Question: clear hand written solution. asap I will give thumb up Suppose that Stock XYZ is currently trading at $80 and does not pay any dividends.

clear hand written solution. asap I will give thumb up

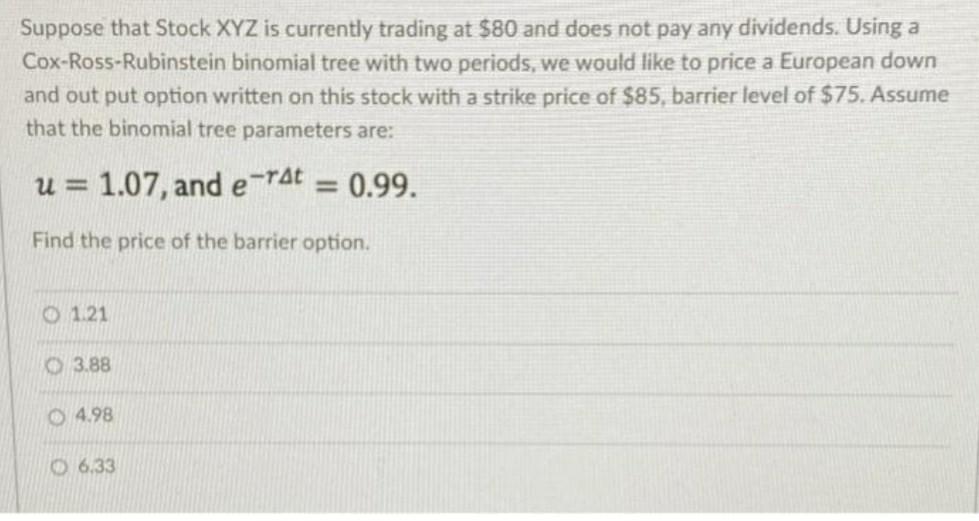

Suppose that Stock XYZ is currently trading at $80 and does not pay any dividends. Using a Cox-Ross-Rubinstein binomial tree with two periods, we would like to price a European down and out put option written on this stock with a strike price of $85, barrier level of $75. Assume that the binomial tree parameters are: u= 1.07, and e-rat 0.99. Find the price of the barrier option 1.21 3.88 4.98 6.33

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock