Question: + Class D License (Practice Test) B) Page Chapter 10 - Current Liabilities Activity 1 1. Madison Company had sales of $13,500. The sales tax

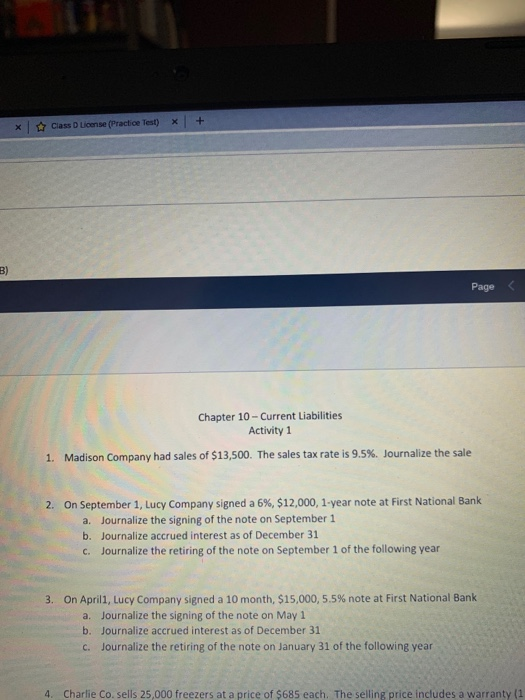

+ Class D License (Practice Test) B) Page Chapter 10 - Current Liabilities Activity 1 1. Madison Company had sales of $13,500. The sales tax rate is 9.5%. Journalize the sale 2. On September 1, Lucy Company signed a 6%, $12,000, 1-year note at First National Bank a. Journalize the signing of the note on September 1 b. Journalize accrued interest as of December 31 c. Journalize the retiring of the note on September 1 of the following year 3. On April1, Lucy Company signed a 10 month, $15,000,5.5% note at First National Bank a. Journalize the signing of the note on May 1 b. Journalize accrued interest as of December 31 Journalize the retiring of the note on January 31 of the following year C. 4 Charlie Co. sells 25,000 freezers at a price of $685 each. The selling price includes a warranty (1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts