Question: Classify these items if they are exclusions or inclusions on the regular income tax and apply the four parameters of BIR used in the

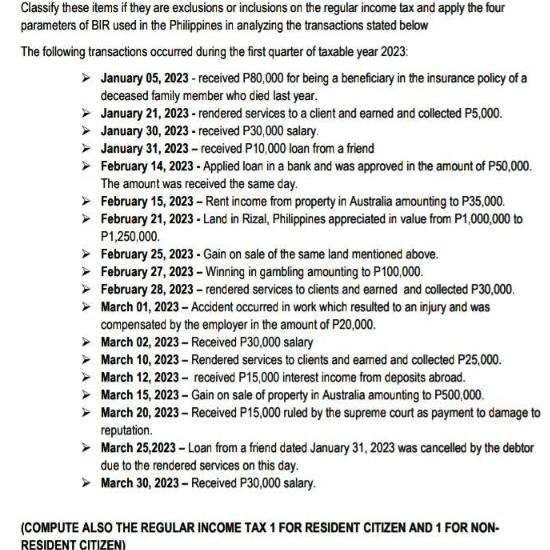

Classify these items if they are exclusions or inclusions on the regular income tax and apply the four parameters of BIR used in the Philippines in analyzing the transactions stated below The following transactions occurred during the first quarter of taxable year 2023: January 05, 2023 - received P80,000 for being a beneficiary in the insurance policy of a deceased family member who died last year. January 21, 2023 - rendered services to a client and earned and collected P5,000. January 30, 2023 - received P30,000 salary. January 31, 2023 - received P10,000 loan from a friend February 14, 2023 - Applied loan in a bank and was approved in the amount of P50,000. The amount was received the same day. > February 15, 2023 - Rent income from property in Australia amounting to P35,000. February 21, 2023 - Land in Rizal, Philippines appreciated in value from P1,000,000 to P1,250,000. February 25, 2023 - Gain on sale of the same land mentioned above. February 27, 2023-Winning in gambling amounting to P100,000. February 28, 2023 - rendered services to clients and earned and collected P30,000. March 01, 2023 - Accident occurred in work which resulted to an injury and was compensated by the employer in the amount of P20,000. March 02, 2023 - Received P30,000 salary March 10, 2023 - Rendered services to clients and earned and collected P25,000. March 12, 2023 - received P15,000 interest income from deposits abroad. March 15, 2023 - Gain on sale of property in Australia amounting to P500,000. March 20, 2023-Received P15,000 ruled by the supreme court as payment to damage to reputation. March 25,2023 - Loan from a friend dated January 31, 2023 was cancelled by the debtor due to the rendered services on this day. > March 30, 2023-Received P30,000 salary. (COMPUTE ALSO THE REGULAR INCOME TAX 1 FOR RESIDENT CITIZEN AND 1 FOR NON- RESIDENT CITIZEN)

Step by Step Solution

3.38 Rating (170 Votes )

There are 3 Steps involved in it

To classify these items as exclusions or inclusions for regular income tax purposes in the Philippines we will consider the four parameters typically used by the Bureau of Internal Revenue BIR 1 Natur... View full answer

Get step-by-step solutions from verified subject matter experts