Question: Clementi Pte Ltd ( Clementi ) , whose functional currency is Singapore Dollar ( S$ ) , operates a S$ bank account. As part of

Clementi Pte Ltd Clementi whose functional currency is Singapore Dollar S$

operates a S$ bank account. As part of its expansion plan into the United States, the

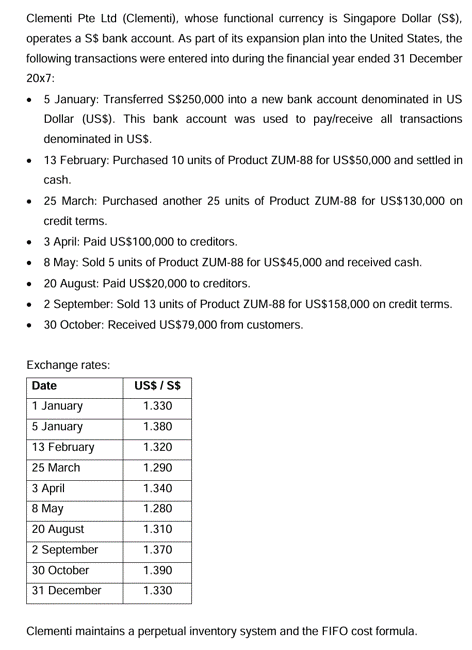

following transactions were entered into during the financial year ended December

x:

January: Transferred S $ into a new bank account denominated in US

Dollar US$ This bank account was used to payreceive all transactions

denominated in US$

February: Purchased units of Product ZUM for US$ and settled in

cash.

March: Purchased another units of Product ZUM for US $ on

credit terms.

April: Paid US $ to creditors.

May: Sold units of Product ZUM for US$ and received cash.

August: Paid US $ to creditors.

September: Sold units of Product ZUM for US $ on credit terms.

October: Received US$ from customers.

Exchange rates:

Clementi maintains a perpetual inventory system and the FIFO cost formula. Assume the net realisable value of inventories is above the cost of inventories at the

end of FYx There was no inventory, US$ bank, trade receivables and trade

payables balances at start of the financial year. Foreign currency monetary account

balances are revalued at the end of the financial year. Ignore the effects of income tax

arising from these transactions and events. a Record the journal entries for Clementi from January x to

December x in accordance with SFRSI The Effects

of Changes in Foreign Exchange Rates and SFRSI

Inventories. Show all necessary workings and round to nearest

dollar.

marks

b Explain who are the users and what are the objectives of

generalpurpose financial statements.

marks

Total: marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock