroll. Assume that you have the following employees: Name Hours Worked Hourly Rate State Tax Rate Federal Tax Rate 42.5 $55.16 19.7% 6.8% 38.75 $49.77 16.3% 9.88% Durant, Steph Curry, Kevin Green, Clay Thompson, Draymond 24.3 $49.99 16.7% 6.95% 54.35 $66.66 20.5% 8.53% Write a C program that will perform the following tasks: Task 1: Allow the user to enter in the data for each employee. (The user will not enter the $ or % symbols.) Task 2: For each employee, calculate the gross pay, the federal tax owed, the state tax owed, and the net pay. The formulas to use are as follows: gross pay = hours worked * hourly rate (do not worry about overtime pay for this program.) federal tax owed = gross pay * federal tax rate / 100 state tax owed = gross pay * state tax rate / 100 net pay = gross pay-federal tax owed-state tax owed Task 3: Print out the name for each employee followed by the results of your four calculations from Task 2. Task 4: Calculate and print the total gross pay, the total federal tax owed, the total state tax owed, and the total net pay for all four of the employees

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts