Question: Clearly identify the requirements being addressed by preparing Schedule M-2 of Form 1120. M-2 Information for an accrual basis corporation Net income per book (after-tax)

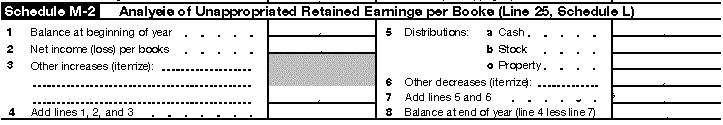

Clearly identify the requirements being addressed by preparing Schedule M-2 of Form 1120.

M-2 Information for an accrual basis corporation

| $386,250 |

Taxable income | $120,000 |

Federal income tax per books | $30,050 |

Cash dividend distributions | $150,000 |

Unappropriated retained earnings, as of January 1, 2013 | $796,010 |

Schedule M-2 Analyeie of Unappropriated Retained Eaminge per Booke (Line 25, Schedule L) 5 Distributions: a Cash. 1 Balance at beginning of year 2 Net income (loss) per books 3 Other increases (itemize): 4 Add lines 1, 2, and 3 b Stock Property. Other decreases (itemize): 7 Add lines 5 and 6 8 Balance at end of year (line 4 less line 7) .

Step by Step Solution

3.33 Rating (168 Votes )

There are 3 Steps involved in it

Solution Schedule M2 Analysis of Unappropriated Retained Earnings per Booke ... View full answer

Get step-by-step solutions from verified subject matter experts