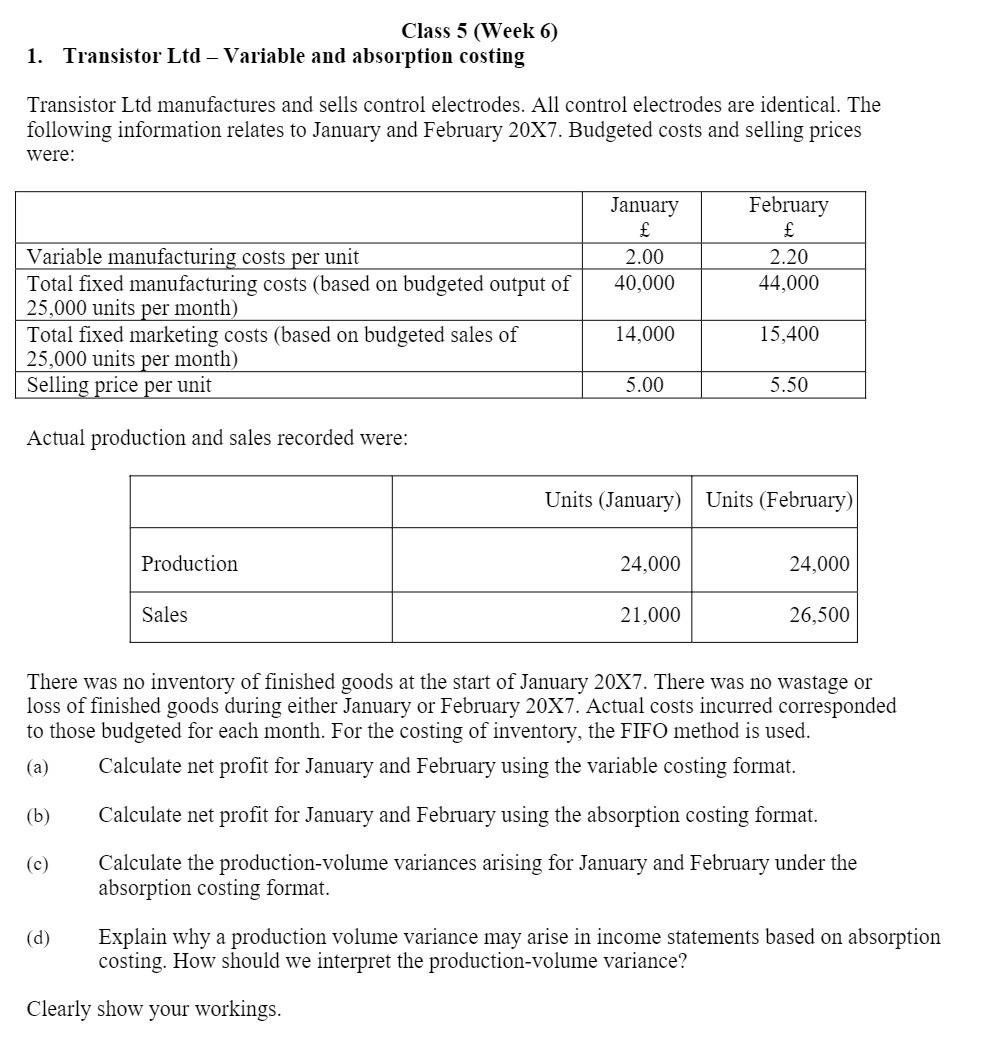

Question: Class 5 (Week 6) 1. Transistor Ltd - Variable and absorption costing Transistor Ltd manufactures and sells control electrodes. All control electrodes are identical. The

Class 5 (Week 6) 1. Transistor Ltd - Variable and absorption costing Transistor Ltd manufactures and sells control electrodes. All control electrodes are identical. The following information relates to January and February 20X7. Budgeted costs and selling prices were : January February f E Variable manufacturing costs per unit 2.00 2.20 Total fixed manufacturing costs (based on budgeted output of 40,000 44,000 25,000 units per month) Total fixed marketing costs (based on budgeted sales of 14,000 15,400 25,000 units per month) Selling price per unit 5.00 5.50 Actual production and sales recorded were: Units (January) Units (February) Production 24,000 24,000 Sales 21,000 26,500 There was no inventory of finished goods at the start of January 20X7. There was no wastage or loss of finished goods during either January or February 20X7. Actual costs incurred corresponded to those budgeted for each month. For the costing of inventory, the FIFO method is used (a) Calculate net profit for January and February using the variable costing format. ( b ) Calculate net profit for January and February using the absorption costing format. (c) Calculate the production-volume variances arising for January and February under the absorption costing format. (d) Explain why a production volume variance may arise in income statements based on absorption costing. How should we interpret the production-volume variance? Clearly show your workings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts