Question: Classify each cost as direct materials (DM), direct labor (DL), manufacturing overhead (MOH), or a period cost for a shoe manufacturer. Leather DM DL

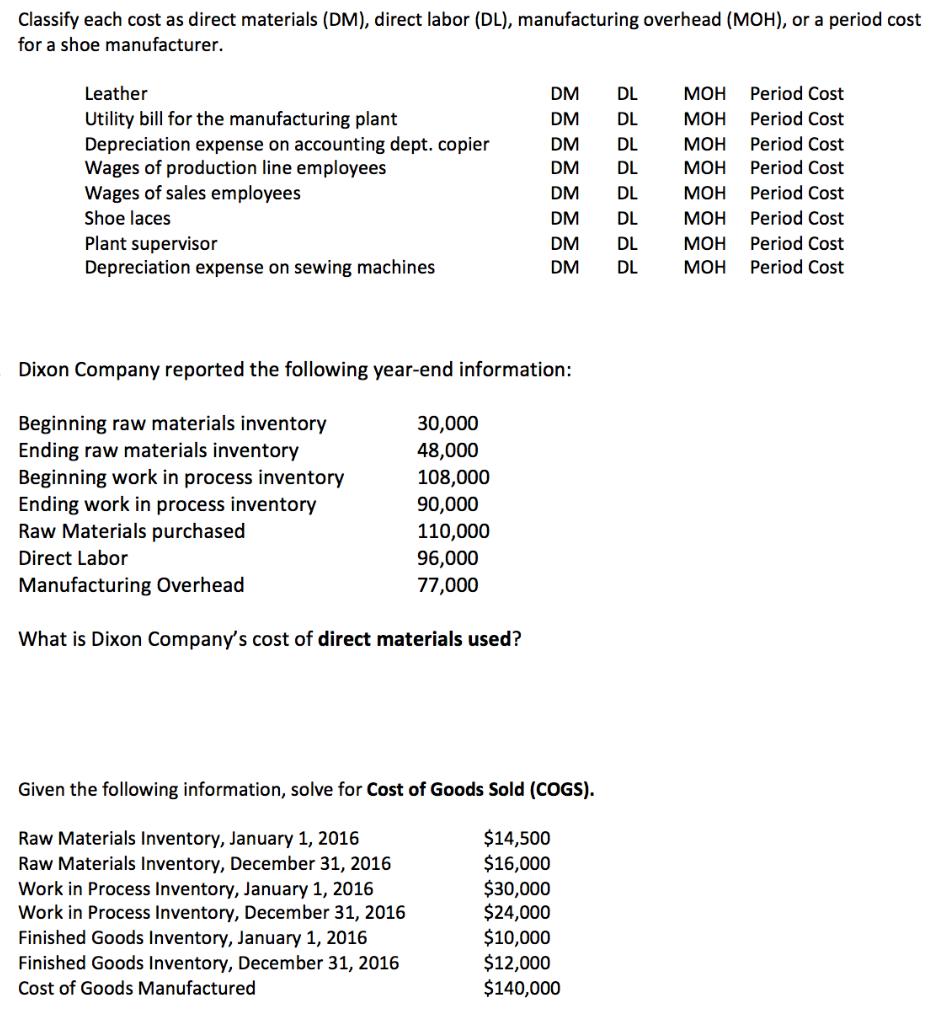

Classify each cost as direct materials (DM), direct labor (DL), manufacturing overhead (MOH), or a period cost for a shoe manufacturer. Leather DM DL Period Cost Period Cost Utility bill for the manufacturing plant Depreciation expense on accounting dept. copier Wages of production line employees Wages of sales employees Shoe laces DM DL DM DL Period Cost DM DL Period Cost DM DL Period Cost DM DL Period Cost Plant supervisor Depreciation expense on sewing machines DM DL Period Cost DM DL Period Cost Dixon Company reported the following year-end information: Beginning raw materials inventory Ending raw materials inventory Beginning work in process inventory Ending work in process inventory Raw Materials purchased 30,000 48,000 108,000 90,000 110,000 96,000 77,000 Direct Labor Manufacturing Overhead What is Dixon Company's cost of direct materials used? Given the following information, solve for Cost of Goods Sold (COGS). $14,500 $16,000 $30,000 $24,000 $10,000 $12,000 $140,000 Raw Materials Inventory, January 1, 2016 Raw Materials Inventory, December 31, 2016 Work in Process Inventory, January 1, 2016 Work in Process Inventory, December 31, 2016 Finished Goods Inventory, January 1, 2016 Finished Goods Inventory, December 31, 2016 Cost of Goods Manufactured

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

1 Leather Direct material Utility bill for the manufacturing plant ... View full answer

Get step-by-step solutions from verified subject matter experts