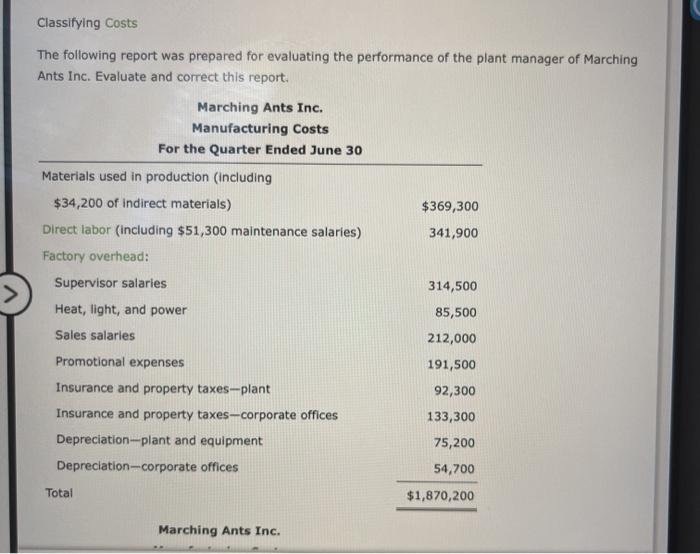

Question: Classifying Costs The following report was prepared for evaluating the performance of the plant manager of Marching Ants Inc. Evaluate and correct this report. Marching

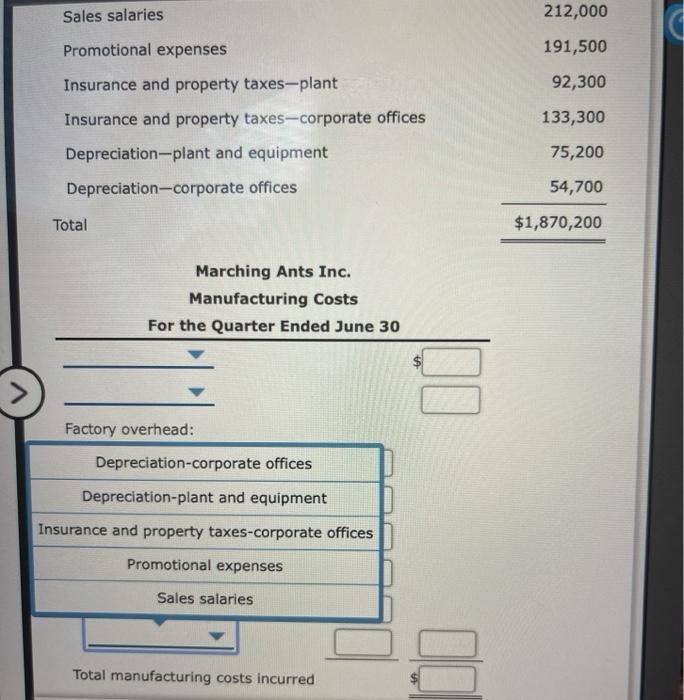

Classifying Costs The following report was prepared for evaluating the performance of the plant manager of Marching Ants Inc. Evaluate and correct this report. Marching Ants Inc. Manufacturing Costs For the Quarter Ended June 30 $369,300 341,900 314,500 Materials used in production (including $34,200 of indirect materials) Direct labor (including $51,300 maintenance salaries) Factory overhead: Supervisor salaries Heat, light, and power Sales salaries Promotional expenses Insurance and property taxes-plant Insurance and property taxes-corporate offices Depreciation-plant and equipment Depreciation-corporate offices 85,500 212,000 191,500 92,300 133,300 75,200 54,700 Total $1,870,200 Marching Ants Inc. Sales salaries 212,000 Promotional expenses 191,500 Insurance and property taxes-plant 92,300 Insurance and property taxes-corporate offices 133,300 Depreciation-plant and equipment 75,200 Depreciation-corporate offices 54,700 Total $1,870,200 Marching Ants Inc. Manufacturing Costs For the Quarter Ended June 30 Factory overhead: Depreciation-corporate offices Depreciation-plant and equipment Insurance and property taxes-corporate offices Promotional expenses Sales salaries Total manufacturing costs incurred

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts