Question: Class Questions 1 a . A 4 % semi - annual - pay coupon bond ( $ 1 0 0 face value ) has ten

Class Questions

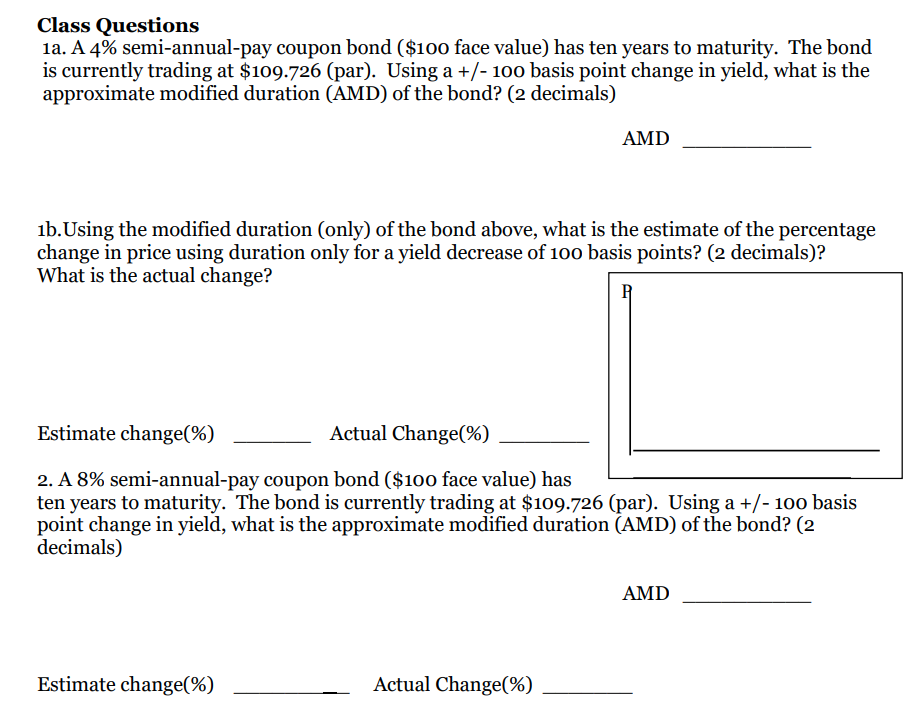

a A semiannualpay coupon bond $ face value has ten years to maturity. The bond

is currently trading at $par Using a basis point change in yield, what is the

approximate modified duration AMD of the bond? decimals

AMD

bUsing the modified duration only of the bond above, what is the estimate of the percentage

change in price using duration only for a yield decrease of basis points? decimals

What is the actual change?Class Questions

a A semiannualpay coupon bond $ face value has ten years to maturity. The bond

is currently trading at $par Using a basis point change in yield, what is the

approximate modified duration AMD of the bond? decimals

AMD

bUsing the modified duration only of the bond above, what is the estimate of the percentage

change in price using duration only for a yield decrease of basis points? decimals

What is the actual change?

Estimate change

Actual Change

A semiannualpay coupon bond $ face value has

ten years to maturity. The bond is currently trading at $par Using a basis

point change in yield, what is the approximate modified duration AMD of the bond?

decimals

AMDClass Questions

a A semiannualpay coupon bond $ face value has ten years to maturity. The bond

is currently trading at $par Using a basis point change in yield, what is the

approximate modified duration AMD of the bond? decimals

AMD

bUsing the modified duration only of the bond above, what is the estimate of the percentage

change in price using duration only for a yield decrease of basis points? decimals

What is the actual change?

Estimate change

Actual Change

A semiannualpay coupon bond $ face value has

ten years to maturity. The bond is currently trading at $par Using a basis

point change in yield, what is the approximate modified duration AMD of the bond?

decimals

AMD

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock