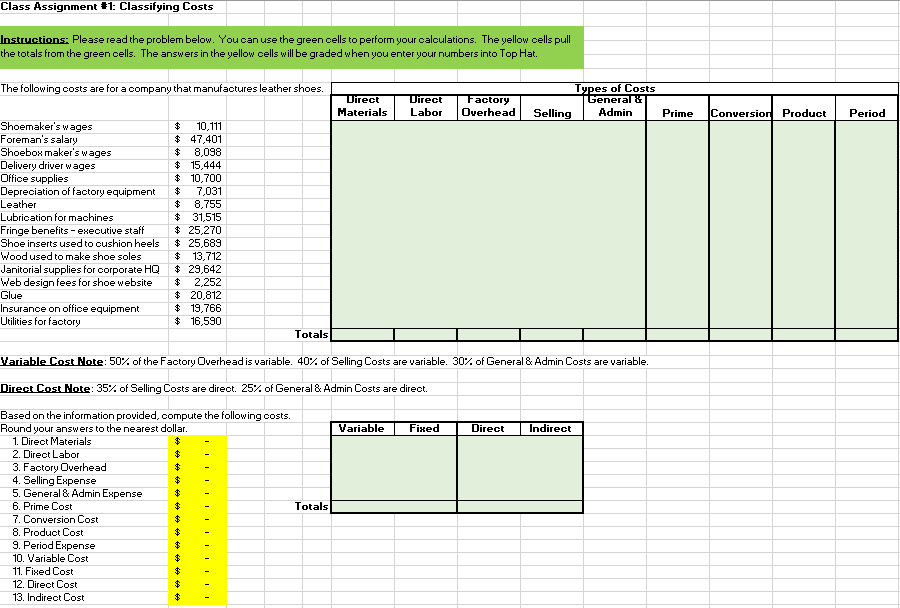

Question: Class Assignment 1: Classifying Costs Instructions Please read the problem below. You can use the green cells to perform your calculations. The yellow cells pll

Class Assignment 1: Classifying Costs Instructions Please read the problem below. You can use the green cells to perform your calculations. The yellow cells pll the totals from the green cells. The answers in the yellow cells will be graded when you enter your numbers into Top Hat. Types of Costs General & The following costs are for a company that manufactures leather shoes. Direct Factory Direct Materials Conversion Product Labor Overhead Admin Selling Prime Period Shoemaker'swages Foreman's salary Shoebox maker's wages Delivery driver wages Office supplies Depreciation of factory equipment 10,111 47,401 8,098 $ 15,444 $ 10,700 7,031 8,755 31,515 $ 25,270 $ 25,689 $ 13,712 $ 29,642 Leather $ Lubrication for machines Fringe benefits - executive staff Shoe inserts used to cushion heels Wood used to make shoe soles Janitorial supplies for corporate HQ Web design fees for shoe website 2,252 $ 20,812 $ 19,766 $ 16,590 Glue Insuranoe on office equipment Utilities for factory Totals Variable Cost Note: 50% of the Factory Overhead is variable. 40% of Selling Costs are variable. 30:% of General & Admin Costs are variable Direct Cost Note: 35% of Selling Costs are direct. 25% of General & Admin Costs are direct Based on the information provided, compute the following costs. Round your answers to the nearest dollar Variable Fixed Direct Indirect 1. Direct Materials 2. Direct Labor 3. Factory Overhead 4. Selling Expense 5. General & Admin Expense 6. Prime Cost Totals 7. Conversion Cost 8. Product Cost 9. Period Expense 10. Variable Cost 11. Fixed Cost 12. Direot Cost 13. Indirect Cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts