Question: Clearly explain each step and have clear and organized formatting PLEASE show calculations and how you got your numbers. Thank you Label Part A and

Clearly explain each step and have clear and organized formatting PLEASE show calculations and how you got your numbers. Thank you

Label Part A and Part B

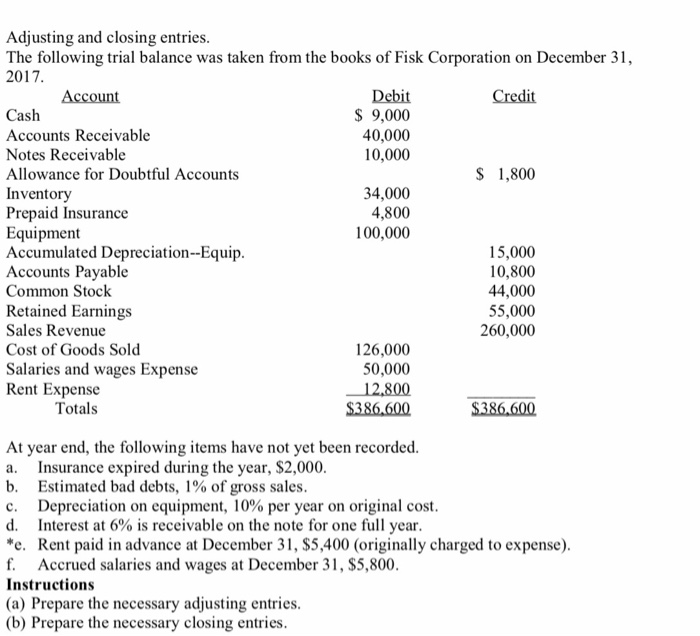

Adjusting and closing entries. The following trial balance was taken from the books of Fisk Corporation on December 31, 2017. Account Debit Credit Cash $ 9,000 Accounts Receivable 40,000 Notes Receivable 10,000 Allowance for Doubtful Accounts $ 1,800 Inventory 34,000 Prepaid Insurance 4,800 Equipment 100,000 Accumulated Depreciation--Equip. 15,000 Accounts Payable 10,800 Common Stock 44,000 Retained Earnings 55,000 Sales Revenue 260,000 Cost of Goods Sold 126,000 Salaries and wages Expense 50,000 Rent Expense 12.800 Totals $386,600 $386,600 At year end, the following items have not yet been recorded. a. Insurance expired during the year, $2,000. b. Estimated bad debts, 1% of gross sales. c. Depreciation on equipment, 10% per year on original cost. d. Interest at 6% is receivable on the note for one full year. *e. Rent paid in advance at December 31, $5,400 (originally charged to expense). f. Accrued salaries and wages at December 31, $5,800. Instructions (a) Prepare the necessary adjusting entries. (b) Prepare the necessary closing entries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts