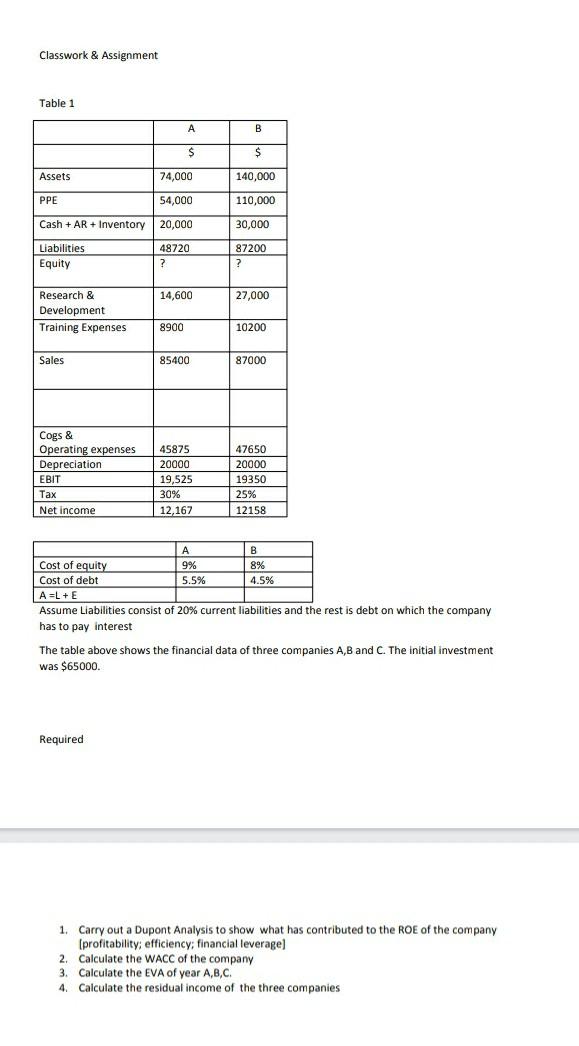

Question: Classwork & Assignment Table 1 1 B $ $ Assets 74,000 140,000 PPE 54,000 110,000 Cash + AR + Inventory 20,000 30,000 Liabilities Equity 48720

Classwork & Assignment Table 1 1 B $ $ Assets 74,000 140,000 PPE 54,000 110,000 Cash + AR + Inventory 20,000 30,000 Liabilities Equity 48720 ? 87200 ? 14,600 27,000 Research & Development Training Expenses 8900 10200 Sales 85400 87000 Cogs & Operating expenses Depreciation EBIT Tax Net income 45875 20000 19,525 30% 12,167 47650 20000 19350 25% 12158 A B Cost of equity 9% 8% Cost of debt 5.5% 4.5% A EL + E Assume Liabilities consist of 20% current liabilities and the rest is debt on which the company has to pay interest The table above shows the financial data of three companies A, B and C. The initial investment was $65000. Required 1. Carry out a Dupont Analysis to show what has contributed to the ROE of the company (profitability, efficiency; financial leverage) 2. Calculate the WACC of the company 3. Calculate the EVA of year A,B,C. 4. Calculate the residual income of the three companies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts