Question: clear answer please Fadey is trying to decided between two different annuities. He wants to know which of the two annuities will require the lowest

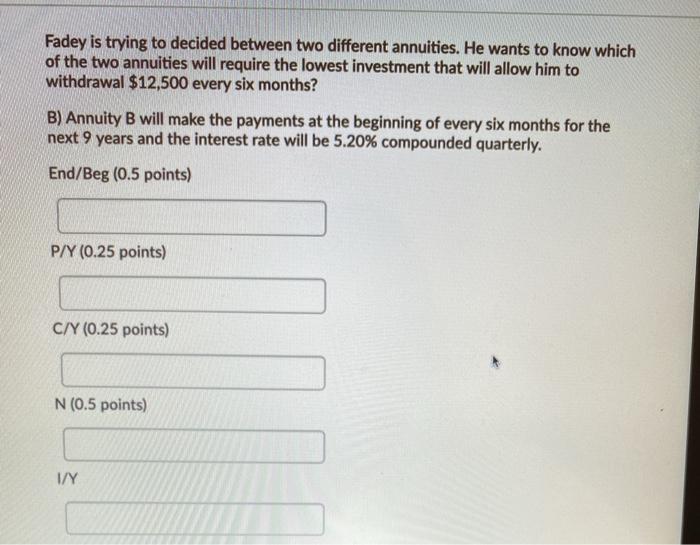

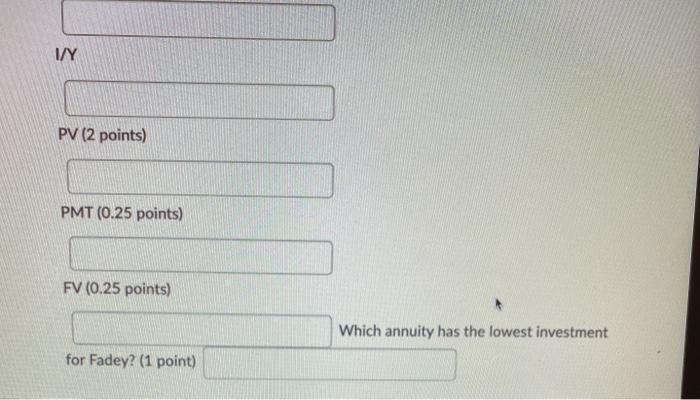

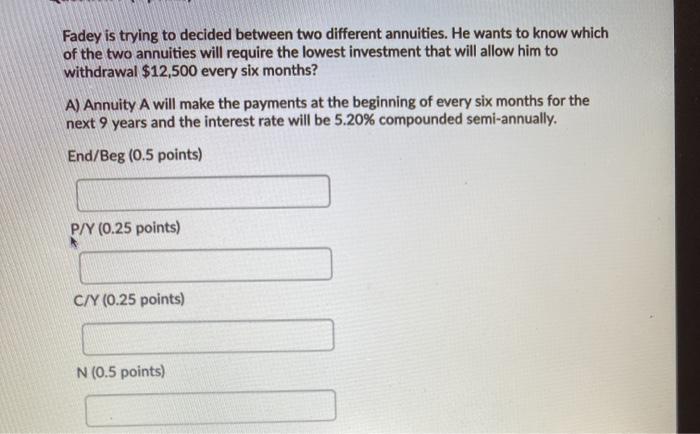

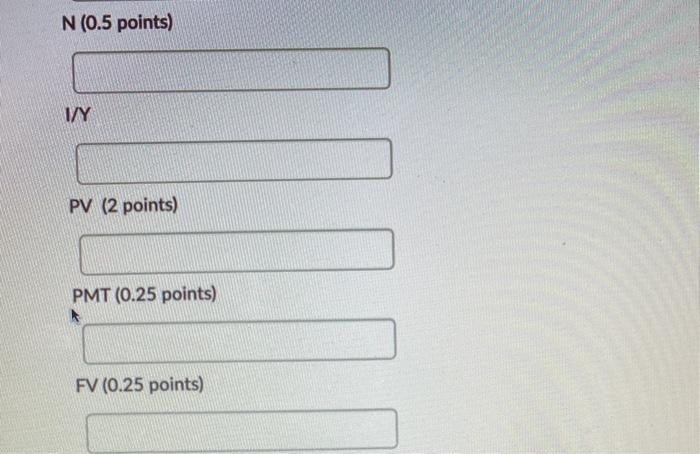

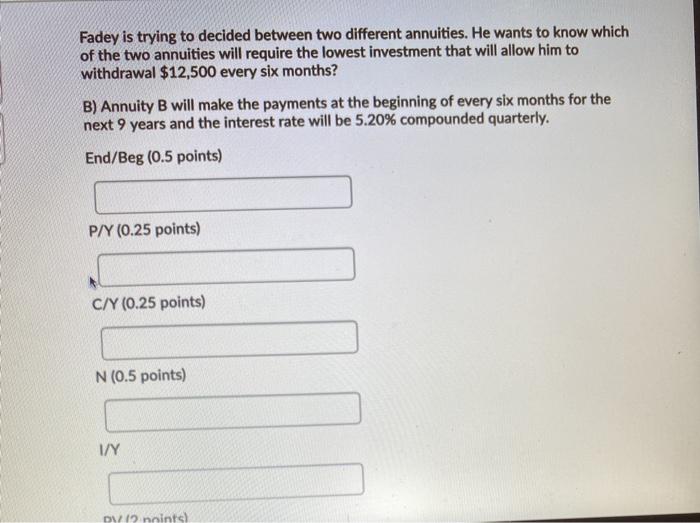

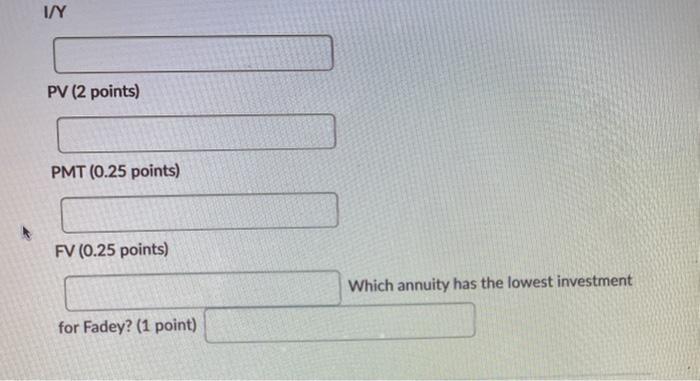

Fadey is trying to decided between two different annuities. He wants to know which of the two annuities will require the lowest investment that will allow him to withdrawal $12,500 every six months? B) Annuity B will make the payments at the beginning of every six months for the next 9 years and the interest rate will be 5.20% compounded quarterly. End/Beg (0.5 points) P/Y (0.25 points) C/Y (0.25 points) N (0.5 points) 1/Y I/Y PV (2 points) PMT (0.25 points) FV (0.25 points) Which annuity has the lowest investment for Fadey? (1 point) Fadey is trying to decided between two different annuities. He wants to know which of the two annuities will require the lowest investment that will allow him to withdrawal $12,500 every six months? A) Annuity A will make the payments at the beginning of every six months for the next 9 years and the interest rate will be 5.20% compounded semi-annually. End/Beg (0.5 points) P/Y (0.25 points) C/Y (0.25 points) N (0.5 points) N (0.5 points) 1/Y PV (2 points) PMT (0.25 points) FV (0.25 points) Fadey is trying to decided between two different annuities. He wants to know which of the two annuities will require the lowest investment that will allow him to withdrawal $12,500 every six months? B) Annuity B will make the payments at the beginning of every six months for the next 9 years and the interest rate will be 5.20% compounded quarterly. End/Beg (0.5 points) P/Y (0.25 points) C/Y(0.25 points) N (0.5 points) I/Y D12 noints) I/Y PV (2 points) PMT (0.25 points) FV (0.25 points) Which annuity has the lowest investment for Fadey? (1 point) Fadey is trying to decided between two different annuities. He wants to know which of the two annuities will require the lowest investment that will allow him to withdrawal $12,500 every six months? B) Annuity B will make the payments at the beginning of every six months for the next 9 years and the interest rate will be 5.20% compounded quarterly. End/Beg (0.5 points) P/Y (0.25 points) C/Y (0.25 points) N (0.5 points) 1/Y I/Y PV (2 points) PMT (0.25 points) FV (0.25 points) Which annuity has the lowest investment for Fadey? (1 point) Fadey is trying to decided between two different annuities. He wants to know which of the two annuities will require the lowest investment that will allow him to withdrawal $12,500 every six months? A) Annuity A will make the payments at the beginning of every six months for the next 9 years and the interest rate will be 5.20% compounded semi-annually. End/Beg (0.5 points) P/Y (0.25 points) C/Y (0.25 points) N (0.5 points) N (0.5 points) 1/Y PV (2 points) PMT (0.25 points) FV (0.25 points) Fadey is trying to decided between two different annuities. He wants to know which of the two annuities will require the lowest investment that will allow him to withdrawal $12,500 every six months? B) Annuity B will make the payments at the beginning of every six months for the next 9 years and the interest rate will be 5.20% compounded quarterly. End/Beg (0.5 points) P/Y (0.25 points) C/Y(0.25 points) N (0.5 points) I/Y D12 noints) I/Y PV (2 points) PMT (0.25 points) FV (0.25 points) Which annuity has the lowest investment for Fadey? (1 point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts