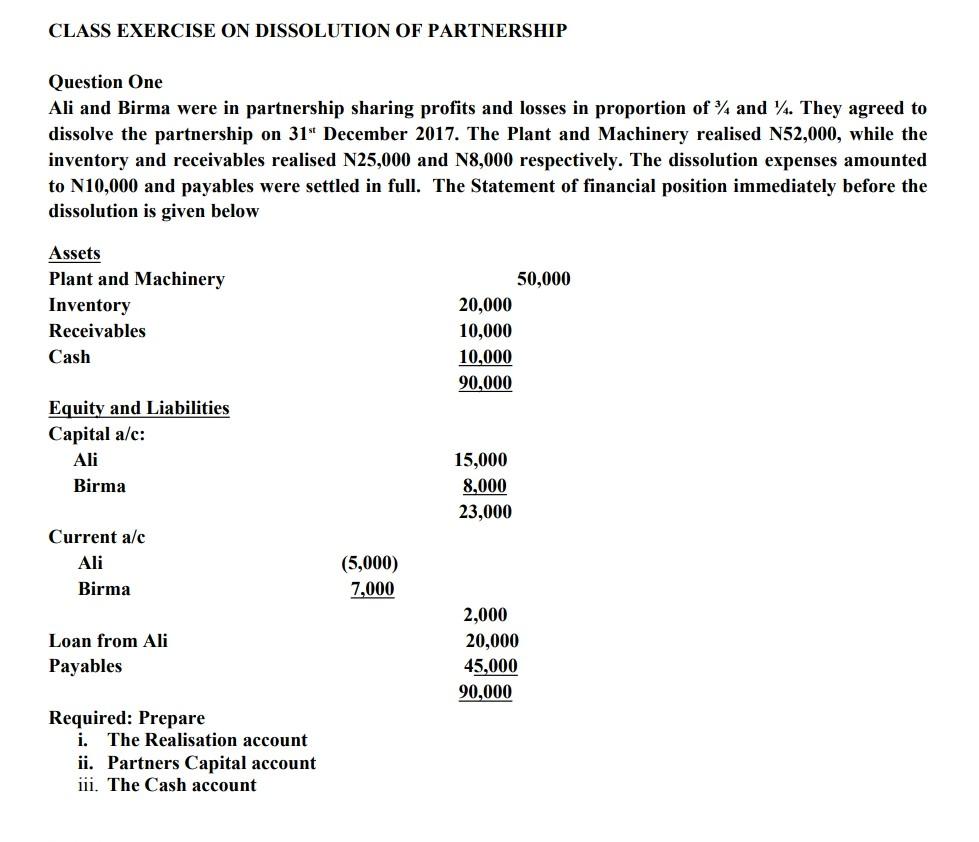

Question: CLASS EXERCISE ON DISSOLUTION OF PARTNERSHIP Question One Ali and Birma were in partnership sharing profits and losses in proportion of 4 and 14. They

CLASS EXERCISE ON DISSOLUTION OF PARTNERSHIP Question One Ali and Birma were in partnership sharing profits and losses in proportion of 4 and 14. They agreed to dissolve the partnership on 31" December 2017. The Plant and Machinery realised N52,000, while the inventory and receivables realised N25,000 and N8,000 respectively. The dissolution expenses amounted to N10,000 and payables were settled in full. The Statement of financial position immediately before the dissolution is given below Assets Plant and Machinery Inventory Receivables Cash 50,000 20,000 10,000 10,000 90,000 Equity and Liabilities Capital a/c: Ali Birma 15,000 8,000 23,000 Current a/c Ali Birma (5,000) 7,000 Loan from Ali Payables 2,000 20,000 45,000 90,000 Required: Prepare i. The Realisation account ii. Partners Capital account iii. The Cash account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts