Question: Clear step by step math process and clear answer. Using the 2018 federal tax bracket on Blackboard, determine how much Sally owes in federal taxes

Clear step by step math process and clear answer.

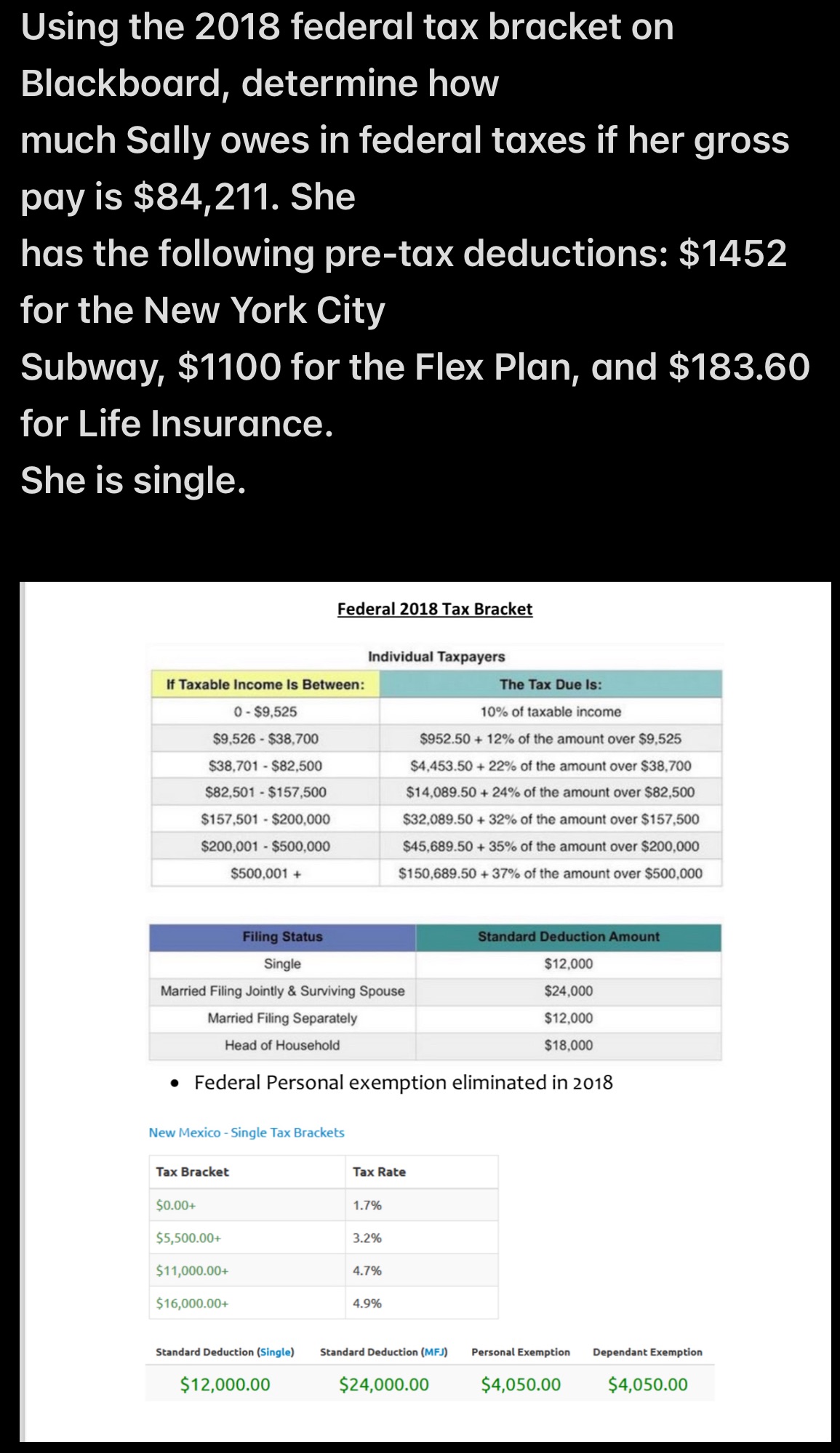

Using the 2018 federal tax bracket on Blackboard, determine how much Sally owes in federal taxes if her gross pay is $84,211. She has the following pre-tax deductions: $1452 for the New York City Subway, $1100 for the Flex Plan, and $183.60 for Life Insurance. She is single. Federal 2018 Tax Bracket Individual Taxpayers If Taxable Income Is Between: The Tax Due Is: 0 - $9,525 10% of taxable income $9,526 - $38,700 $952.50 + 12% of the amount over $9,525 $38.701 - $82,500 $4,453.50 + 22% of the amount over $38,700 $82,501 - $157,500 $14,089.50 + 24% of the amount over $82,500 $157,501 - $200,000 $32,089.50 + 32% of the amount over $157,500 $200,001 - $500,000 $45,689.50 + 35% of the amount over $200,000 $500,001 + $150,689.50 + 37% of the amount over $500,000 Married Filing Jointly & Surviving Spouse $24,000 Married Filing Separately $12,000 Head of Household $18,000 e Federal Personal exemption eliminated in 2018 Tax Bracket Tax Rate 1.7% 4.9% Standard Deduction (Single) Standard Deduction (MFJ) Persona | Exemption Dependant Exemption $12,000.00 $24,000.00 $4,050.00 $4,050.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts