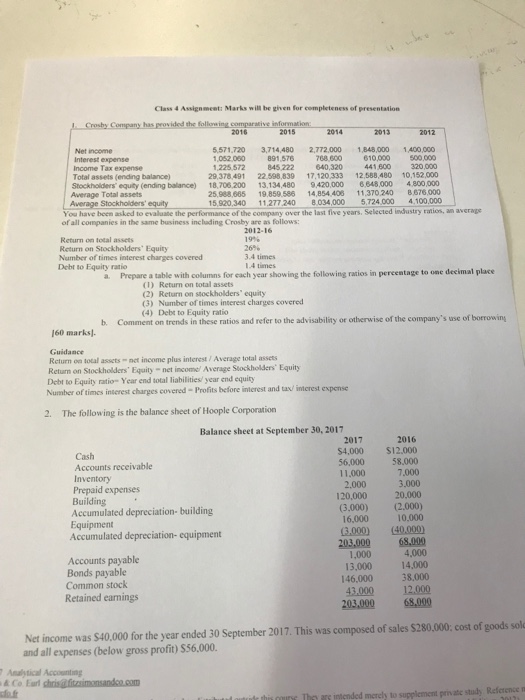

Question: Class 4 Assignment: Marks will be gihen for completeness of presentation 2015 2013 2016 2014 5.571,720 3,714,480 2,772,000 1,848,000 1400,000 500,000 Net incorme 1052.060 891,576

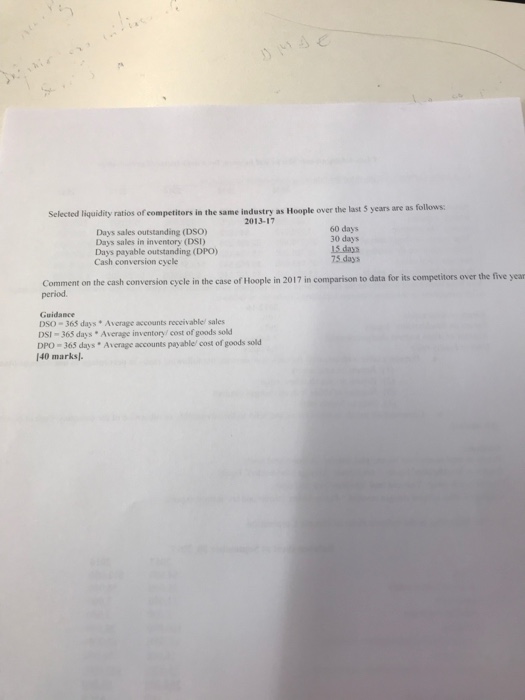

Class 4 Assignment: Marks will be gihen for completeness of presentation 2015 2013 2016 2014 5.571,720 3,714,480 2,772,000 1,848,000 1400,000 500,000 Net incorme 1052.060 891,576 768 600 610,000 Interest expense Income Tax expense Total assets (ending balance) Stockholders equity (ending balance) 18,706.200 Average Total assets Average Stockholders 1225 572 845.222 29,378491 22.598,839 17,120 333 12,588,480 10,152,000 640,320 441,600 320,000 13,134,480 9,420,000 6848,000 4,800,000 25,988,685 19,859.586 14,854 408 11,370.240 8876,000 15.920340 11.277240 8034,000 5724 4.100.000 You have bocm asked to evaluate the performance of the comany over the last five years. Selected industry ratios, an average of all companies in the same business inclading Crosby are as follows: 2012-16 Return on total assets Return on Stockholders Equity Number of times interest charges covered Debt to Equity ratio 26% 3.4 times 1.4 times a Prepare a table with columns for each year showing the following ratios in percemtage to one decimal place (1) Return on total assets (2) Return on stockholders equity (3) Number of times interest charges covered (4) Debt to Equity ratio b. Comment on trends in these ratios and refer to the advisability or otherwise of the company's use of borrowing 160 marks) Guidance Return on total assets nct income plus interest /Average total assets Returm on Stockholders' Equity-net incomel Average Stockholders Equity Debt to Equity ratio Year end total liabilities/ year end equity Number of times interest charges covered-Profits before interest and tax/ interest expense 2. The following is the balance sheet of Hoople Corporation Balance sheet at September 30, 2017 2016 S4,000 $12.000 56,000 58,000 7,000 3,000 120,000 20,000 (3.000) (2.000) 10,000 (3,000) (40.000) 2017 Cash Accounts receivable 11,000 Prepaid expenses Building Accumulated depreciation- building 16,000 Accumulated depreciation- equipment 1,000 4,000 Accounts payable 14,000 13.00038.000 43,000 12.000 203,000 68,000 Bonds payable Common stock 146,000 Retained earnings Net income was $40,000 for the year ended 30 September 2017. This was composed of sales $280,000. cost of goods sol and all expenses (below gross profit) $56.000. Analytical Accounting & Co Earl ch

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts