Question: Clearly explain plz Consider two investment projects with equal lives and equal initial investments (CO), but different patterns of cash flows. One project, D, has

Clearly explain plz

Clearly explain plz

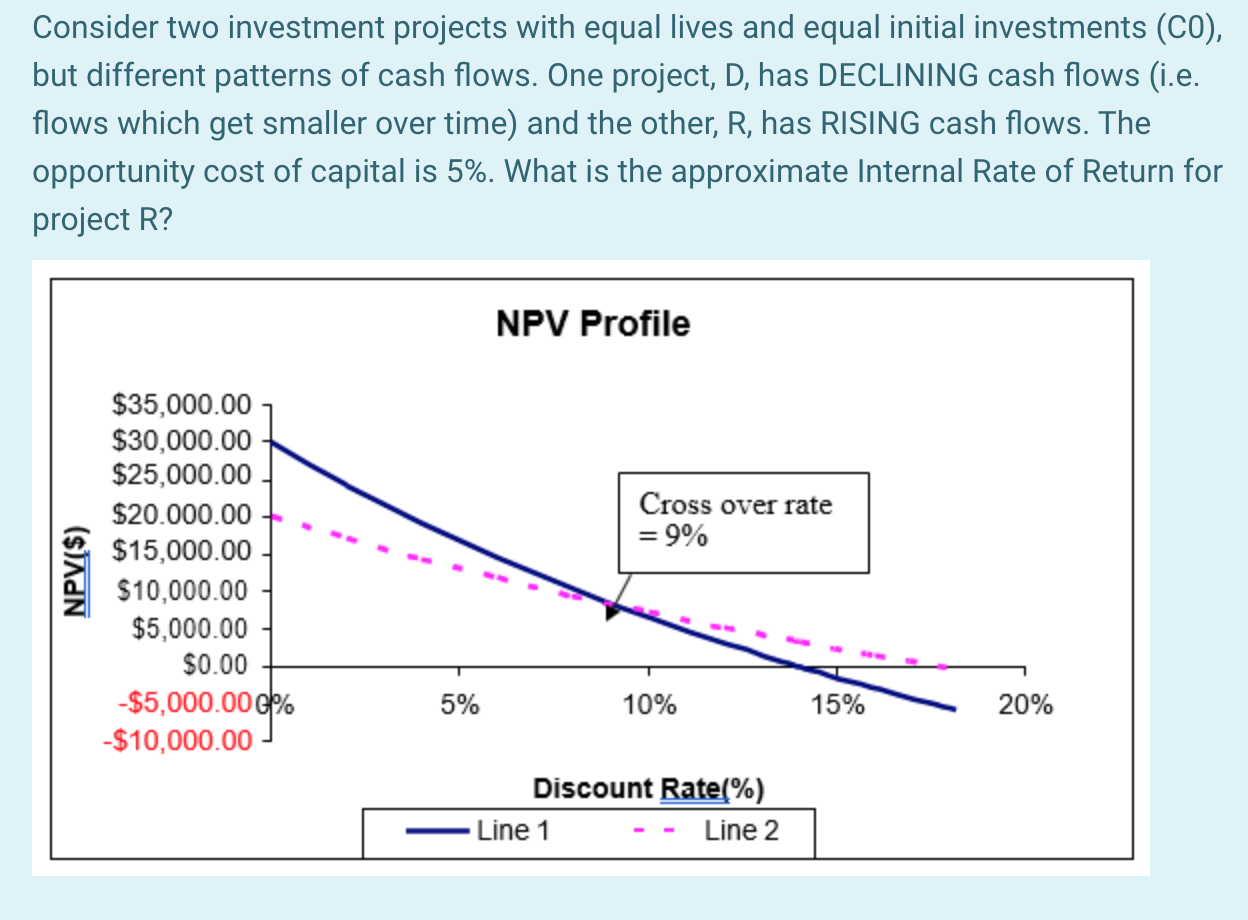

Consider two investment projects with equal lives and equal initial investments (CO), but different patterns of cash flows. One project, D, has DECLINING cash flows (i.e. flows which get smaller over time) and the other, R, has RISING cash flows. The opportunity cost of capital is 5%. What is the approximate Internal Rate of Return for project R? NPV Profile Cross over rate = 9% NPV($) $35,000.00 $30,000.00 $25,000.00 $20.000.00+ $15,000.00 $10,000.00 $5,000.00 $0.00 -$5,000.00% -$10,000.00 5% 10% 15% 20% Discount Rate(%) - Line 1 - - Line 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts