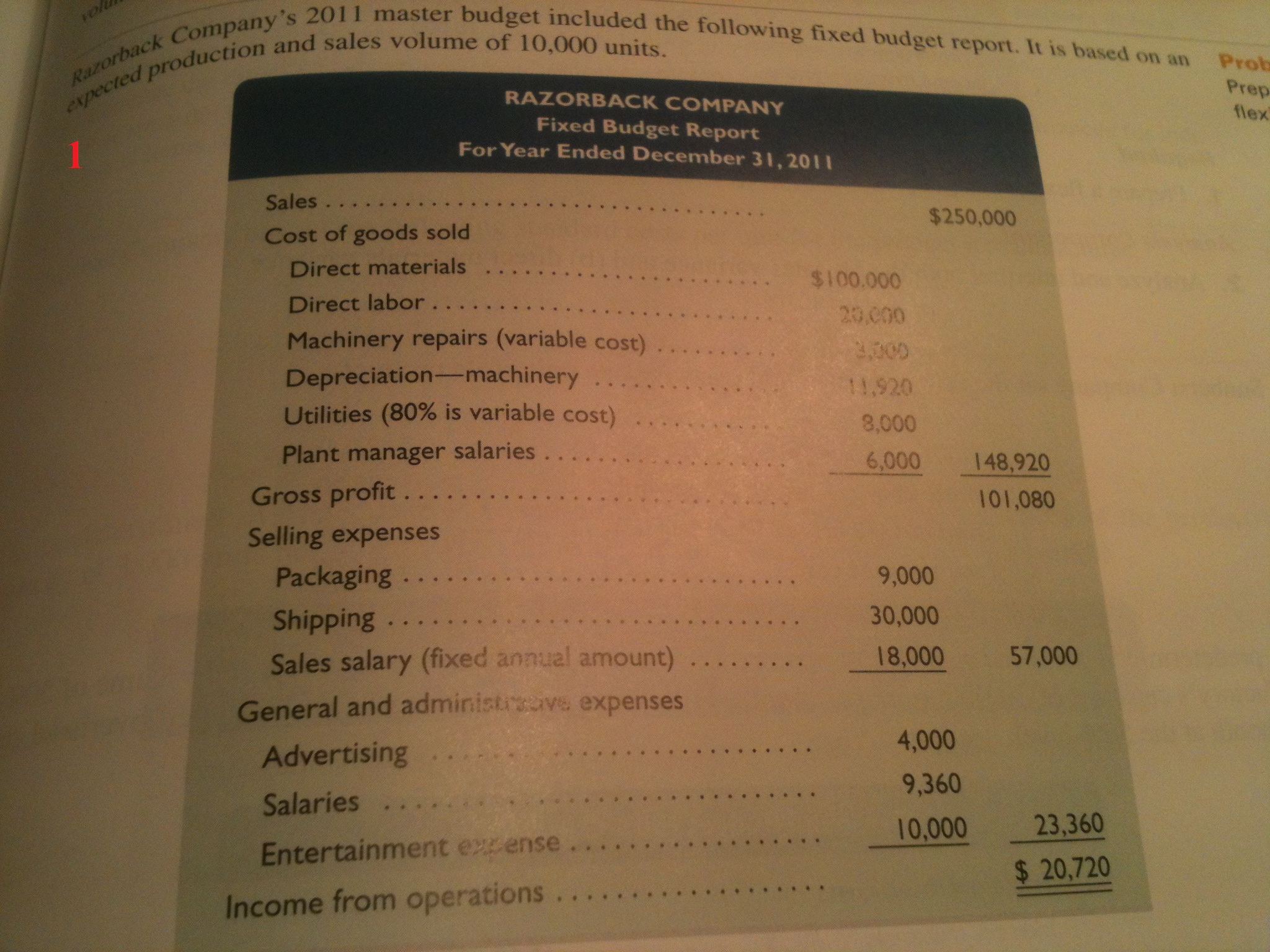

Question: Classify all items listed in the fixed budget as variable or fixed. Also determine their amounts per unit or their amounts for the year, as

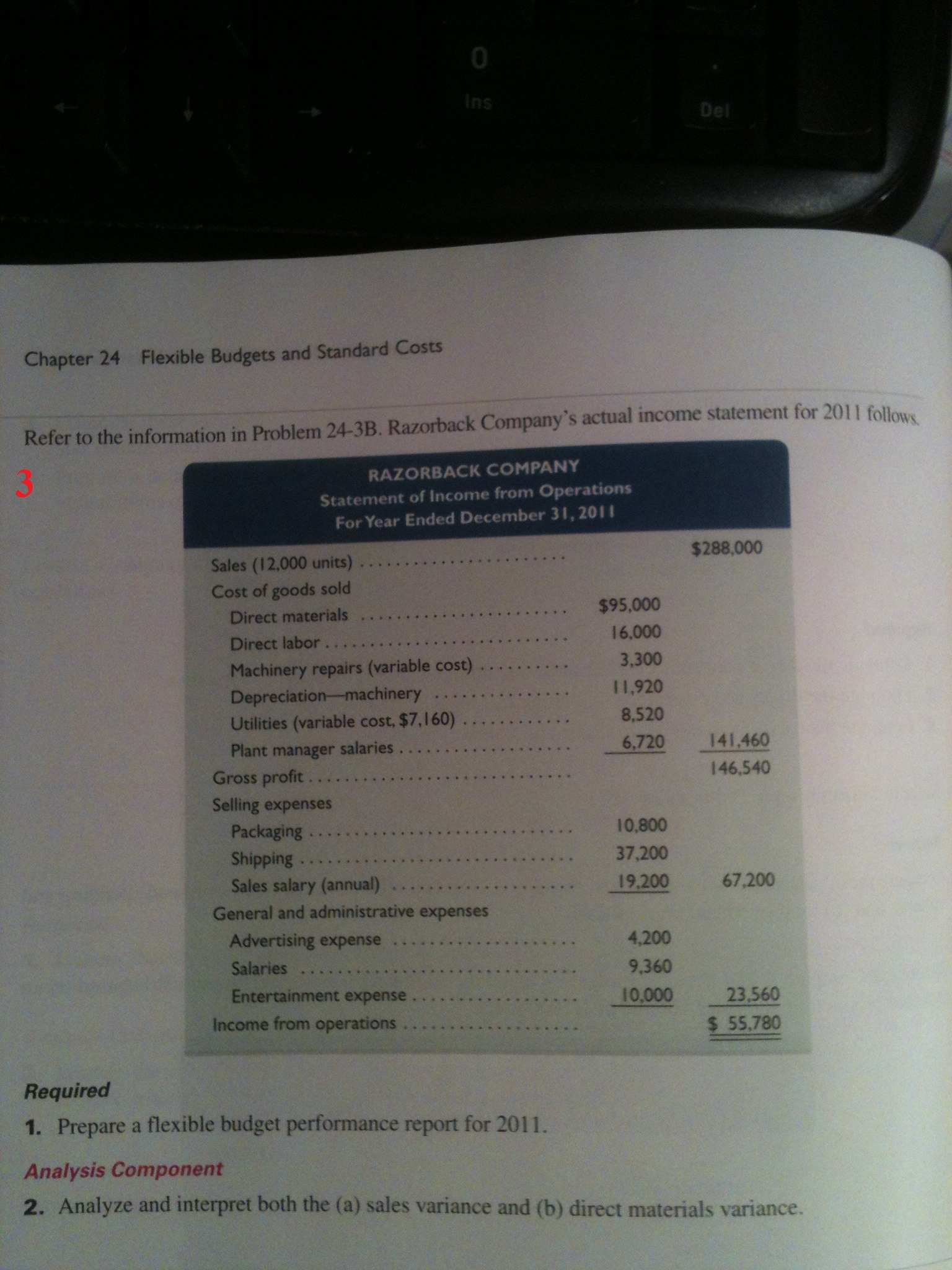

Classify all items listed in the fixed budget as variable or fixed. Also determine their amounts per unit or their amounts for the year, as appropriate. Prepare flexible budgets (se Exhibit 24.3) for the company at sales volumes of 8,000 and 12,000 units. The company's business conditions are improving. One possible result is a sales volume of approximately 14,400 units. The company president is confident that this volume is within the relevant range of existing capacity. How much would operating income increase over the 2011 budgeted amount of $20,720 if this level is reached without increasing capacity? An unfavorable change in business is remotely possible; in this case, production and sales volume for 2011 could fall to 5,000 units. How much income (or loss from) operations would occur if sales volume falls to this level? Refer to the information in problem 24-3B. Razorback Company's actual income statement for 2011 follows. Required Prepare a flexible budget performance report for 2011. Analysis Component Analyze and interpret both the sales variance and direct materials variance. Classify all items listed in the fixed budget as variable or fixed. Also determine their amounts per unit or their amounts for the year, as appropriate. Prepare flexible budgets (se Exhibit 24.3) for the company at sales volumes of 8,000 and 12,000 units. The company's business conditions are improving. One possible result is a sales volume of approximately 14,400 units. The company president is confident that this volume is within the relevant range of existing capacity. How much would operating income increase over the 2011 budgeted amount of $20,720 if this level is reached without increasing capacity? An unfavorable change in business is remotely possible; in this case, production and sales volume for 2011 could fall to 5,000 units. How much income (or loss from) operations would occur if sales volume falls to this level? Refer to the information in problem 24-3B. Razorback Company's actual income statement for 2011 follows. Required Prepare a flexible budget performance report for 2011. Analysis Component Analyze and interpret both the sales variance and direct materials variance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts