Question: Class _ Date Chapter 2 Net Income Lesson 2.6 Statement of Earnings E Mathematics You may have additional deductions taken from your gross pay for

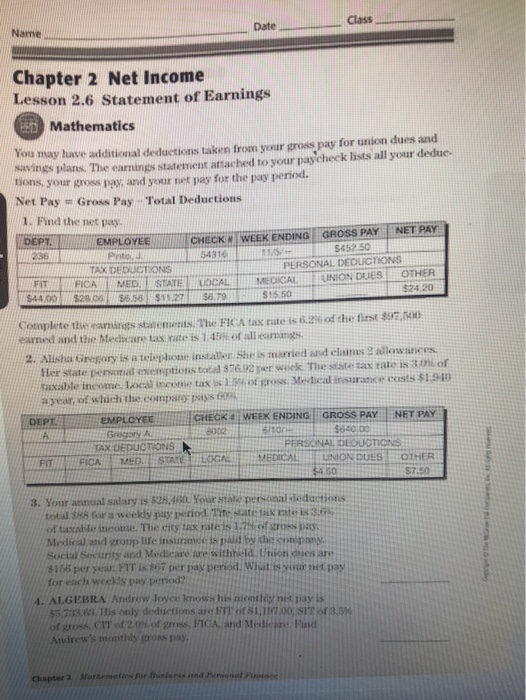

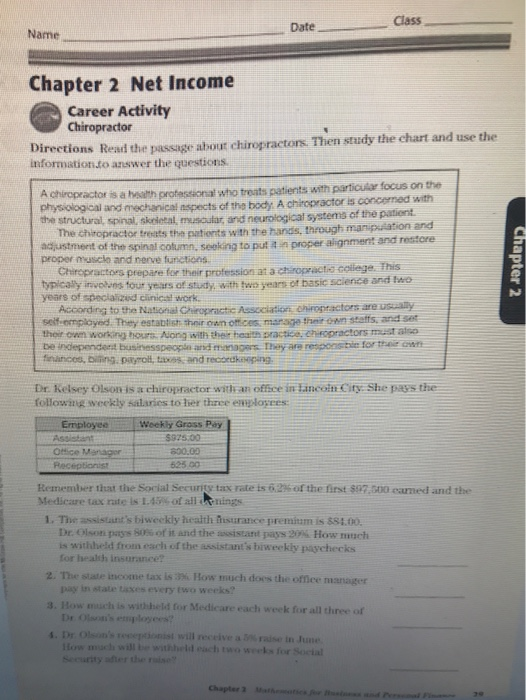

Class _ Date Chapter 2 Net Income Lesson 2.6 Statement of Earnings E Mathematics You may have additional deductions taken from your gross pay for union dues and savings plans. The earnings statement attached to your paychecklists all your dedue tions, your gross pay, and your net pay for the pay period. Net Pay - Gross Pay Total Deductions 1. Find the net pay DEPY EMPLOYEE C HECK WEEK ENDING GROSS PAYNET PAY 54316 5452.50 TAX DEDUCTIONS PERSONAL DEDUCTIONS FICA | MED, STATE LOCAL MEDICAL UNION DUES OTHER $44.00 $28.00 $6.55 $11.27 $13.50 $24. 20 $6. 9 Complete the warning statements. The F o x rate is 8.29 of the first $97.000 ered and the Medicare tax rate is 1.45 alemans 2. Alisha Gregory is a telephone installer She is muried and claims allow s Her state pronal exemptions to her wek The s tatale is the of Taxable income income tax of Medical insurance costs $19.00 a year, of which the company DEPT EMPLOYEE CHECK WEEK ENDING GROSS PAYNET PAY GA $540. TAX DEDUCTIONS PERSONAL DEDUCTIONS FIT WEDSTATE LOCAL MEDICAL UNION DUES OTHER FIONA 3. Your annual salary is $28.480. Your tale per al deductions to for a weekly pay d ie state tax 3.0 of taxable income. The city as it is 1.7 Medic and group life insurandis al by the Social Security and Medicare are within Unionues are $165 per FITI 857 per pay period. What is your ne pay for each weekly pay period? 4. ALGEBRA Andrew Joyce mows his monthly net pay is ANTI only deductions are F SLUITTO, STAN of gross CIT of 2.0 ofers, FICA and Medien Find Andrew's monthly pay Chapter Mathematics for and Prot e Class Date Name Chapter 2 Net Income Career Activity Chiropractor Directions Read the passage about chiropractors. Then study the chart and use the information to answer the questions A chiropractors a la protassionalwho treat patients with particular focus on the physiological and mechanical aspects of the body. A chlopractor is concerned with the structural, spinal, skeletal muscular, and neurological systems of the patient The Chiropractor treats the patients with the hands, through manipation and adjustment of the spinal column, sealing to put in proper alignment and restore proper mascio and nerve functions Chiropractos prepare for their profession at a cropractic college. This typically i n tour with sot basic science and he years of special clinical work According to the National Chiropractic Associations Chiropractors are usually self playedThey establish their own ces m e that staffs, and set their own working hou rs with the heart chopractors must also De independent businesspeon and managers. They are responsible for the financos, M ayroll, take and recording Chapter 2 Dr. Kelsey Olson is a chiropractor with an office in lancoln City. She pass the following weekly salaries to her three yees: Weekly Gross Pay Employee Assistant Nice Manager Receptionist 800.00 50 Remember that the Social Security tax rate is 62 of the first $7.500 oamed and the Medicare tax rate is 1.43% of all things 1. The assistant biweekly health issurance premium is 881.00 Dr. Olson of it and the musistant pas 20 How much is withheld from each of the usistant's biweekly paychecks for health insurance 2. The state income tax is: How much does the office manager 3. How much is withheld for Medicare each week for all three of Class _ Date Chapter 2 Net Income Lesson 2.6 Statement of Earnings E Mathematics You may have additional deductions taken from your gross pay for union dues and savings plans. The earnings statement attached to your paychecklists all your dedue tions, your gross pay, and your net pay for the pay period. Net Pay - Gross Pay Total Deductions 1. Find the net pay DEPY EMPLOYEE C HECK WEEK ENDING GROSS PAYNET PAY 54316 5452.50 TAX DEDUCTIONS PERSONAL DEDUCTIONS FICA | MED, STATE LOCAL MEDICAL UNION DUES OTHER $44.00 $28.00 $6.55 $11.27 $13.50 $24. 20 $6. 9 Complete the warning statements. The F o x rate is 8.29 of the first $97.000 ered and the Medicare tax rate is 1.45 alemans 2. Alisha Gregory is a telephone installer She is muried and claims allow s Her state pronal exemptions to her wek The s tatale is the of Taxable income income tax of Medical insurance costs $19.00 a year, of which the company DEPT EMPLOYEE CHECK WEEK ENDING GROSS PAYNET PAY GA $540. TAX DEDUCTIONS PERSONAL DEDUCTIONS FIT WEDSTATE LOCAL MEDICAL UNION DUES OTHER FIONA 3. Your annual salary is $28.480. Your tale per al deductions to for a weekly pay d ie state tax 3.0 of taxable income. The city as it is 1.7 Medic and group life insurandis al by the Social Security and Medicare are within Unionues are $165 per FITI 857 per pay period. What is your ne pay for each weekly pay period? 4. ALGEBRA Andrew Joyce mows his monthly net pay is ANTI only deductions are F SLUITTO, STAN of gross CIT of 2.0 ofers, FICA and Medien Find Andrew's monthly pay Chapter Mathematics for and Prot e Class Date Name Chapter 2 Net Income Career Activity Chiropractor Directions Read the passage about chiropractors. Then study the chart and use the information to answer the questions A chiropractors a la protassionalwho treat patients with particular focus on the physiological and mechanical aspects of the body. A chlopractor is concerned with the structural, spinal, skeletal muscular, and neurological systems of the patient The Chiropractor treats the patients with the hands, through manipation and adjustment of the spinal column, sealing to put in proper alignment and restore proper mascio and nerve functions Chiropractos prepare for their profession at a cropractic college. This typically i n tour with sot basic science and he years of special clinical work According to the National Chiropractic Associations Chiropractors are usually self playedThey establish their own ces m e that staffs, and set their own working hou rs with the heart chopractors must also De independent businesspeon and managers. They are responsible for the financos, M ayroll, take and recording Chapter 2 Dr. Kelsey Olson is a chiropractor with an office in lancoln City. She pass the following weekly salaries to her three yees: Weekly Gross Pay Employee Assistant Nice Manager Receptionist 800.00 50 Remember that the Social Security tax rate is 62 of the first $7.500 oamed and the Medicare tax rate is 1.43% of all things 1. The assistant biweekly health issurance premium is 881.00 Dr. Olson of it and the musistant pas 20 How much is withheld from each of the usistant's biweekly paychecks for health insurance 2. The state income tax is: How much does the office manager 3. How much is withheld for Medicare each week for all three of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts