Question: Clear image for problem CA-24-9. Please help! CA24.9 GROUPwORK meatment of various Interim Reporting Situations) The following statement is an excerpt from the FASB p

Clear image for problem CA-24-9. Please help!

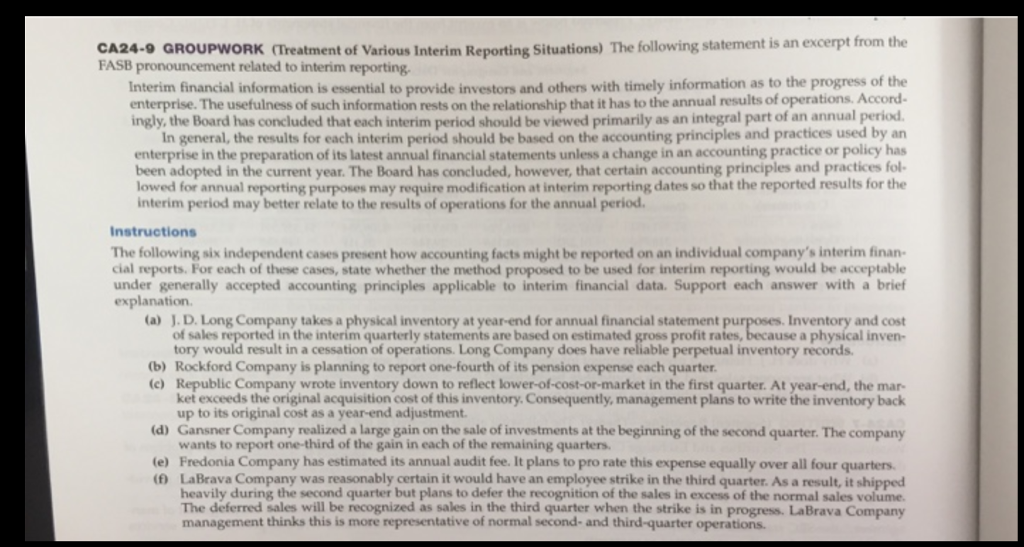

CA24.9 GROUPwORK meatment of various Interim Reporting Situations) The following statement is an excerpt from the FASB p ronouncement related to interim reporting. Interim financial information is essential to provide investors and others with timely information as to the progress of the terprise. usefulness such information on relationship that has tothe results of operations Accord ingly the Board that each interim period be primarily as an integral of an annual in general, the results for each interim period should be based on the accounting principles and practices used by an enterprise in the preparation of its latest annual financial statements unless a change in an accounting practice or policy has been adopted in the current year. The Board has concluded, however, that certain accounting principles and practices fol lowed for annual reporting purposes may require modification at interim reporting dates so that the reported results for the interim period may better relate to the results of operations for the annual period. Instructions The following six ent cases present how accounting facts might be reported on an individual company's interim finan- cial reports. For each of these cases, state whether the method proposed to be used for interim reporting would be acceptable under generally accepted interim financial data. Support each answer with a brief accounting principles applicable explanation. (a) J. D. Long Company takes a physical inventory at year-end for annual financial statement pu Inventory and cost tory would result in a cessation of operations. Long Company does have reliable perpetual inventory records. (b) Rockford Company is planning to report one-fourth of its pension expense each quarter. Republic Company wrote inventory down to reflect lower-of-cost-or-market in the first quarter. At year-end, the mar- the cost of this inventory.Consequently management plans to write the inventory back up to its original cost as a year-end adjustment. wants to report one-third of the gain in each of the remaining quarters. (e) Fredonia Company has estimated its annual audit fee. It plans to pro rate this expense equally over all four quarters. LaBrava Company was reasonably certain it would have an employee strike in the third quarter. As a result, it heavily during the second quarter but plans to defer the recognition of the sales in excess of the normal sales volume The deferred sales will be recognized as sales in the third quarter when the strike is progress. LaBrava Company management thinks this is more represen tative of normal second- and third-quarter operations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts