Question: Classifying Intangible Costs on the Balance Sheet The adjusted trial balance of Lawrence Corporation showed the following selected account balances (all debits) at December

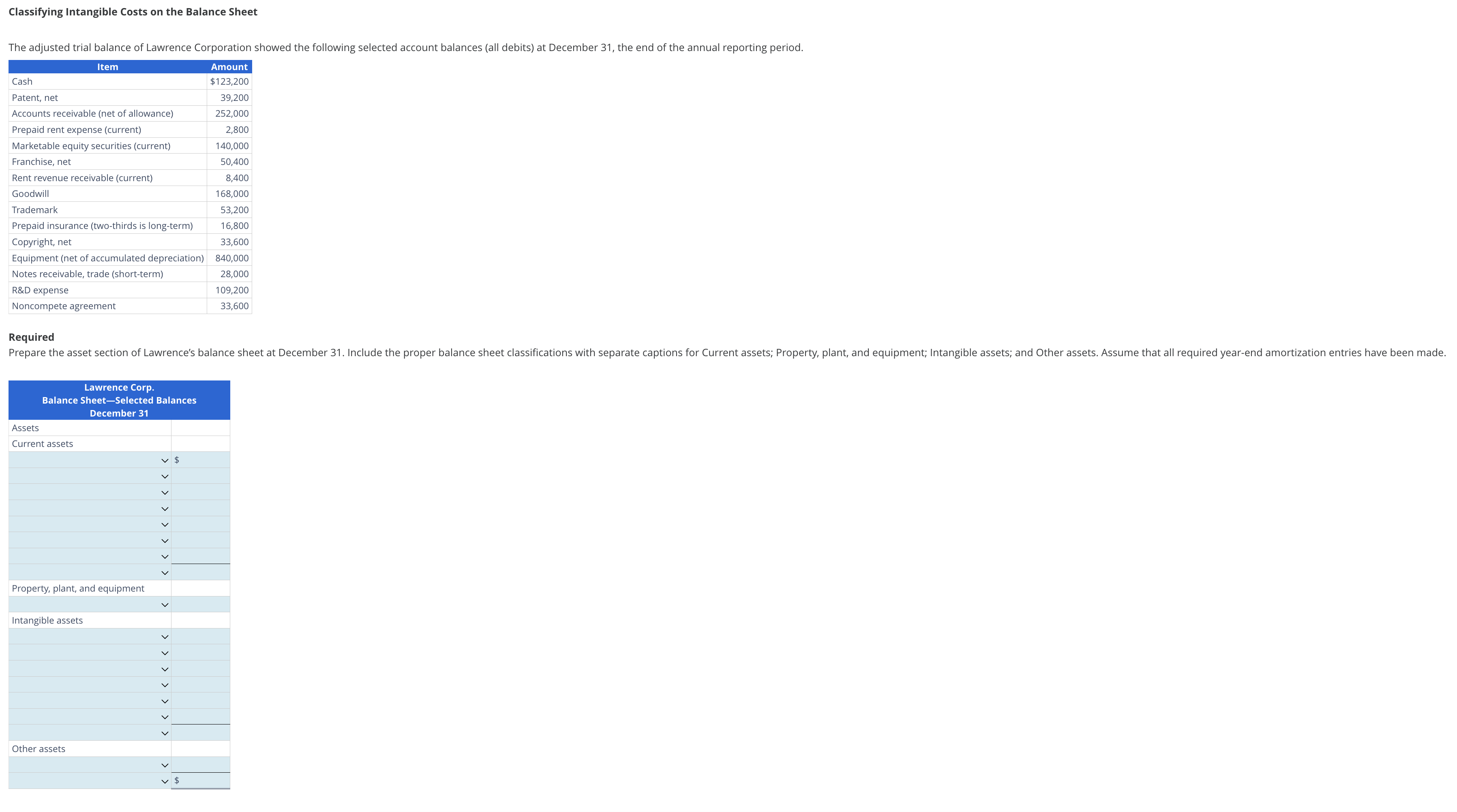

Classifying Intangible Costs on the Balance Sheet The adjusted trial balance of Lawrence Corporation showed the following selected account balances (all debits) at December 31, the end of the annual reporting period. Item Cash Amount $123,200 Patent, net Accounts receivable (net of allowance) 39,200 252,000 Prepaid rent expense (current) 2,800 Marketable equity securities (current) 140,000 Franchise, net 50,400 Rent revenue receivable (current) 8,400 Goodwill 168,000 Trademark 53,200 Prepaid insurance (two-thirds is long-term) Copyright, net 16,800 33,600 840,000 28,000 109,200 33,600 Equipment (net of accumulated depreciation) Notes receivable, trade (short-term) R&D expense Noncompete agreement Required Prepare the asset section of Lawrence's balance sheet at December 31. Include the proper balance sheet classifications with separate captions for Current assets; Property, plant, and equipment; Intangible assets; and Other assets. Assume that all required year-end amortization entries have been made. Lawrence Corp. Balance Sheet-Selected Balances December 31 Assets Current assets Property, plant, and equipment Intangible assets Other assets $ > > > > > > > > > > > > > >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts